After the rapid growth at the auctions of the week before last, the trading of the last five days ended with a decline for the main currency pair of the Forex market. Let me remind you that the growth of the single European currency, which was shown the week before last, was caused by the more "hawkish" rhetoric of the European Central Bank (ECB) and its president Christine Lagarde. Although the author did not find in Lagarde's last speech such signals that could lead to such a sharp appreciation of the euro. Well, okay, everyone has their own opinion on this and everyone has the right to it. As for the fundamental factors of the strengthening of the US dollar at the auction on February 7-11, in my opinion, consumer prices played a key role in this, which continued to rise in the United States. And it is really necessary to do something about this factor, and the most effective method for this is to increase the main interest rate.

However, do not think that there are no "dovish" left in the ranks of the Federal Reserve System (FRS) who insist that it is still premature to carry out the process of raising rates. At least, proponents of a soft monetary policy will do their best to resist raising the federal funds rate by 50 basis points at once. According to the "dovish" wing of the Fed members, if you raise the rate, then it is best not to do it abruptly, but very smoothly. But there is practically no doubt that the rate will be increased following the results of the March FOMC meeting. Now let's move on to our sinful deeds and start analyzing the EUR/USD price charts. First, let's turn to the weekly timeframe.

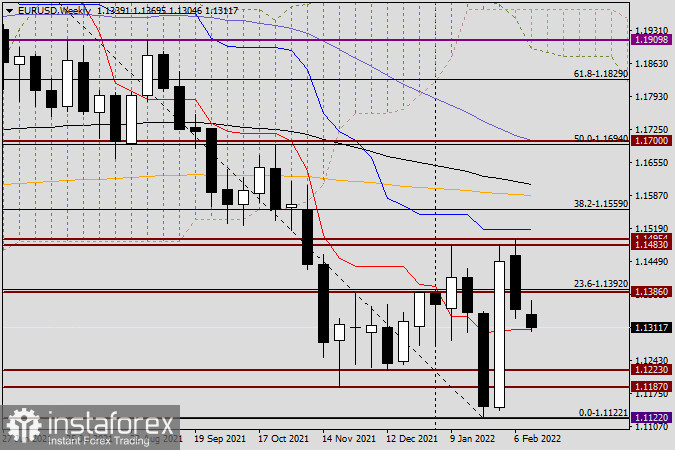

Weekly

As you can see, the resistance of sellers in the area of 1.1483 is very strong. For the third time, EUR/USD bulls tried to storm this mark and failed again. Although they managed to move a little higher, a sharp and very strong reversal of the course in the south direction followed from 1.1495. Thus, it can be concluded that the protection of the most important historical, psychological and technical level of 1.1500 remains at the proper level. In general, if you look at how many obstacles there are above the 15th figure in the form of indicators, then, in my personal opinion, it will be extremely difficult to overcome them all without a strong driver for the euro. But if Lagarde suddenly comes out and says, they say, that's it, high inflation has got us, we are raising the main interest rate in April – that will be the number. In this scenario, the pair can go up as much as you want. However, let's remain realistic. The primary task of the euro bulls is to pass the 1.1500 mark, as well as the blue Kijun line located at 1.1515, and with mandatory fixing above. Bears on the euro/dollar need to continue to move the quote down and alternately push through the red Tenkan line, which runs near the very important technical level of 1.1300 and consolidate, that is, close the week, under this mark.

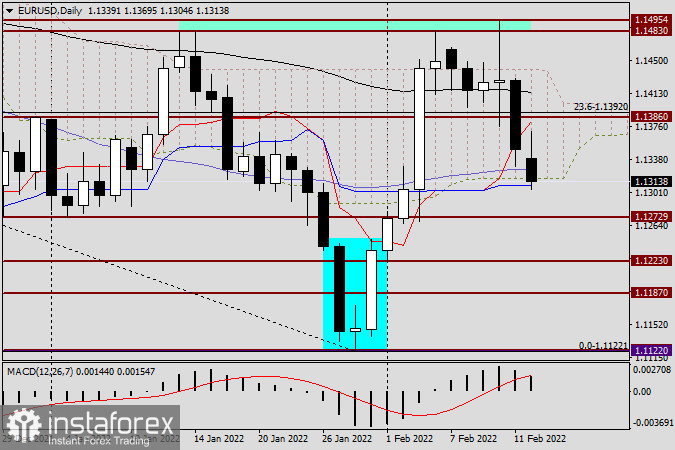

Daily

As you can see on the daily timeframe, the reversal model of the Morning Star candlestick analysis has received its working out. An attempt to break out of the Ichimoku indicator cloud and break through the hated resistance zone of 1.1483-1.1495 turned out to be impossible for the players to increase the exchange rate. As a result, EUR/USD not only returned to the cloud limits but did it so confidently that there are all prerequisites for the pair to fall to the lower border of the cloud and try to get out of its limits. But this will happen only if the 50-simple moving average is truly broken, and then the blue Kijun line of the Ichimoku indicator is broken. Thus, the situation on the two charts considered today can be recognized as very uncertain. And yet, selling EUR/USD after the pair's attempts to rise to the levels of 1.1385 and 1.1400 looks like the most priority option. In tomorrow's article, we will consider smaller time intervals and, if necessary, adjust today's forecast.