Higher-than-expected inflationary pressures in America caused a strong sell-off in the stock markets, while the US dollar strengthened amid a sharp increase in Treasury yields.

As suggested in the previous article, the high probability of higher-than-expected US inflation could lead to changes in Fed rate hike expectations. This actually happened. According to the presented data, annual consumer inflation rose above the consensus forecast of 7.3%, to 7.5%. In monthly terms, the consumer price index did not lower the growth rate to 0.5% but kept it at the level of 0.6%. In addition, the base figures did not go behind the general inflation values. The core consumer price index in annual terms rose above expectations to 6.0% against 5.5% and the forecast of 5.9%. It also maintained a growth rate of 0.6% against the forecasted decline to 0.5% in monthly terms.

Such figures affected the dynamics of government bond yields. Sensitively reacting to the prospects of rate changes, 2-year notes sharply declined, causing a strong increase in yield, which was approaching the 1.650% mark. The yield of the benchmark 10-year treasuries also sharply increased above 2.050% and is currently at 2.036%. Previously, the yield of ten-year securities reached this value in August 2019.

Amid increased inflationary pressure, the growing fears that the Fed may raise rates at the March meeting not by 0.25%, but immediately by 0.50%, manifested itself in the growth of futures for federal funds rates, which already show an unexpected increase in the cost of borrowing by 0.25%, and immediately by 0.50%. This is a clear signal that the US dollar simply cannot ignore. A shift in market sentiment from a more moderate rate hike by the Fed of 0.25% to a more vigorous 0.50% will support the US dollar in currency markets. If earlier, its growth already took into account an increase of 0.25%, then a change in expectations on rates will lead to a revision of its levels concerning a basket of major currencies and not only to them. So, before the opening of the European trading session, the ICE dollar index is again above the 96.00 mark after yesterday's volatile trading session, while the prospects for its growth to 97.00 points have increased markedly.

Observing the current situation, we believe that the sales in the stock markets are likely to continue today, while the US dollar will receive support, and commodity market asset prices will remain under pressure.

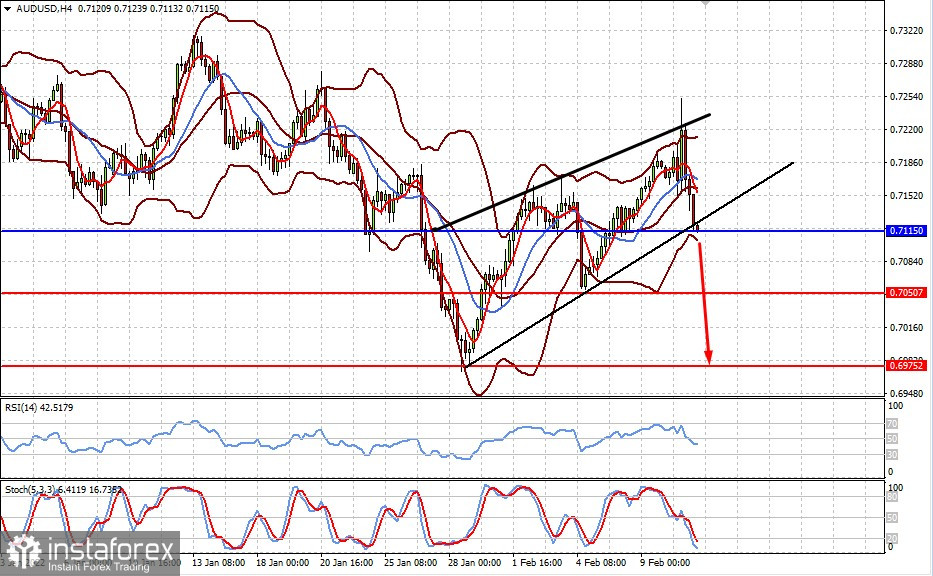

Forecast for the day:

The AUD/USD pair is testing the support level of 0.7115, the breakdown of which may become the basis for the pair to continue falling to the level of 0.7050, and then to 0.6975.

The USD/CAD pair is rising amid the strengthening of the US dollar and the decline in crude oil prices. If the price rises above the level of 1.2780, it will most likely further rise towards 1.2850.