Following the Federal Open Market Committee's emergency meeting, investors were waiting for only one outcome – an increase in the refinancing rate. This circumstance partially contributed to the gradual growth of the US dollar, which began last Thursday, when the emergency meeting was announced. The fact that the interest rate invariably changed according to the results of all previous emergency meetings gave confidence in such an outcome. But the results of yesterday's meeting turned out to be quite strange. The American regulator decided to make them closed, limiting itself only to a short press release without any comments and observations. However, the content of it provides answers to many questions. The regulator focused on reducing the share of overdue loans, which hints at the inevitability of an increase in the refinancing rate. The Fed may be preparing the market to raise the refinancing rate by 0.50% at once – from the current 0.25% to 0.75%. In any case, the results of the meeting somewhat surprised the market, which resulted in its stagnation.

Judging by today's data, the market will continue to stagnate. And while the UK's average wage growth should slow from 3.8% to 3.6%, employment could rise by 75,000, and unemployment claims could decline by 27,000. That is, wages seem to be declining, but employment itself is growing, which is a completely normal combination. Meanwhile, the unemployment rate itself is likely to remain unchanged.

Unemployment rate (UK):

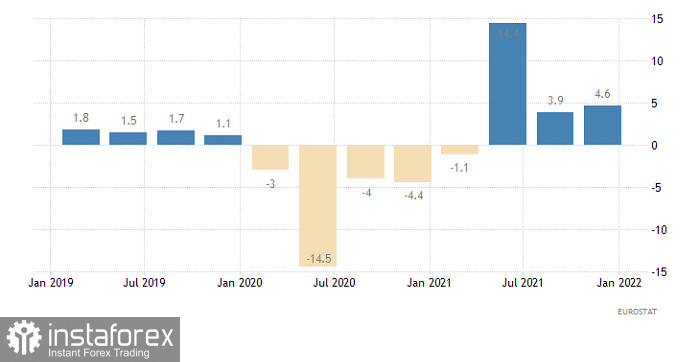

The only thing that will be published in the EU is the second GDP estimate for the fourth quarter, which should coincide with the first, where there is an acceleration in economic growth from 3.9% to 4.6%. There is nothing new here for the market.

Change in GDP (Europe):

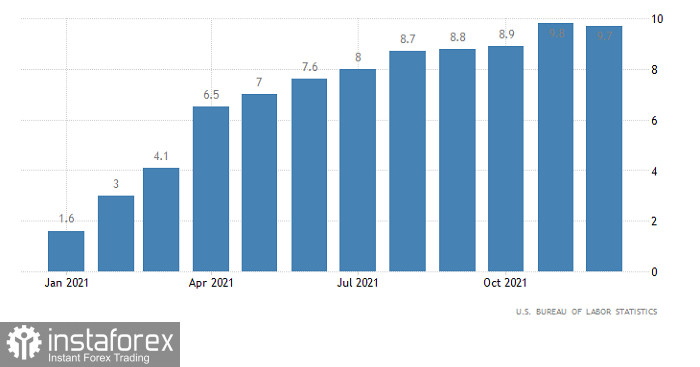

Data on producer prices will be released in the US, the growth rate of which may accelerate from 9.7% to 10.0%. However, only a few people are interested in this, since, judging by the results of yesterday's meeting, the issue of raising the refinancing rate has already been resolved. Therefore, growth in the producer price index will not affect anything.

Producer Price Index (United States):

The EUR/USD pair returned the quote to the area of 1.1280 during the rapid decline, where there was an insignificant stop, expressed in a pullback. A temporary slowdown in activity can be assumed, which will lead to stagnation. Traders can regard this move as a regrouping of trading forces in the upcoming acceleration in the market. A new round of growth in the volume of short positions is expected after holding the price below the level of 1.1260 in a four-hour period.

The GBP/USD pair has not shown proper activity on the market. The quote is still within the side channel 1.3500/1.3600. Thus, the trading tactics are focused on keeping the price outside the key levels relative to the four-hour and daily timeframes. In this case, a breakdown signal will be received.