The EUR/USD pair retreated a little in the short term but the bias remains bullish. It stands at 1.0409 at the time of writing. After its strong growth, a minor retreat was natural. It could test and retest the support levels before extending its growth.

Fundamentally, the pair jumped higher after the US services and manufacturing data came in worse than expected, while the Eurozone and German manufacturing and services figures came in better than expected. Also, the FOMC Meeting Minutes signaled that the FED is to deliver only a 50 bps hike at the next meeting.

Today, the Euro received a helping hand from German ifo Business Climate which came in better than expected.

EUR/USD Retests The Broken Obstacles!

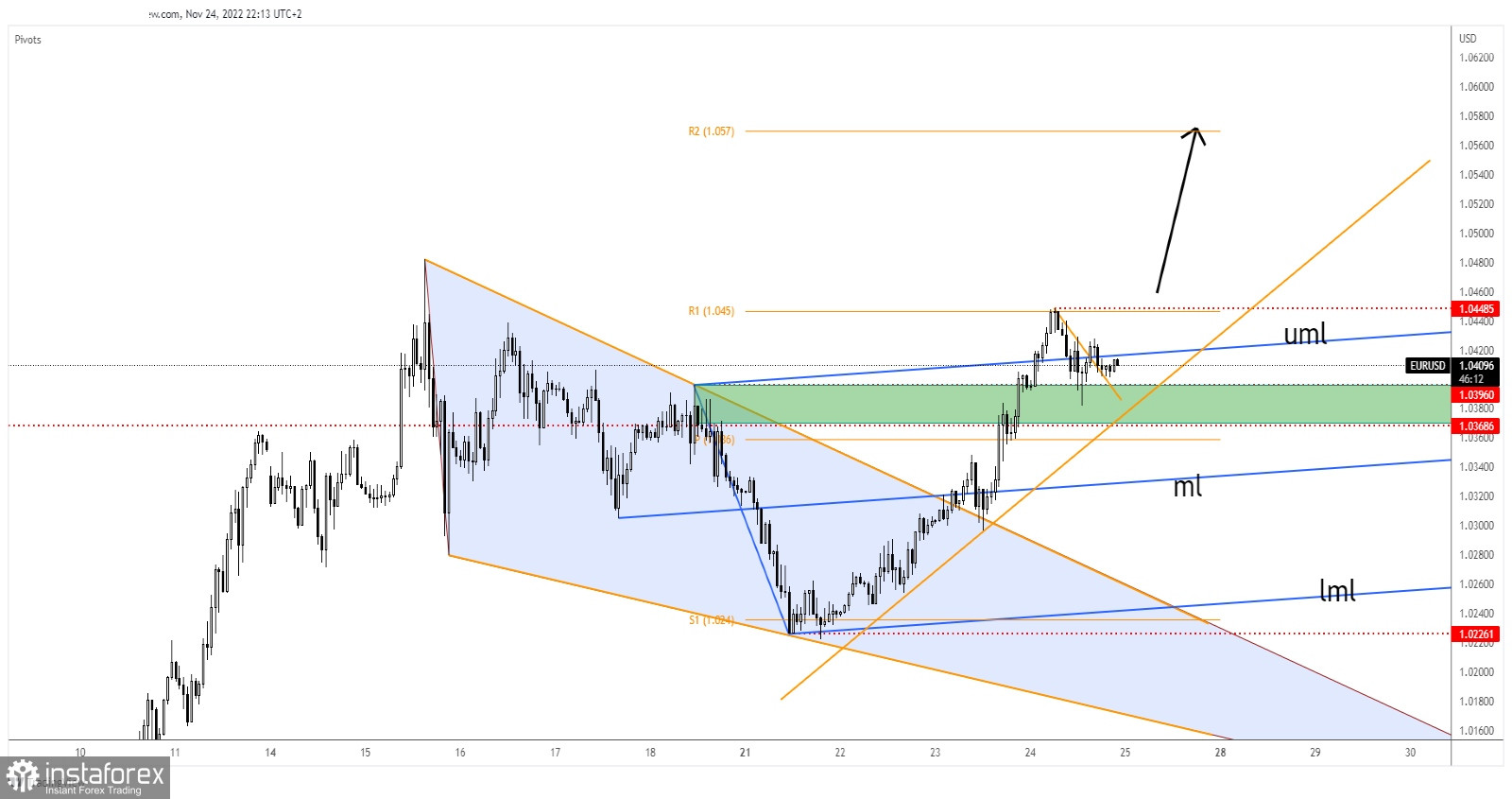

Technically, the rate found resistance at the R1 (1.0450) and now it has retested the 1.0396 static support. As long as it stays above the uptrend line, the bias remains bullish.

The 1.0448 and the R1 represent upside obstacles. In the short term, it could accumulate more bullish energy before jumping higher.

EUR/USD Forecast!

Staying above the uptrend line and making a new higher high announces further growth. Personally, I will try to go long if this scenario takes shape. An upside continuation could be invalidated only by a valid breakdown below the uptrend line.