Analysis of Wednesday's trades:

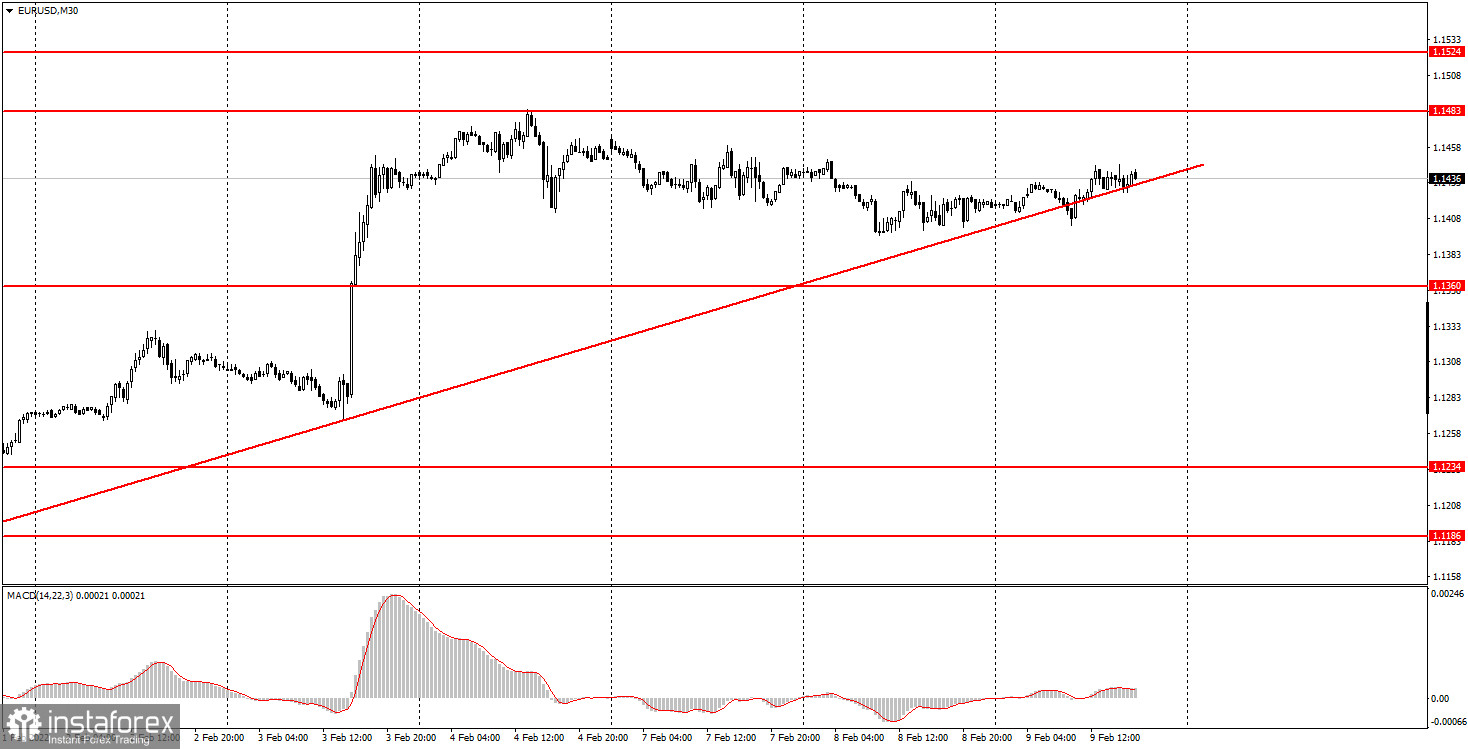

30M chart of EUR/USD

On Wednesday, the euro/dollar pair traded sideways with daily volatility of just 43 pips, which was lower than on Monday and Tuesday. So, strong signals were hardly expected on Wednesday. Moreover, beginner traders were warned yesterday that the pair might not produce any signals near the ascending trendline. The trendline itself was rather strong. Therefore, a pullback or a breakout there would determine the pair's further movement. However, given the flat market, the pair did not even notice the trendline and traded as if it did not exist. As a result, no signals were generated in the M30 time frame. In addition, the macroeconomic calendar was empty both in the US and the eurozone on Wednesday and there were no fundamentals as well. Thus, Wednesday was an uneventful and calm day in the market.

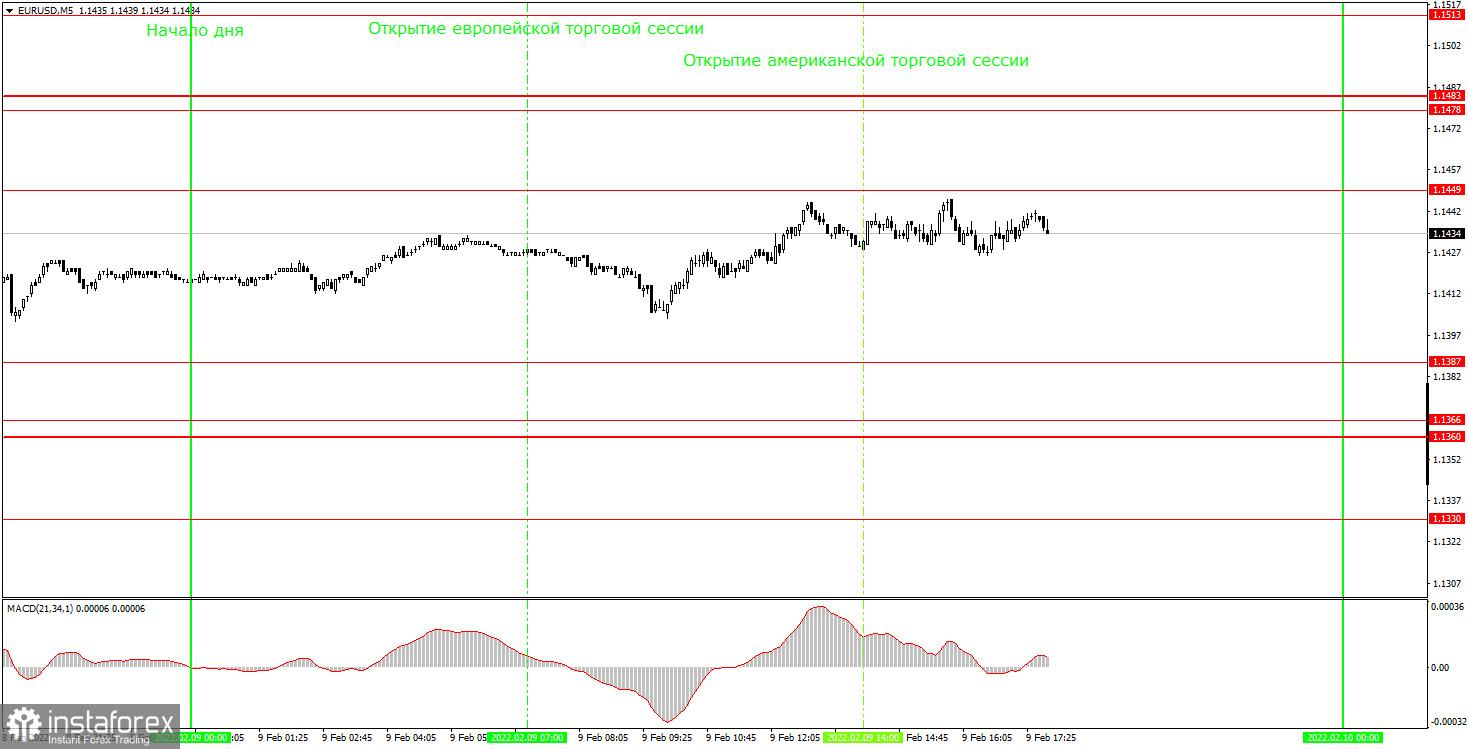

M5 chart of EUR/USD

In the M5 time frame, the pair showed a sluggish, almost sideways, movement. No signals were generated in this time frame because the pair failed to test any level. Perhaps it is for the better. Indeed, trading during the flat market is too hard due to the likelihood of false signals and unprofitable trades. Therefore, the novice were not supposed to enter the market on Wednesday. The situation may change for the better today when the important macroeconomic statistics are published in the United States. At the same time, Friday will be a claim day in the market as there will be no data published. Generally speaking, the current week turns out to be extremely boring and uneventful, while the pair has moved just sideways. Unfortunately, there is nothing we can do about it. All we can do is wait until active trading begins.

Trading plan for Thursday:

In the 30M time frame, the uptrend continues but it is just a formality. During the week, the pair headed towards the descending trendline. However, when it finally approached it, no signals were produced. So, traders gained no benefit from that move. However, if the price goes below the trendline, it will not be the end of the uptrend. The target levels in the 5M time frame are seen at 1.1360-1.1366, 1.1387, 1.1449, 1.1478-1.1483, and 1.1513. A stop-loss order should be set at the breakeven point as soon as the price passes 15 pips in the right direction. On Thursday, market players will focus solely on US inflation. Besides, no other reports are expected. The European Commission will present its economic forecast today. However, the market is unlikely to show any reaction to it. At the same time, the novice should be very cautious at the time of its publication. All in all, the release of US inflation will be the major event on Thursday.

Basic principles of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

On charts:

Support and resistance levels can serve as targets when buying or selling. You can place Take Profit near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginner traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management is the key to success in long-term trading.