This is probably for the best that the macroeconomic calendar is empty today and nothing will distract market players from the closed meeting of the Federal Reserve. No doubt, a certain decision will be made. The interest rate may be raised or asset purchases reduced further at least. Otherwise, there would be no point in holding an emergency meeting. Previously, the US central bank used to always make a certain monetary policy decision at such meetings. However, they were about cutting interest rates. The current state of the economy is somewhat different from the ones in 2009 and 2020. At the same time, the euro is hardly prepared for such an outcome. Indeed, since the closed meeting was announced last Thursday, the euro has been on a losing streak. However, there were also other headwinds, including ECB President Lagarde's speech. Therefore, if a rate hike is announced today, the euro will tumble.

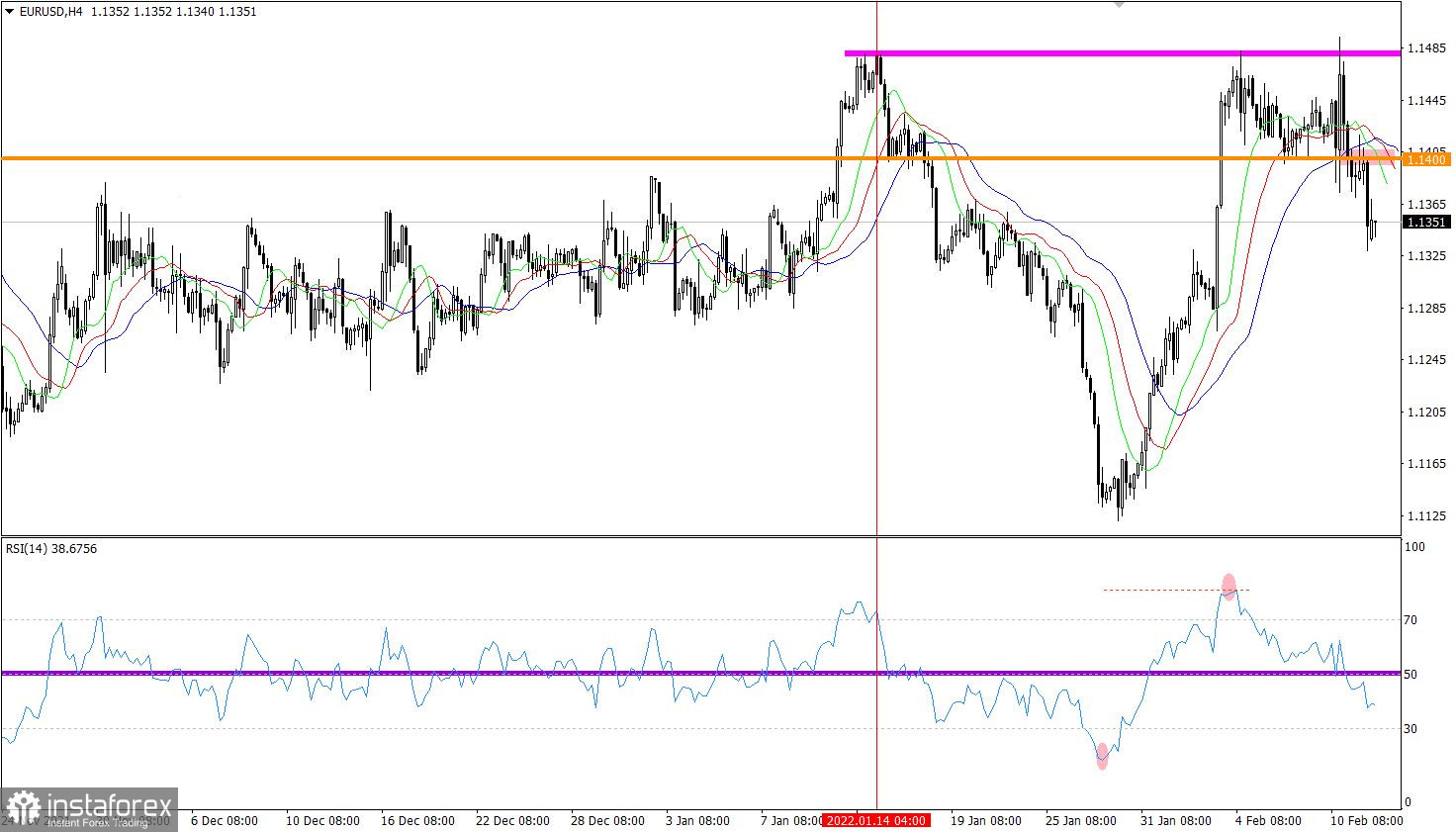

Having broken the sideways channel of 1.1400/1.1480, the EUR/USD pair extended the downtrend. Consequently, it led to a rebound, so the pair could recoup some of its earlier losses during a correction.

The RSI indicator is moving down in the range between 50 and 30 on the H4 chart, indicating increased bearish sentiment in the market.

A reversal of the moving averages of the Alligator indicator confirms the end of the corrective move.

Outlook:

There is currently a signal to sell the instrument. A stronger sell signal will be produced if the quote consolidates below 1.1320. If so, the volume of short positions will increase and lead to a stronger US dollar.

As for complex indicator analysis, there is a signal to sell the pair in the short term and intraday amid a bearish cycle.