No important macro statistics were published during the previous three days. It will be finally issued today. At 13:30 GMT the latest US inflation data will be released, which may determine or clarify the Fed's short-term monetary policy outlook

The January CPI is projected at 7.3% year-on-year, higher than the previous reading of 7.0%. Besides, the Core CPI is forecasted at 5.9%, compared to the previous figure of 5.5%. These figures are above the Fed's inflation target of 2%. Moreover, the data also indicate an acceleration in inflation. This fact definitely puts pressure on the Fed to tighten monetary policy more aggressively.

However, economists believe if the data indicate an easing of inflationary pressures, it can have a negative impact on the dollar.

Market participants will also focus on the publication of weekly data on the US labor market at 13:30 GMT. They are expected to show a decline in the number of initial jobless claims to 230,000 from 238,000 in the previous reporting period after their unexpected growth to 260,000 and 290,000 a month earlier. Moreover, it is a low number of jobless claims. It remains at about 200,000, its lowest level in several decades. It is a positive factor for the dollar after the US Labor Department report showed that the nation's unemployment rate was at a pandemic and multi-year low of 4.0%.

In short, a surge of volatility is expected at 1:30 pm (GMT) and especially in dollar quotes.

Federal Reserve Bank of Cleveland President Loretta Mester and voting member of the FOMC said on Wednesday that she supported aggressive measures of accelerating the reduction of the US Federal Reserve's balance with a volume of about $9 trillion. She noted that she supported selling some mortgage-backed bonds at some point to accelerate the transition to a balance sheet that consisted mostly of government bonds. Mester added that she would back raising federal funds rates in March in case there was no sudden change in economic conditions. However, she did not mention how many rate hikes she was willing to support, taking into account the uncertainty concerning the economic outlook.

Mester added that she expected some improvement in inflation rates later in 2022 as demand declined and factors holding back activity in the manufacturing sector and labor market eased.

The statements may have had a sobering effect on those market participants who had priced in 4 or 5 Fed's interest rate hikes this year, provided that Fed policymakers would decide at the March meeting to raise interest rates immediately by 0.50%.

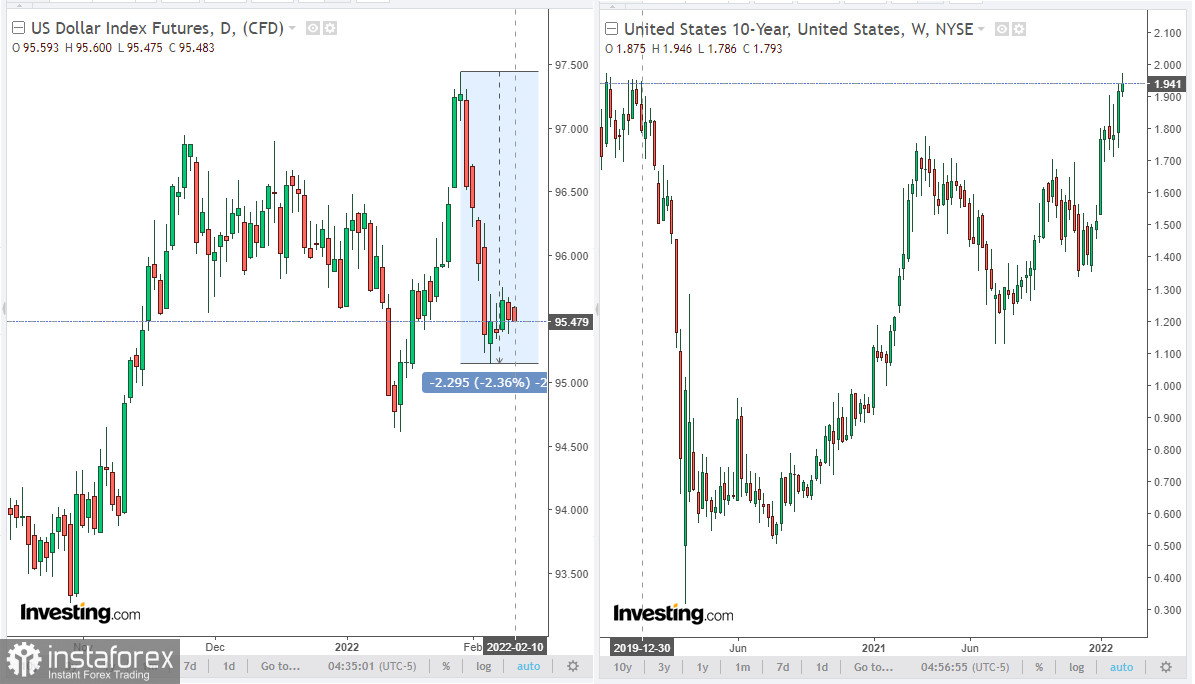

Therefore, the DXY dollar index is slightly down today. As of this article's publication, the DXY dollar index futures are trading near 95.48, 34 points above last week's low before the release of a fairly strong monthly report from the US Department of Labor.

Meanwhile, today's speech of Bank of England Governor Andrew Bailey at 17:00 GMT is highly significant. The Bank of England raised its key interest rate last week, further outperforming other central banks in the process of tightening monetary policy to curb accelerating inflation. The key rate was raised to 0.5% from 0.25%. Moreover, the bank officials said they would expect annual inflation to accelerate to above 7% in coming months due to low unemployment, rising wages and soaring energy prices. However, Bank of England policymakers held opposing views about how much to raise interest rates to curb accelerating price growth without hindering the economic recovery from the coronavirus pandemic. Four of the nine members of the Monetary Policy Committee suggested raising the rate to 0.75%.

The market participants will expect Andrew Bailey to clarify the situation regarding the further policy of the UK central bank. Andrew Bailey will likely provide explanations about the decision taken by the Bank of England on the interest rate and will touch upon the state and prospects of the British economy after Brexit and the partial lifting of COVID-19 restrictions. If Bailey does not mention monetary policy, the reaction to his speech will be weak.

Today, Bailey is delivering a speech ahead of tomorrow's release of the preliminary estimate of the UK GDP for the fourth quarter (07:00 GMT). After Brexit, British GDP growth slowed and with the start of the global coronavirus pandemic the figure fell into negative territory.

According to the forecast, UK GDP is expected to grow by 1.1% in Q4 2021. The previous indicator values: it rose by 1.1% in Q3, it added 5.5% in Q2 after falling by 1.6% in Q1 2021. The main factors that may push the Bank of England to keep the rate low are weak GDP and labor market growth, as well as low levels of consumer spending. If inflation rises, British citizens will be forced to draw on their savings to maintain consumption levels while prices rise significantly. In the medium term, consumption could reduce, exerting pressure on British GDP.

A strong GDP report from the National Statistics Office would strengthen the pound. However, if the GDP data is much worse than the previous figures and the forecast, it will put downward pressure on the pound.

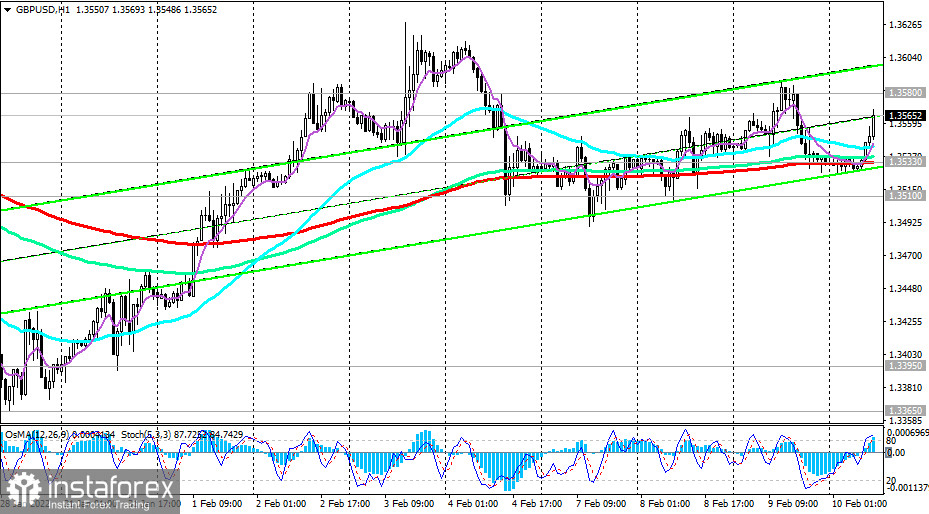

At the beginning of today's European session the GBP/USD pair is trading near 1.3566, showing a tendency for further growth.

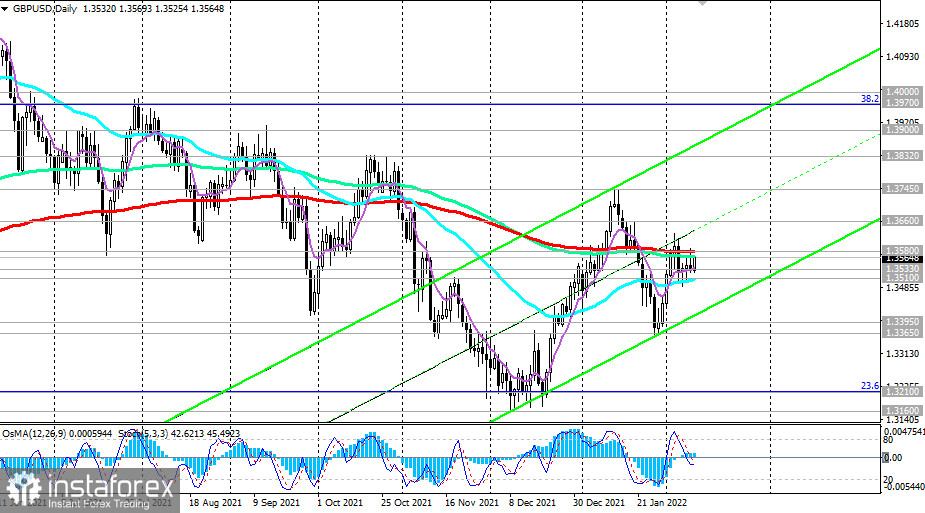

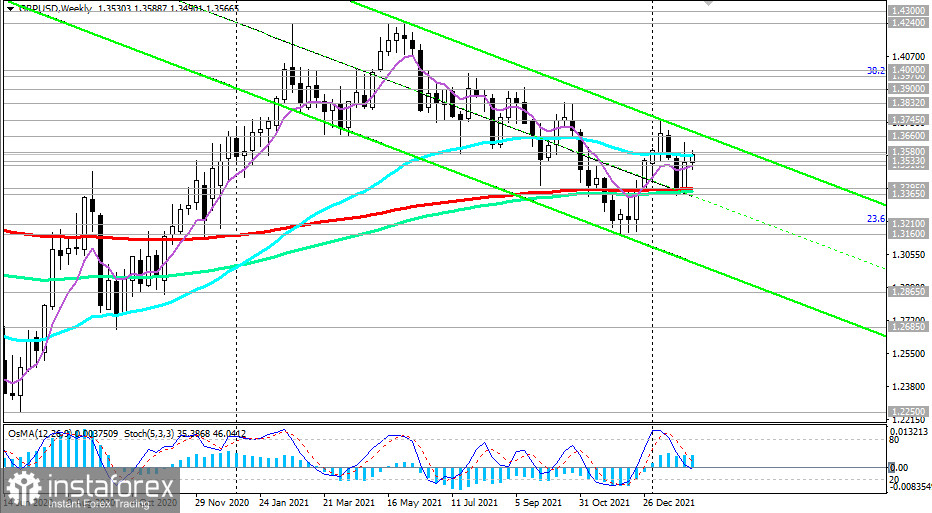

In case of breakout of the key resistance level of 1.3580 (EMA200 on the daily chart) the target will be the local resistance level of 1.3660 (local highs and the upper border of the descending channel on the weekly chart).

A breakout of the local resistance level of 1.3745 may again increase the risk of GBP/USD bearish trend break, directing the pair towards the highs of 2021 and the level of 1.4200.

Technical analysis and trading recommendations

The pound strengthened immediately after last week's Bank of England rate decision publication. Moreover, the GBP/USD pair reached a local intraday high of 1.3627. However, then the pair declined to the support level of 1.3510 (EMA50 on the daily chart). A retest to the support at 1.3510 is likely. In case of its breakout, a further fall towards the support levels of 1.3395 (EMA200 on the weekly chart), 1.3365 (local support level) is possible.

A breakout of the support levels of 1.3210 (23.6% Fibonacci level of correction to the GBP/USD pair decline in the wave, started in July 2014 near 1.7200), 1.3160 (2021 lows) may finally return the pair to the bear market zone and direct it deep into the downward channel on the weekly chart with the targets at the local support levels of 1.2865, 1.2685. Longer downside targets are at 1.2100 and 1.2000.

GBP/USD: Sell Stop 1.3520. Stop-Loss 1.3610. Take-Profit 1.3510, 1.3395, 1.3365, 1.3300, 1.3210, 1.3160, 1.3000, 1.2865, 1.2685

Buy Stop 1.3610. Stop-Loss 1.3520. Take-Profit 1.3660, 1.3700, 1.3745, 1.3832, 1.3900, 1.3970, 1.4000

Alternatively, after the breakout of the key resistance level of 1.3580 (EMA200 on the daily chart) the local resistance level of 1.3660 will become a target (local highs and the upper border of the descending channel on the weekly chart).

A breakout of the local resistance level of 1.3745 may again increase the risks of breaking the bearish trend of the GBP/USD pair, directing it towards the 2021 highs and the level of 1.4200.

Support levels: 1.3533, 1.3510, 1.3395, 1.3365, 1.3300, 1.3210, 1.3160, 1.3000, 1.2865, 1.2685

Resistance levels: 1.3580, 1.3660, 1.3700, 1.3745, 1.3832, 1.3900, 1.3970, 1.4000

Trading recommendations

GBP/USD: Sell Stop 1.3520. Stop-Loss at 1.3610. Take-Profit 1.3510, 1.3395, 1.3365, 1.3300, 1.3210, 1.3160, 1.3000, 1.2865, 1.2685.

Buy Stop 1.3610. Stop-Loss 1.3520. Take-Profit 1.3660, 1.3700, 1.3745, 1.3832, 1.3900, 1.3970, 1.4000