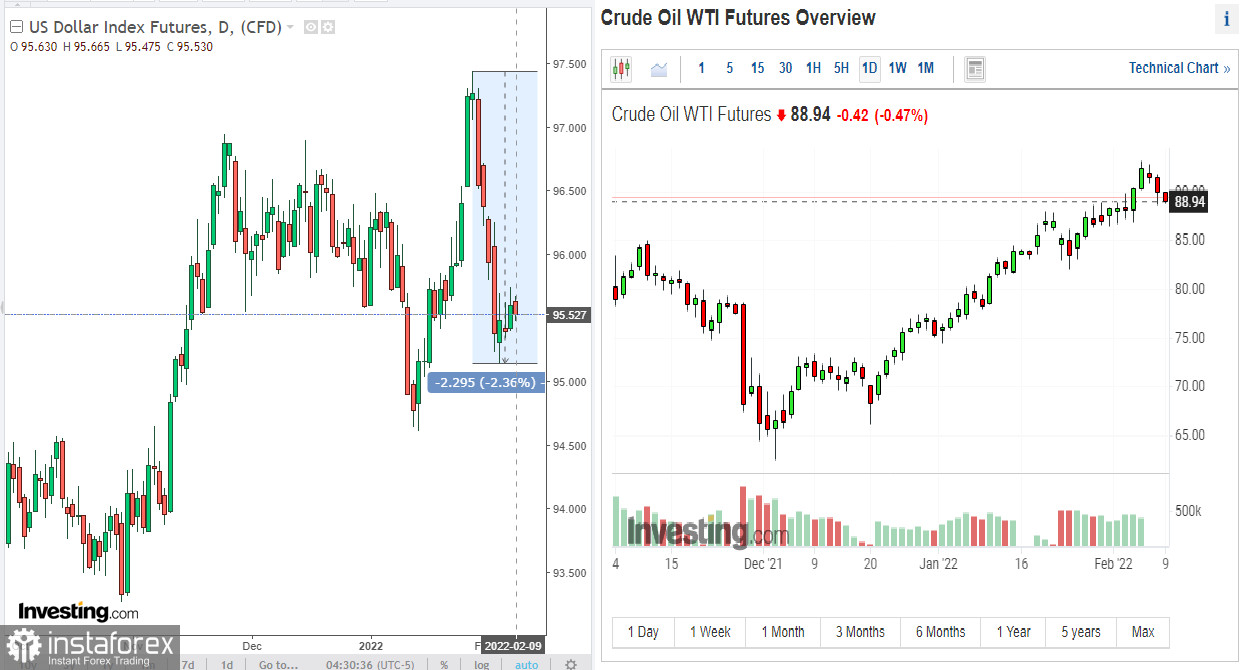

The dollar attempted to grow during the Asian trading session on Wednesday, but with the start of the European session, it fell again. As of this writing, DXY dollar index futures are trading near the 95.53 mark, 40 points above the low hit last week ahead of the rather strong monthly report from the U.S. Department of Labor.

In January, 467,000 new jobs were created in the non-agricultural sector of the U.S. economy (economists predicted their growth by 150,000), and although unemployment rose by 0.1% to 4.0%, it still remained at pandemic levels — low. The data also showed that average hourly earnings rose 5.7% in January compared to the same period in the previous year, with forecast of a 5.2% increase.

Employment data exceeded forecasts, although the markets were preparing for disappointing indicators amid a spike in omicron infections. Now investors will keep an eye on the February labor market data, which will be published on March 4 and may show even greater growth, according to economists. In view of this, market participants will pay attention to tomorrow's publication of weekly data on the U.S. labor market at 13:30 GMT.

Initial claims for unemployment benefits are expected to decrease to 230,000 after their unexpected growth to 260,000 and to 290,000 a month earlier. One way or another, this is still a low number of applications for unemployment. It remains at the lowest level for several decades – about 200,000. This is a positive factor for the dollar, after it became clear from the report of the U.S. Department of Labor that unemployment in the country is at the minimum pandemic and multi-year level of 4.0%.

If the data turns out to be better than the forecast, then the U.S. dollar should strengthen in the short term.

The U.S. labor market continues to recover along with the rapid growth of inflation, which is becoming a key factor in determining the decision of the Fed's leaders on how quickly and how much to raise the key rate.

Some of the most optimistic market participants expect that the Fed may raise the interest rate 5 or even more times this year. Even if this is an overly optimistic assessment of the Fed's monetary policy prospects, positive employment data in the United States should further strengthen the dollar on expectations that the Federal Reserve System will start raising interest rates in March, economists say.

Tomorrow, at 13:30 GMT, updated data on inflation in the United States will be published. According to the forecast, the January consumer price index (in annual terms) will be 7.3% (higher than the previous value of 7.0%), and the core consumer price index is 5.9% (higher than the previous value of 5.5%). This is well above the 2% inflation target that the Fed is aiming for, and the data again points to an acceleration in inflation. This, of course, puts pressure on the Fed in favor of a more aggressive tightening of monetary policy. And the closer the March meeting of the U.S. Federal Reserve is, the stronger the volatility in the quotes of the dollar and U.S. stock indices will grow.

Today, there are no particularly important publications in the economic calendar. However, market participants will pay attention to the speeches of Cleveland Fed Bank President Loretta Mester and Bank of Canada Governor Tiff Macklem.

Market participants expect Macklem to clarify the situation around the plans of the Bank of Canada regarding the prospects for its monetary policy. The Canadian economy, like the entire global economy, slowed down in 2020 due to the coronavirus pandemic. It will now be interesting to hear Macklem's opinion on the stability of the labor market, the economy, and the monetary policy of the central bank.

Unemployment in the country rose to 6.5% in January from 6.0% in December, while employment declined sharply (the number of jobs in January decreased by 200,100 compared to the previous month after growth of nearly 55,000 in December). These are negative factors for CAD.

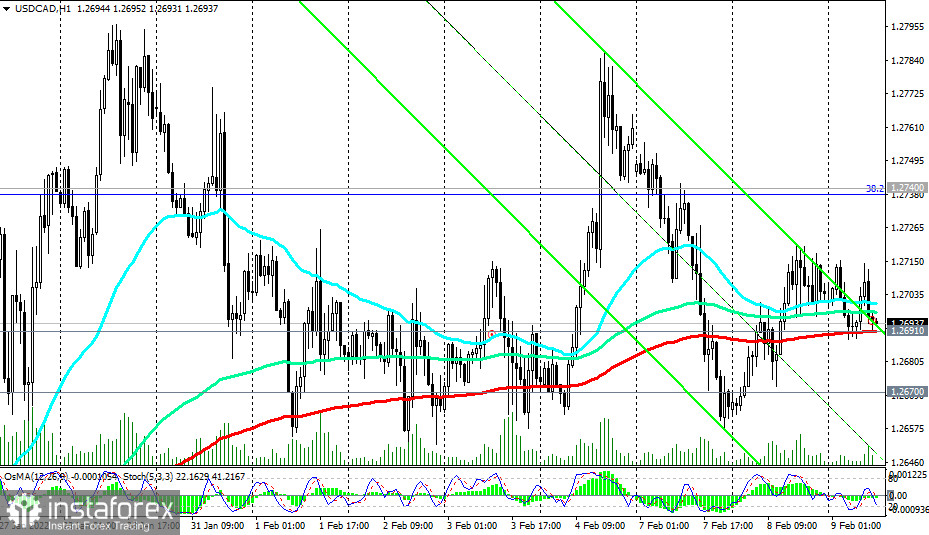

If Macklem touches upon the subject of the monetary policy, then the volatility in the quotes of the Canadian dollar will increase sharply. The tough tone of his speech will help strengthen the Canadian dollar, while his soft-spoken rhetoric and loose monetary stance will negatively impact CAD quotes, including USD/CAD, which is trading near 1.2693 at the time of this writing, just above the 1.2691 important near-term support zone (200 EMA on the 1-hour chart), 1.2670 (200 EMA on the 4-hour chart and 50 EMA on the daily chart).

A breakdown of these levels may provoke a decline in USD/CAD to the key support level of 1.2630 (200 EMA on the daily chart).

CAD may also receive support today from the publication (at 15:30 GMT) of the U.S. Department of Energy's weekly report (oil market analysts predict a decrease in US oil inventories). Oil prices have been fluctuating lately in anticipation of news of talks on the Iranian nuclear deal. There is some progress in negotiations between the U.S. and Iran, which put pressure on prices. The new agreement could lead to the lifting of sanctions on oil exports from Iran, which is likely to cause oil prices to fall.

Market participants are also evaluating data from the American Petroleum Institute (API), released on Tuesday. According to these data, oil inventories in the United States fell by 2 million barrels in the reporting week, while gasoline inventories decreased by 1.1 million barrels. This is a positive factor for oil prices and CAD.

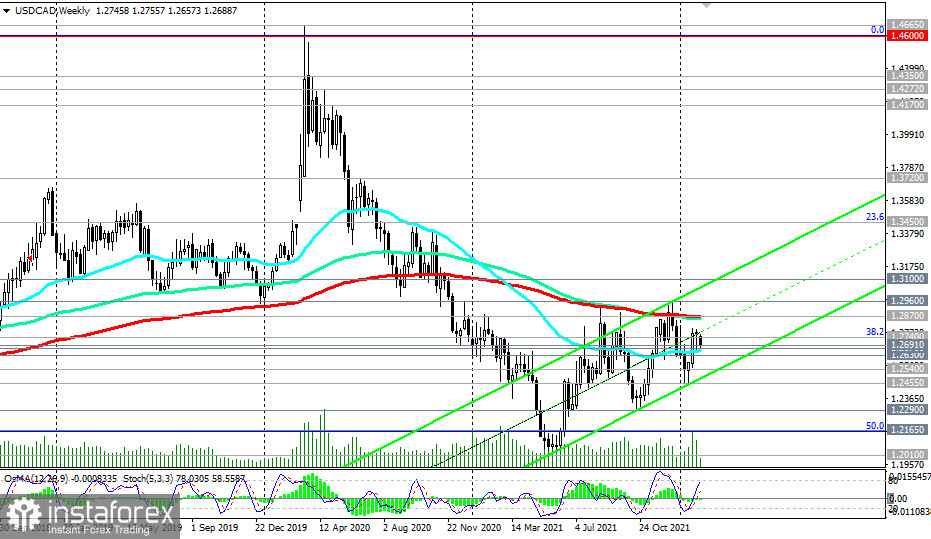

In the meantime, in general, the positive dynamics of USD/CAD remains with the prospect of growth towards the upper border of the ascending channel on the weekly chart, passing through the level of 1.3100, with intermediate targets at the resistance levels of 1.2740 (38.2% Fibonacci retracement in the USD/CAD growth wave from 0.9700 to 1.4600), 1.2870 (200 EMA on the weekly chart), 1.2960 (12-month highs and 2021 highs).

Support levels: 1.2691, 1.2670, 1.2630, 1.2600, 1.2540, 1.2455, 1.2290, 1.2165, 1.2010

Resistance levels: 1.2720, 1.2740, 1.2870, 1.2900, 1.2960, 1.3100

Trading scenarios

Sell Stop 1.2665. Stop-Loss 1.2720. Take-Profit 1.2630, 1.2600, 1.2540, 1.2455, 1.2290, 1.2165, 1.2010

Buy Stop 1.2720. Stop-Loss 1.2665. Take-Profit 1.2740, 1.2870, 1.2900, 1.2960, 1.3100