Global financial markets will closely follow the publication of important economic statistics from the US today. These are consumer inflation figures that will undoubtedly have a noticeable impact on all markets.

Earlier last year, Fed Chairman J. Powell had to make it clear to investors that the first increase in interest rates should be expected at the March meeting of the US regulator amid a strong increase in inflationary pressure. It can be recalled that interest rates fell in 2020 in the wake of the outbreak of the COVID-19 pandemic.

Markets have considered the topic of rate hikes, and they are expecting a 0.25% increase in the key interest rate to 0.50% in March. However, it seems that they take into account the very fact of rising inflation, and not its numerical value. It is actually very important. If the current rate of inflation growth continues, investors may reconsider not only the number of increases in the direction of their increase, but, for example, the possibility of a one-time rate hike in March by 0.50% at once, and not the currently assumed 0.25%.

If the Fed makes such a decision unexpectedly for the markets, then we should certainly expect the US dollar's sharp increase in the currency markets and the US stock market's resumption of sales. This scenario will be shocking and will respond to the US Treasury bond market with a sharp growth in yields.

Let's return to the expected release today. According to the presented forecast, the total value of inflation in annual terms should rise from 7.0% to 7.3% in January. As for the monthly terms, it should fall from 0.6% in December to 0.5% in January. The core consumer price index also suggests an increase to 5.9% year-on-year from 5.5% and a decrease in the growth rate from 0.6% to 0.5% in January.

We will find out the real values today, but the scenario that was described above can fully change all current ideas about the Fed's actions.

Now, let's consider another possible development of events. If inflation unexpectedly shows a weakening of pressure, the regulator's plans to raise interest rates are unlikely to change, but the further number of rate increases may be, at least in the speeches of J. Powell, adjusted towards reduction i.e from likely four to three or even two this year.

In general, we will soon find out how the situation will develop in the near future.

Forecast of the day:

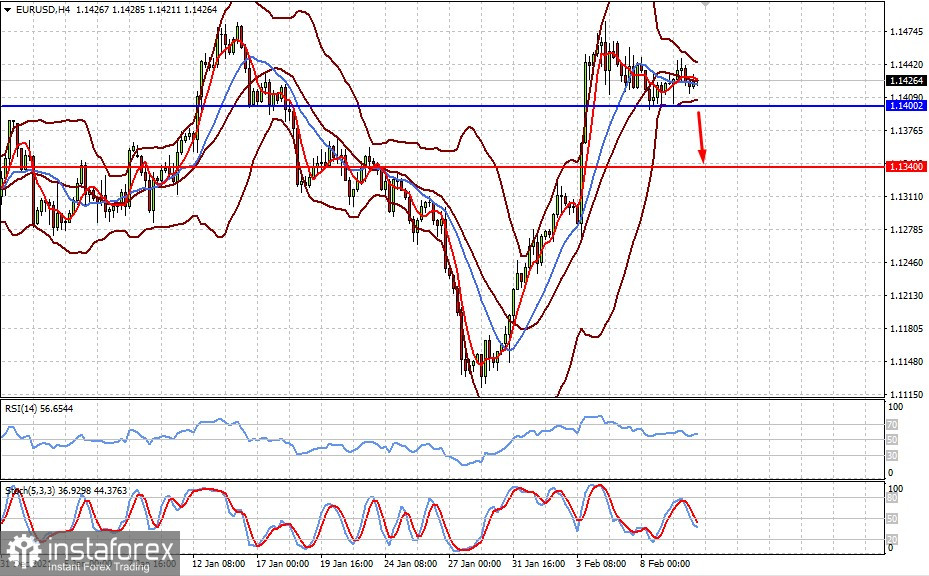

The EUR/USD pair continues to consolidate above the level of 1.1400. It should be noted that higher-than-expected inflation data may resume the pair's decline to the level of 1.1340.

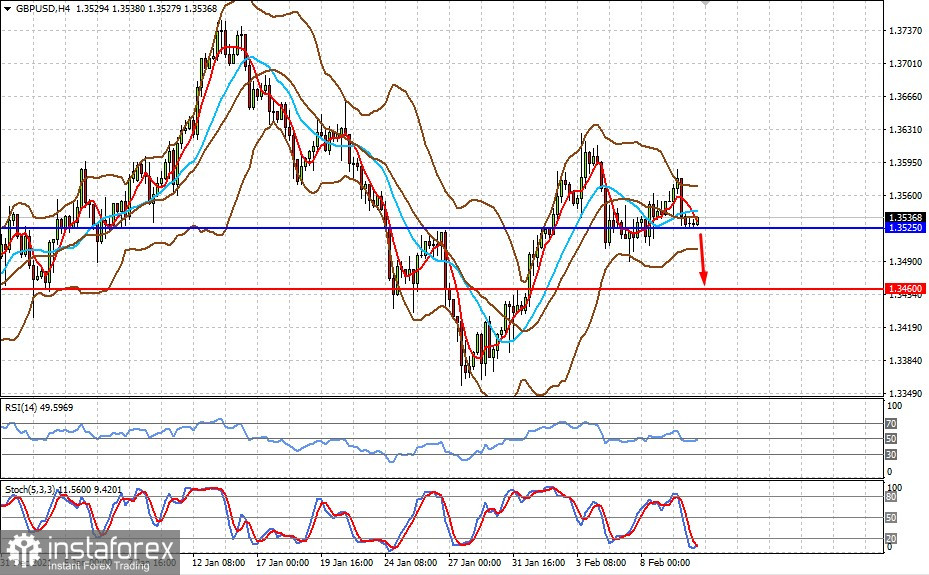

The GBP/USD pair is consolidating above the support level of 1.3525. If the inflation data turns out to be higher than expected, this may cause the pair to further fall to 1.3460.