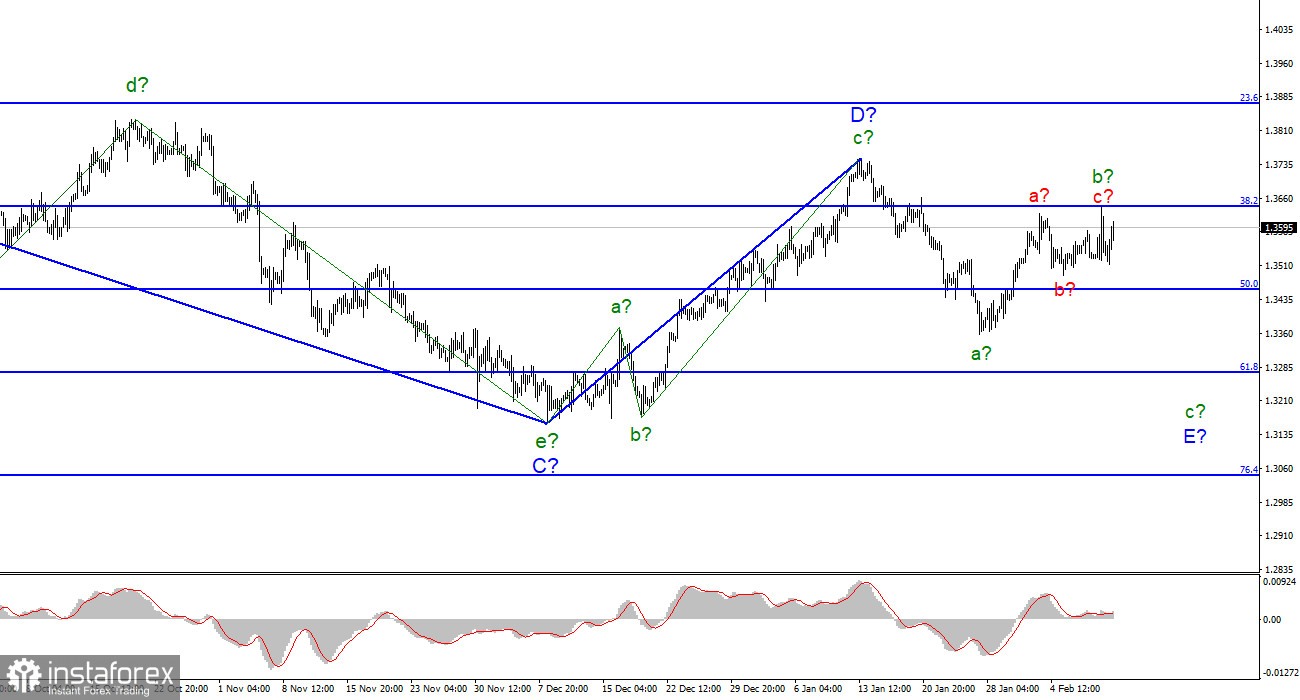

The wave analysis of the pound/dollar pair remains convincing, but it may change in the near future. Wave b became more complicated and longer than wave a due to the recent rise. This means that the trading instrument is trying to form a new upward section of the trend instead of continuing forming the downward correctional section. In this case, wave D will be considered the first wave of a correctional section of trend A. Since it still consists of three waves, it cannot be wave 1. A successful break of 1.3642 will point to the market's readiness to buy the pair, thus pushing the price to the peak of wave D. If the prediction comes true, the wave picture may change. However, if the pair fails to break the mentioned level, there will be no changes. .

GBP rose amid GDP report

On February 11, the pound/dollar pair advanced by 40 pips amid the UK GDP data for December and for the fourth quarter. In fact, both reports were not very positive. Thus, in December, GDP dropped by 0.2%. Economists had expected a decline of 0.5%. It means that the report was a bit better than expected. This could not become a strong reason for a rise in the pair. The quarterly report should have unveiled a rise of 1.1%. In fact, the indicator inched up by only 1.0%. In both cases, the GDP readings were rather weak. Thus, the appreciation of the British pound is just an incident since in the second half of the day there were no reasons for a rise. The UoM consumer sentiment index was well below the forecast. It hit just 61.7 points instead of 67.2 points. Thus, the British pound had very controversial reasons for a rise. Judging by the currency wave analysis, we may still expect the formation of the downward wave. This could happen amid mounting demand for the US dollar. The greenback had every chance for a rise, but the inflation data had only a short-lived effect. Shortly after its publication, traders began to avoid buying the US dollar, thus causing a decline.

Conclusion

Judging by the wave analysis, we may expect the formation of wave E. However, at the moment, we see that a new upward wave is under formation. That is why it is better to avoid buying the British pound. The instrument returned to 1.3645, and wave b is turning into a three-wave structure. However, a further increase in the pair may point to the opposite. That is why it is possible to sell the pair with the targets near 1.3272 that is the 61.8% Fibonacci level, if the pair fails to break 1.3645.

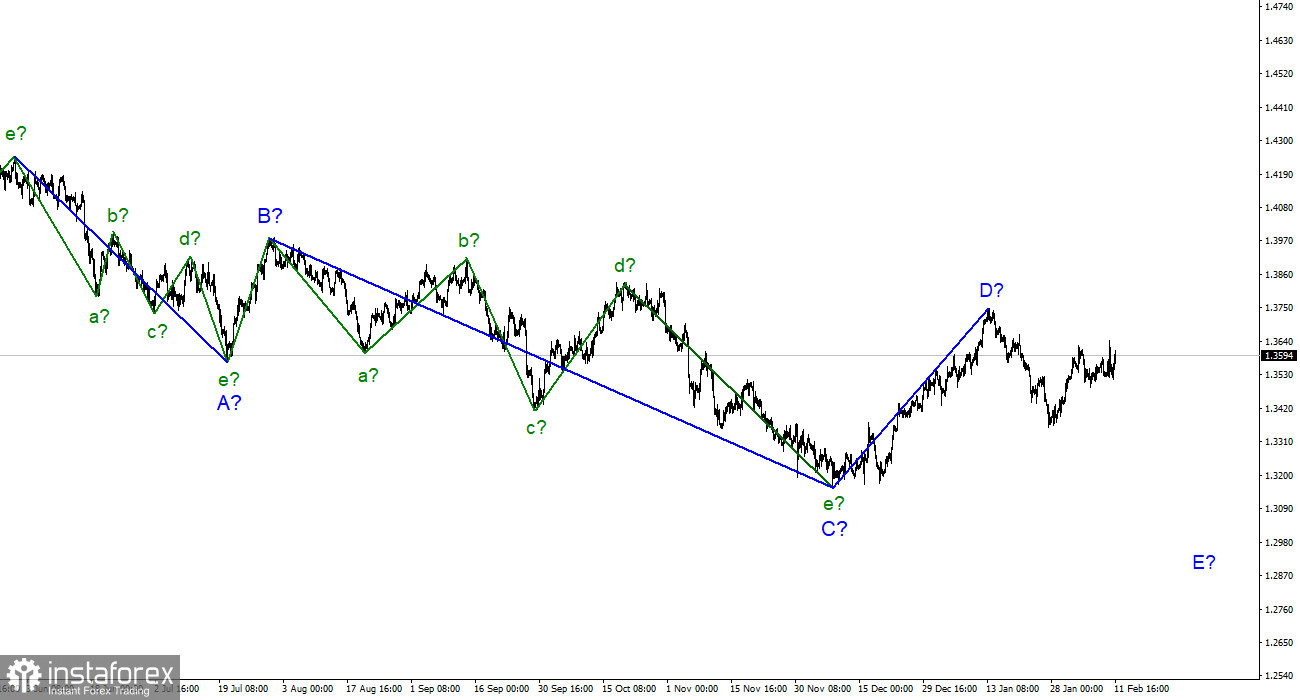

On a bigger period, wave D looks finished, whereas the downward section of the trend may continue its formation. Thus, in the next few weeks, the pair may resume falling below the low of wave C. Wave D consists of three waves. That is why I cannot consider it wave 1 of a new upward section of the trend.