As soon as it became known that inflation in the United States accelerated from 7.0% to 7.5%, and thus reached a record level since February 1982, the pound immediately began to rise strongly. Growing concerns about the general economic risks posed by excessive consumer price growth have been the main driving force behind this. However, in just a couple of hours, the direction of movement turned one hundred and eighty degrees. As a result, quotes fell even below the values at which the market was before the inflation data was published. And there were two good reasons for that.

First, the risks to the economy clearly do not contradict the plans of the Federal Reserve to tighten monetary policy. Rather, they are an additional argument in favor of policy changes. In particular, the increase in interest rates. So they started talking about the possibility of raising the refinancing rate immediately by 0.50% even more actively. And already in March.

Secondly, having somewhat moved away from inflation data, market participants finally paid attention to the words of European Central Bank President Christine Lagarde, which she said at about the same time when macroeconomic statistics were published. And Lagarde said that a sharp tightening of monetary policy would have a negative effect on the economy as a whole. A simple conclusion follows from this - the ECB is not yet ready to raise interest rates. So the probability of its growth this year is extremely small. But until recently, this prospect was one of the driving forces in the foreign exchange market. Working just to weaken the dollar. In general, the euro confidently went down and pulled the pound along with it.

It turns out the following picture - the Fed is about to start raising interest rates, and will do it quite rapidly, and the ECB is afraid to do anything.

Inflation (United States):

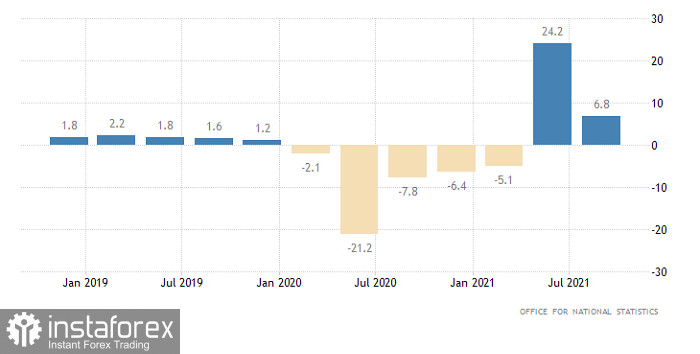

At the same time, the pound has enough internal reasons for concern today. A preliminary estimate of GDP for the fourth quarter should show a slowdown in economic growth from 6.8% to 6.6%. And this is the most optimistic forecast. There is an opinion that the growth rate will even slow down to 6.4%.

Change in GDP (UK):

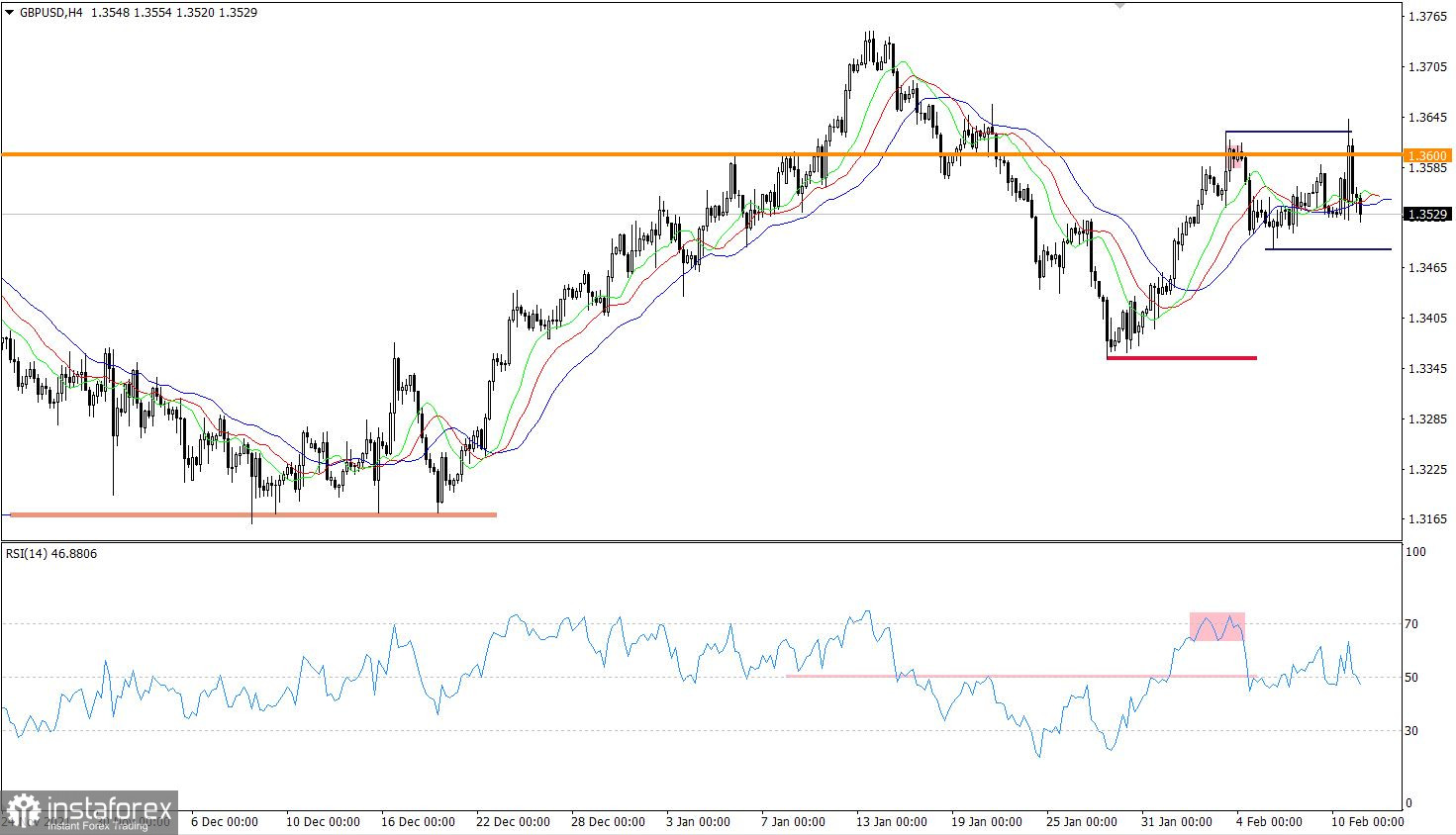

Speculation has not bypassed the British currency, and so with the information background on the market, a local high of February 3 (1.3626) appeared on the market. This step did not lead to anything drastic, almost immediately the quote returned to its original position, from which it all began.

The RSI technical instrument is moving below the 50 line in a four-hour period, which in the future may indicate an increase in the volume of short positions. RSI D1 is still following the 50 line, which in turn indicates stagnation.

The Alligator indicator in a four-hour period confirms the stagnation stage by intertwining between the MA moving lines.

On the daily chart, the stagnation and characteristic uncertainty among market participants is confirmed by a series of doji type candles.

Expectations and prospects.

Despite local price jumps, the control values of 1.3480 and 1.3630 were not confirmed in the four-hour period. Thus, traders are still guided by them.

I remind you that long positions were considered after keeping the price above 1.3630 in H4, and short positions would be relevant after keeping the price below 1.3480 in H4.

Until then, the quote is in the stage of stagnation.

A complex indicator analysis gives a sell signal based on the short-term and intraday periods.