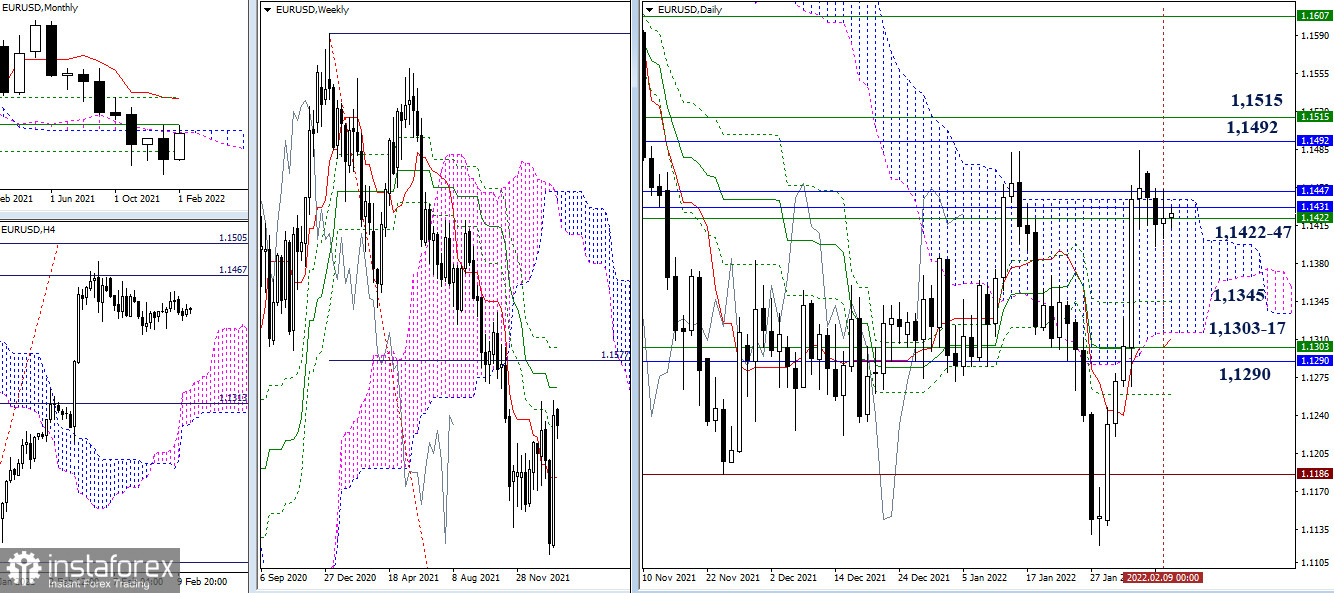

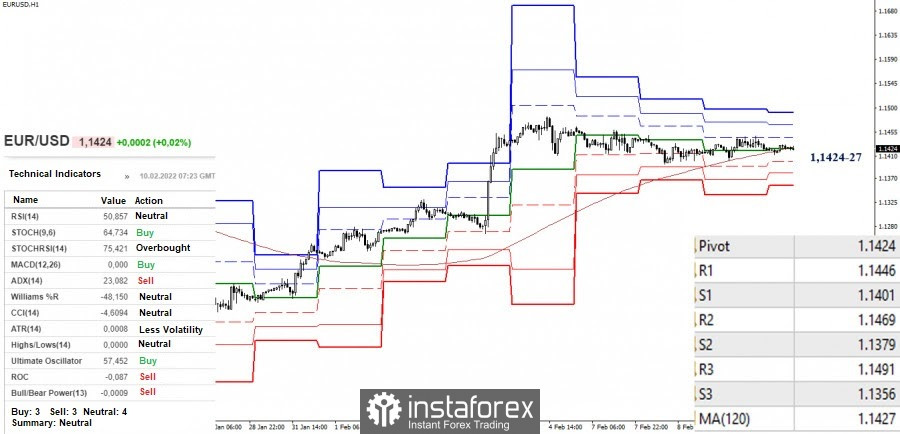

EUR/USD

The slowdown in the attraction and influence zone of levels 1.1422-47 continues. Over the past day, the situation has not changed significantly again. The borders and pivot points both retain their location. For the bulls, it is still important for them to combine the resistances of medium-term trends (month 1.1492 + week 1.1515) and for the bears, the support levels of 1.1345 (daily Fibo Kijun) and 1.1317 - 1.1303 - 1.1290 (lower border of the daily cloud + weekly short-term trend + monthly Fibo Kijun) are interesting.

The sideways movement continues in the smaller timeframes. The key levels (central pivot level 1.1424 + weekly long-term trend 1.1427) have united and entered the zone of the current movement. Changes associated with a change in the balance of power are possible only after leaving the sideways movement and forming the directional extremes. Now, the pivot points for the development of movement are the classic pivot levels, which are set at 1.1446 - 1.1469 - 1.1491 (resistance) and 1.1401 - 1.1379 - 1.1356 (support) today.

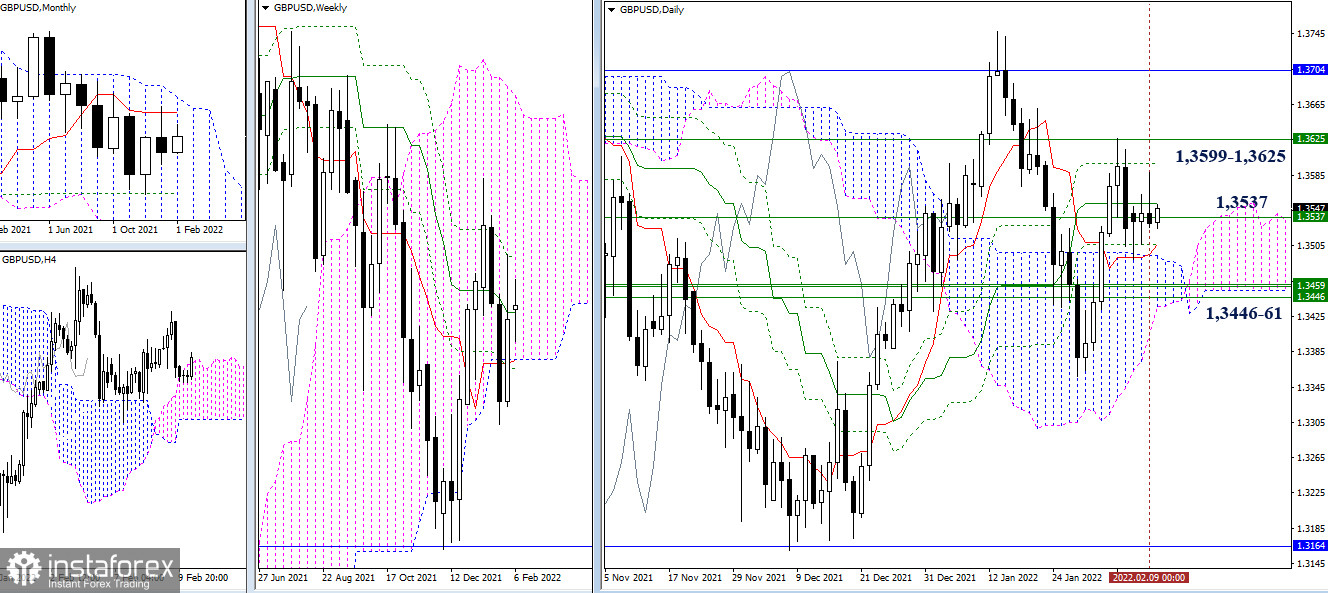

GBP/USD

The pair remains in the attraction and the influence zone of daily levels (cross + upper border of the cloud), with the weekly medium-term trend (1.3537) acting as the center in this attraction zone. As a result, there are no changes in conclusions and expectations regarding the development of the situation. The primary task of the bulls still rests on the final borders of the daily (1.3599) and weekly (1.3625) Ichimoku dead crosses, followed by the breakdown of these crosses. In turn, the bears need to sharply break through the accumulation of weekly levels in the area of 1.3446 - 1.3461 for new prospects to emerge.

The pair is moving around the key levels in the smaller timeframes, which are connected at the turn of 1.3549. Trading above or below the levels gives some advantage to one side or the other. However, it is difficult to talk about a clear advantage while there is no directed development of the movement, and the pound trades in the attraction and the influence zone of key levels. The upward targets to further rise can be noted at 1.3570 - 1.3610 - 1.3632 (resistance of the classical pivot levels), while the downward targets to further decline are at 1.3508 - 1.3486 - 1.3446 (support for the classic Pivot levels).

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.