Markets stood still while waiting for the US inflation data in January to be released. Yields continue to slow down their growth, pushing investors to buy risky assets. If the forecast (+7.3% for general inflation and +5.9% for core inflation) is correct, this will further limit the Fed's variability in actions and be regarded by markets as a clear hawkish signal.

The ideal option for the Fed is to lower inflation without active action on its part. Factors contributing to such a scenario could be the restoration of global production chains and an increase in supply that overlaps growing consumer demand. However, one must note that there are not enough signals indicating such a development of events. The IBD/TIPP optimism index fell from 44.7p to 44p this month. In small businesses, the NFIB index also fell from 98.9p up to 97.1p. And although the trade balance in December turned out to be slightly better than expected, it still showed the worst result in history.

It can be assumed that low volatility will remain in the next 24 hours. The movement may resume on Thursday after the publication of inflation data.

USD/CAD

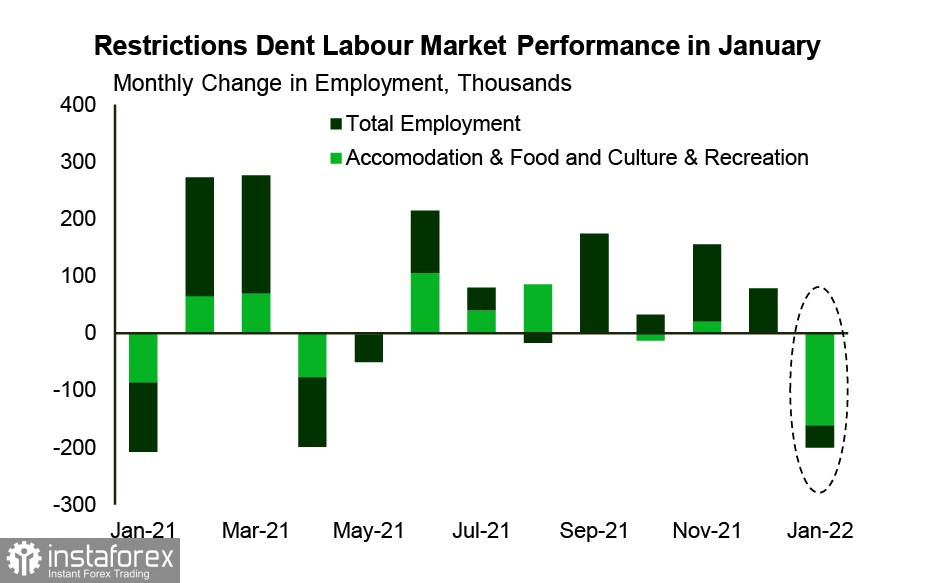

The Bank of Canada has received several negative signals that may adjust expectations for the pace of normalization of monetary policy. On Friday, it was reported that the January economy lost 200 thousand jobs and the unemployment rate rose from 6% to 6.5%. Restrictions imposed due to fear of Omicron made themselves entirely felt.

Since the GDP report was positive, there is reason to believe that the Bank of Canada will not pay attention to the decline of the labor market, since it will be possible to expect an equally rapid recovery upon lifting the restrictions. The same applies to the trade balance – despite the deficit growth in December to 137 billion, this is largely a consequence of the lifting of some restrictions on imports. The real growth in the purchasing power of citizens and enterprises will quickly increase GDP growth due to the revival of the manufacturing sector.

The Governor of the Bank of Canada, Macklem, will make a report to the Chamber of Commerce today, after which a press conference will be held. The latest data is likely to require clarification, as Macklem previously linked rate growth to whether or not GDP growth will outpace employment growth.

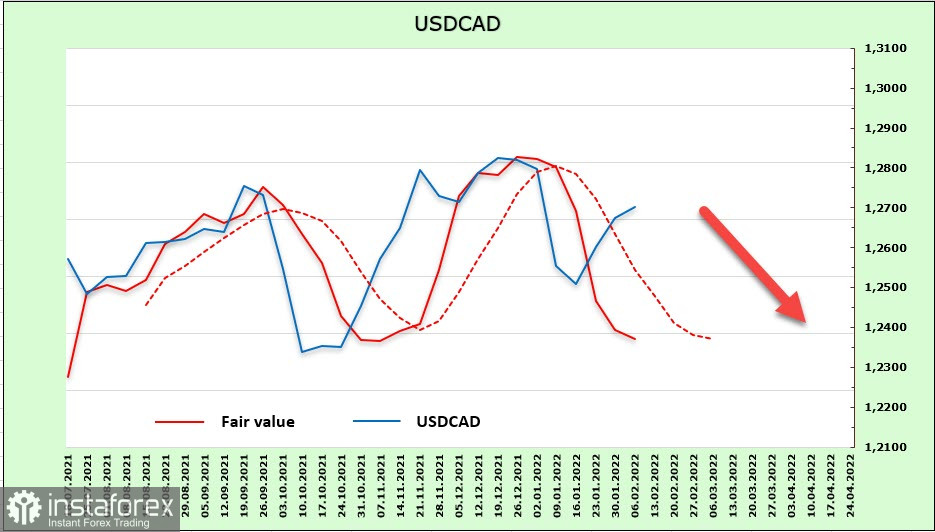

According to the CFTC, the Canadian dollar's net long position rose by 464 million, reporting to 1.44 billion during the reporting week. There is no change in investor sentiment in favor of the US dollar. The settlement price is still below the long-term average.

This means that a downward exit from the converging triangle is still more likely than an upward one. Even though it is unclear what could trigger a strong movement, the first target is the support level of 1.2450. To make an upturn, it is necessary to see the need for even more hawkish actions by the Fed than the market currently assumes.

USD/JPY

Unlike most of the world's central banks, the Bank of Japan does not single out price movements as the main factor influencing monetary policy. BoJ's Governor Kuroda said in April 2020 that "the price momentum has been lost, which prompted us to strengthen easing," and since then, the wording has remained virtually unchanged. Accordingly, similar wording was observed after the meeting last January 18: "the bank will not hesitate to take additional stimulus measures if necessary."

Is there no reason for the Bank of Japan to begin considering the issue of ending the stimulus? It should be noted that if positive signals about the recovery of the global economy continue to strengthen, the Japanese yen will weaken across the entire spectrum of the currency market.

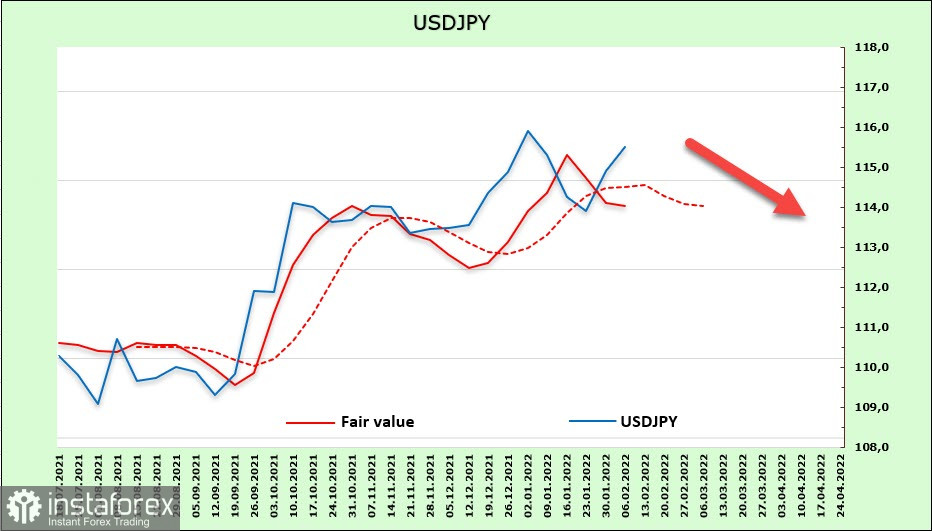

According to the CFTC report, the yen's short position fell by 886 million to -6.608 billion. Short-term signals made allowed the settlement price to go below the long-term average, which gives reason to expect a downward correction in the USD/JPY pair.

The nearest resistance level is 115.70. It is possible to sell around this level with the target at 113.50 and stop at 115.75/85. The next target is 112.50, but a decline to this level looks great in the current conditions.