U.S. inflation has again entered the green zone, refuting the timid assumptions of some experts that at the beginning of this year the main inflation indicators will start to slow down. Thursday's release was another confirmation that the Fed is rightfully worried about inflationary trends. The main indicators in this area have not only been growing steadily for many months, but are also ahead of rather bold forecasts.

All this suggests that the American regulator at the March meeting may take a rather hawkish position, raising the interest rate by 50 basis points at once and announcing further steps in this direction. At least after the publication of Thursday's report, the market will price the implementation of this particular scenario.

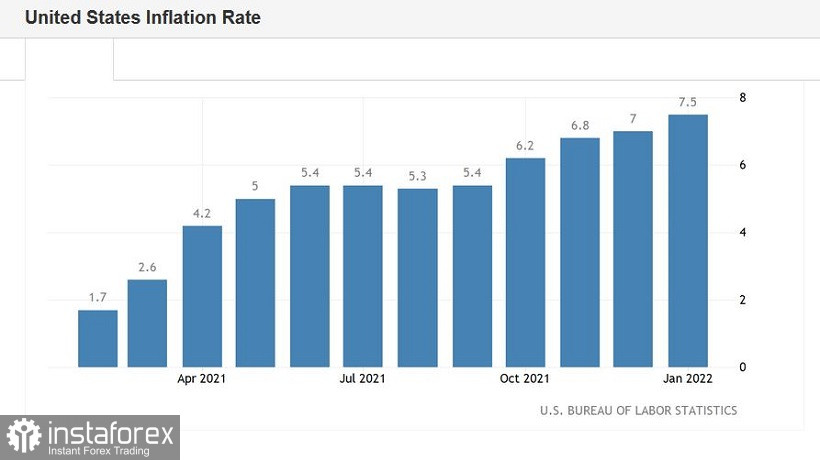

U.S. consumer price index remains at the level of multi-year highs. According to published data, the overall CPI in January accelerated to 7.5% YoY (with a forecast of growth to 7.3% and the previous value of 7.0%). This is the maximum value of the indicator for the last 40 years. The last time this indicator was at this level was in March 1982. On a monthly basis, the index also showed positive dynamics, rising to 0.6% (with a slight decline forecast to 0.4%).

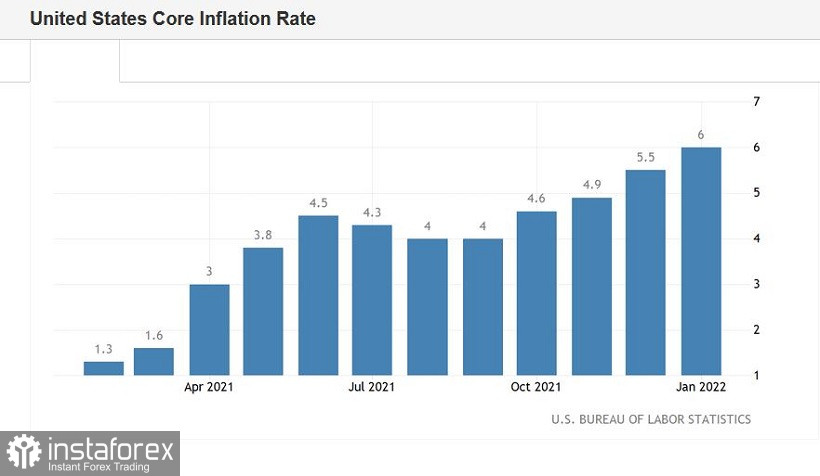

The core consumer price index, excluding volatile food and energy prices, similarly shot up. In monthly terms, an increase of up to 0.6% was recorded, in annual terms - up to 6.0% (with a growth forecast of up to 5.9%). And here again is a long-term record: the index last "gave out" such results in annual terms in 1982.

The structure of the release suggests that inflation is growing primarily due to higher prices for energy resources (+27% YoY) and food (+7%). The prices of cars, both used and new (trucks and cars), have also risen. The cost of medical services has also risen significantly. In general, inflationary growth is driven not only by higher energy prices, but by a shortage of workers, a significant increase in demand, and disruptions in global supply chains.

It should be noted here that Thursday's release complemented the overall picture, which is developing in favor of the dollar. The latest macroeconomic reports suggest that the Fed, most likely, will not waste time on the swing, and by July will raise the rate to one percent. After all, in addition to the CPI, not so long ago (namely, the week before last), another inflation indicator was published – the main index of personal consumption expenditures (PCE Price Index), which measures the core level of spending and affects the dynamics of inflation in the United States. It is believed that this indicator is monitored by the members of the regulator "especially carefully." So, in December, it also showed a significant increase, ending up at 4.9%. This is the strongest growth rate since 1989.

Inflation data indicate the strongest growth in consumer spending against the background of limited supply. After all, not only general inflation is growing, but also core inflation, which excludes volatile food and energy components. This suggests that Americans are actively spending their accumulated funds with a limited supply, thereby accelerating inflation and supporting the "hawkish" position of the Fed.

Despite such "unipolar" and unambiguous data, EUR/USD traders reacted very strangely to it again. The price impulsively dived into the area of the 13th figure, but failed to develop a large-scale downward movement. Then the buyers became more active, who managed to update the almost weekly price maximum. Note that exactly a month ago, traders showed a similar reaction to the inflation report, which also updated long-term records.

Moreover, contrary to common sense, the dollar was hit by a wave of sales throughout the market, immediately after the publication of the data (then the EUR/USD pair updated the multi-month high, rising to 1.1483). Traders began to open longs on downward pullbacks, thereby provoking an upward price spurt. However, after a few days, the pair turned 180 degrees, more than regaining the lost positions. If on January 14 the pair updated the high at 1.1483, then on January 28 it updated the multi-month low at 1.1121. It took EUR/USD bears just two weeks to make the 350-point way down.

At the moment, buyers of the pair also open longs on the wave of price decline. But in my opinion, a large-scale upward trend is unlikely under the current conditions. And, therefore, it is extremely risky to go into purchases today. The allies of the dollar are the CPI, PCE, nonfarm payrolls, and the Fed, which plainly declares hawkish intentions.

After Thursday's data release, the American regulator may raise the rate in March immediately by 0.5%, starting to reduce the balance after that. The allies of the euro are the "hawks" of the ECB, which only allow the option of normalizing monetary policy within the current year. Directly, the head of the ECB, Christine Lagarde, following the results of the January meeting, stated that "much will depend on the March revision of the macroeconomic forecasts of the Central Bank."

Thus, in my opinion, today it is advisable to take a wait-and-see attitude for the EUR/USD pair. As soon as the current upward impulse begins to fade (especially if it happens near the borders of the 15th figure), sales will be relevant again. Short positions can be opened with the target in the area of 1.1400-1.1410.