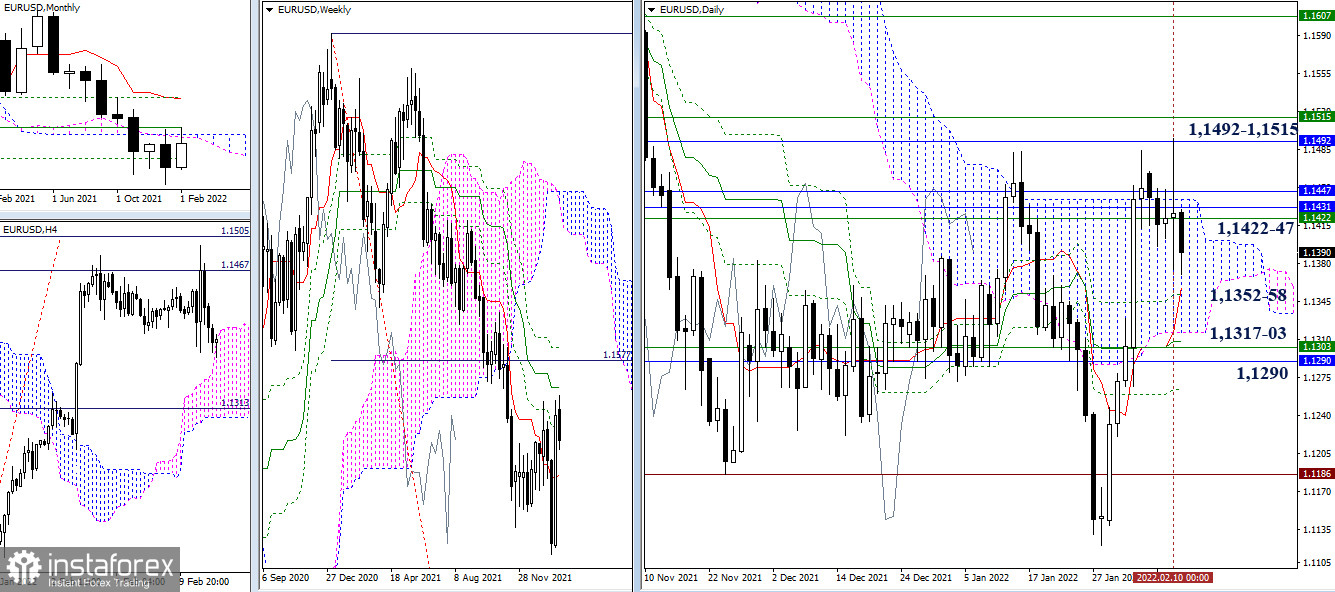

EUR/USD

The previous day managed to stand out with quite a lot of volatility, but it was not possible to change the situation. The pair remains in the attraction and influence zone of various levels 1.1422-47. Uncertainty persists, but the main pivot points for possible movements retain their location. For the bulls, the medium-term trend resistance zone (1.1492 monthly + 1.1515 weekly), which was tested yesterday, is still important. In turn, the bears are interested in support levels of 1.1352-58 (daily Fibo Kijun + daily Tenkan) and 1 .1317 - 1.1303 - 1.1290 (lower limit of the daily cloud + daily medium-term trend + weekly short-term trend + monthly Fibo Kijun). Today, the week will be closed. The results will be interesting.

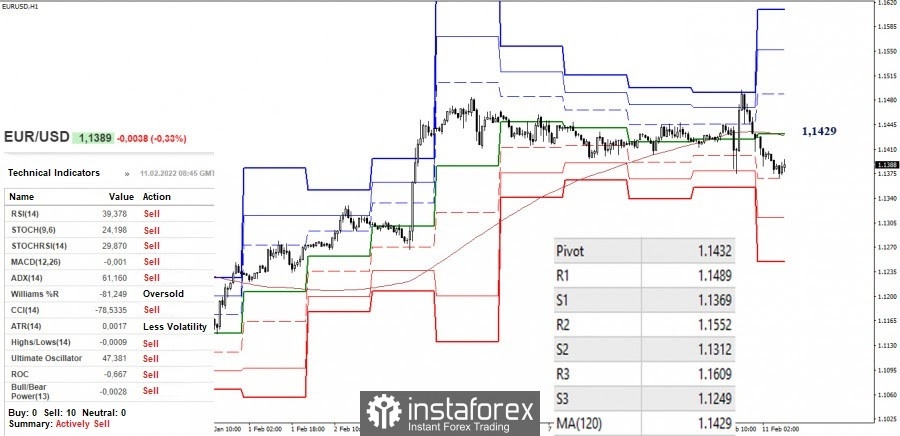

The daily volatility led to the fact that priorities changed immediately in the smaller timeframes. The advantage is currently on the bearish side. They are testing the first support of the classic pivot levels (1.1369), so if the decline continues, the next level might be 1.1312 (S2) and 1.1249 (S3). The key levels in the smaller timeframes have joined forces and act as resistance (central pivot level 1.1432 + long-term weekly trend 1.1429). The resistances of the classic pivot levels, which are also pivot points for intraday movement, can be noted at 1.1489 - 1.1552 - 1.1609

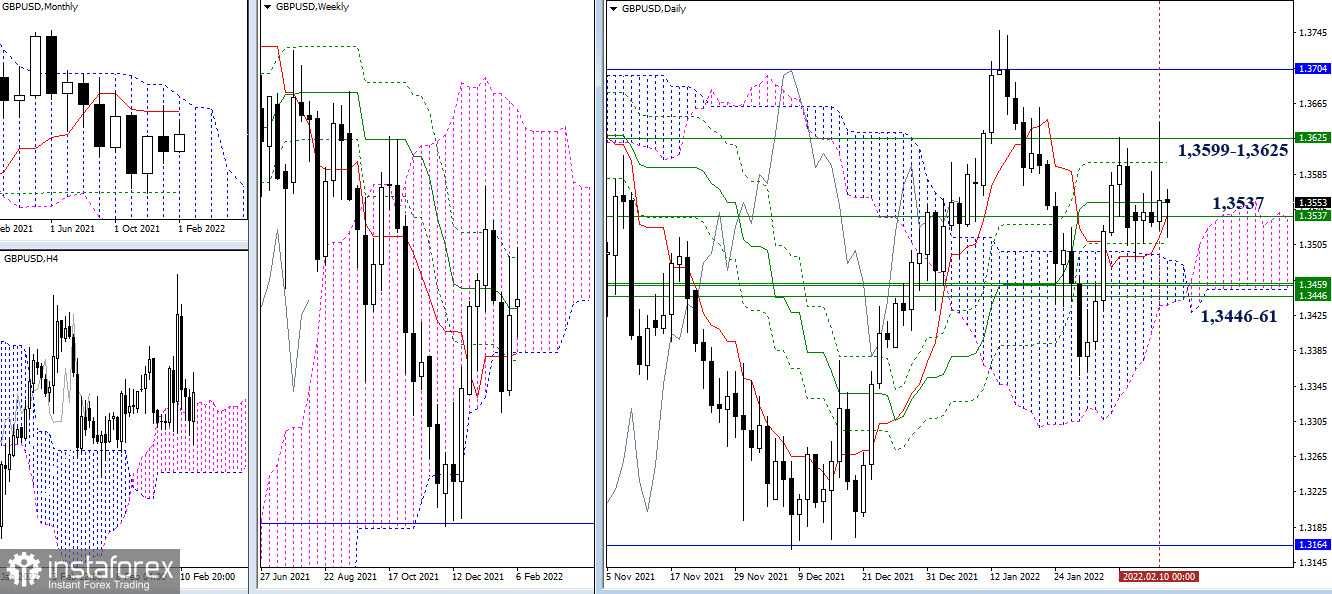

GBP/USD

The pair in the smaller timeframes tested the final lines of the Ichimoku dead crosses (daily 1.3599 + weekly 1.3625) again but failed to hold the position. The market returned to the former attraction and influence zone, the center of which is the weekly medium-term trend (1.3537). Today is the closing of the week and uncertainty will most likely continue.

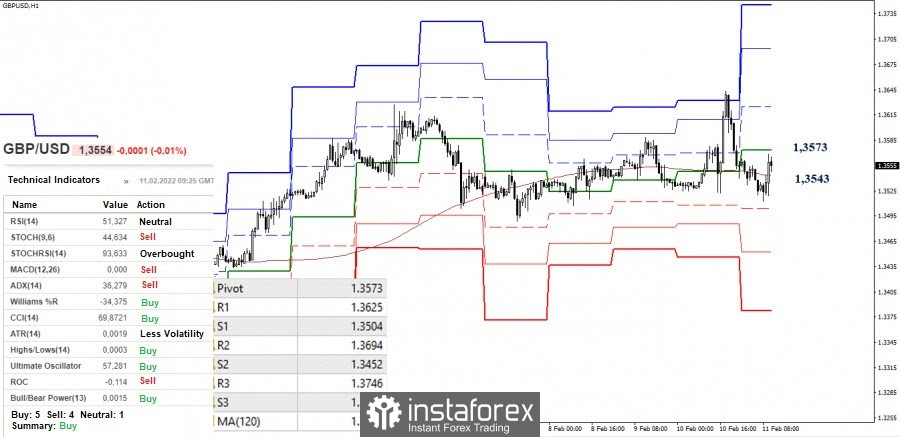

The bulls' attempt did not succeed. The pair returned to the attraction zone of key levels and continues to fight for them. Today, the key levels in the smaller timeframes are set at 1.3543 (weekly long-term trend) and 1.3573 (central pivot level). Trading below the levels will retain the advantage of the bears and enhance the possibility of further decline. But if we consolidate higher, the pair can change the current balance of power in favor of the bulls. The downward pivot points are the support of the classic pivot levels, which are set at 1.3504 - 1.3452 - 1.3383, while the upward pivot points are the resistance of the classic pivot levels at 1.3625 - 1.3694 - 1.3746.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.