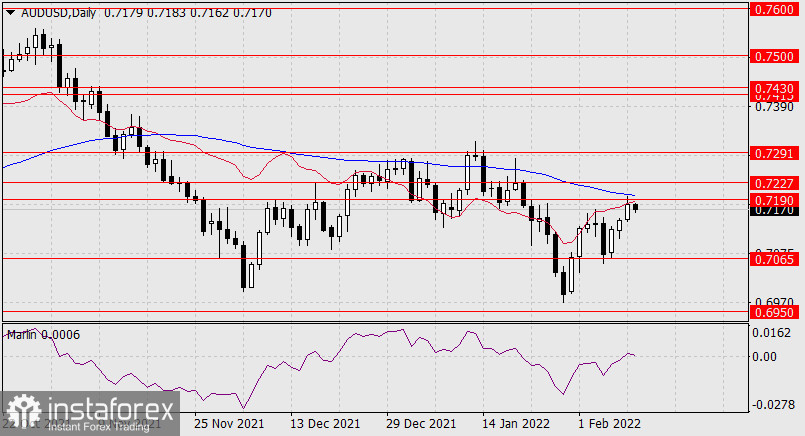

The Australian dollar has been a clear market leader in the past three days - the AUD/USD growth amounted to 1.53% against the growth of the US dollar index by 0.1%. As a result, the price reached the nearest target level 0.7190 and almost touched the MACD indicator line of the daily scale. The price is moving down in today's Asian session. Also, the Marlin Oscillator shows the intention to turn down from the border of the territory of the growing trend (the zero line of the oscillator).

If we take into account the release of today's inflation data in the US, where the CPI for January is expected at 7.3% y/y against 7.0% y/y a month earlier, then the price reversal may turn out to be qualitative. The target for the decline is 0.7065, and it is exactly from it that the aussie's growth against the rest of the hard currency market began.

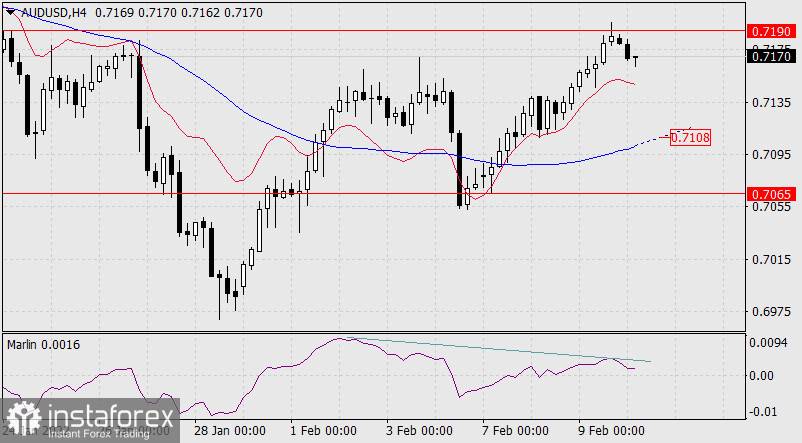

On the chart of the four-hour scale, a price divergence is formed with the Marlin Oscillator. The correction is clearly overdue, its nearest target is 0.7108 – the MACD line. Price drop below the line will open the main target at 0.7065.