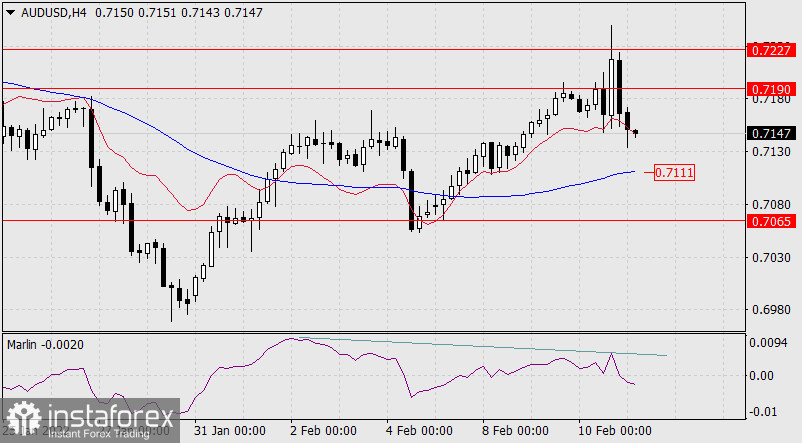

Yesterday's inflation data in the US was stronger than expected, the market volatility increased, the upper shadow of the daily candle of the Australian dollar broke through the target level of 0.7227, and the close was below the level of 0.7190.

The US CPI in the January estimate amounted to 7.5% y/y against the forecast of 7.3% y/y and, as we wrote in yesterday's review, we received a qualitative downward price reversal. The Marlin Oscillator on the daily chart went positive for a very short time, now it has returned to the negative area. The downside target at 0.7065 is the June 2020 high. Consolidation below the level will open the target at 0.6950.

The price divergence with the Marlin Oscillator has finally taken shape on the four-hour chart. The price aims for the MACD line to the 0.7111 mark. Breaking the support opens the target of 0.7065.