This week, several FOMC policymakers delivered speeches. We have already discussed their content. Fed members spoke in favor of rate hikes. As usual, they did not provide any new details as it may trigger panic. Perhaps many Fed officials who take part in the voting on rates (there are 18 of them) acknowledge the fact that the regulator may hike the key rate more than 3 or 4 times. These measures will be enough to return inflation to the 2% target level. Currently, it is rising rapidly due to soft monetary policy and huge money injections that were made to revive the economy after the coronavirus crisis. It means that an increase in the benchmark rate by 1-1.25% may stop the growth of inflation but it will not return it to the target level. However, if Rafael Bostic or James Bullard voiced that the Fed was going to raise the key rate 7 times, the stock market would collapse. Therefore, FOMC policymakers should ensure stability in markets without causing panic. This is why their speeches are so neutral.

At the same time, analysts and banks are not restrained in their comments. For instance, Bank of America believes that there will be 7 rate hikes this year. As inflation jumped to 7.5%, many economists also revised their forecasts. The probability of a 0.50% rate hike in March is already 50%. James Knightley, ING's chief international economist, assumes that rate hakes will hardly help the Fed. He doubts that rate hikes will resolve the issues of supply chain problems together with a shortage of workers. It may lead to a temporary weakening of the economy and help supply and demand to stabilize.

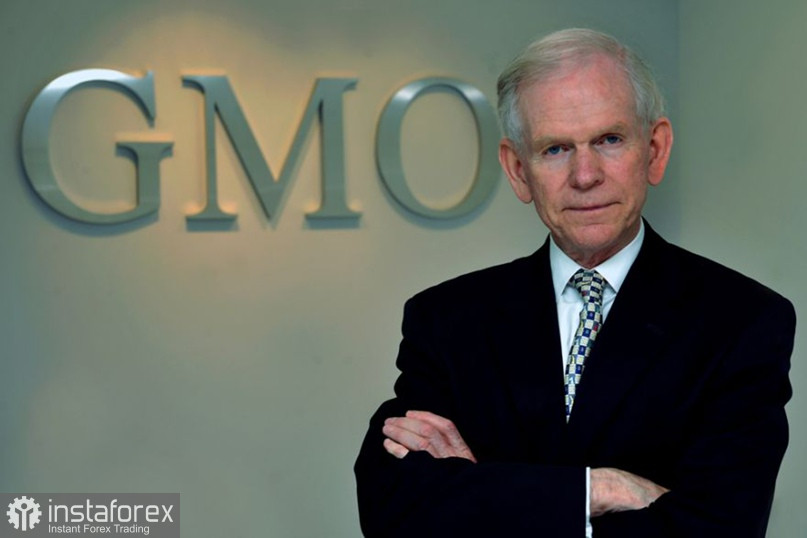

US investor Jeremy Grantham predicts a 50% drop in the S&P 500 index. "The Federal Reserve is prepared to let the stock market drop another 15% to 20% before it acts in any way to stem the decline," Greg Jensen, the co-chief investment officer at Bridgewater Associates, said. He reckons that the period of stability in markets that has been lasted for the last 25 years is coming to an end. Hence, many states are likely to face shortages and inflation spikes now. Jensen also notes that it will be for the Fed if the stock market falls by 15-20%. Goldman Sachs does not expect a strong fall in the stock market as the regulator will raise rates at a time of slowing economic growth, not a recession. This is why the equity market will continue to rise. Nevertheless, the majority of analysts forecast a strong and prolonged correction.