Gold rose sharply in price on Monday. This was facilitated by increased geopolitical tensions. The whole world is watching how the protracted conflict between Russia and Ukraine will be resolved.

Last week, some Western media reported insider information that Moscow could launch an attack on February 16.

In response, yesterday the President of Ukraine Volodymyr Zelensky declared this date a day of unity. He called on Ukrainians to hang the country's flags on buildings on Wednesday and sing the national anthem together.

Many interpreted his statement as a bold hint. It seems that the head of Ukraine has been officially informed that February 16 will be the day of the invasion.

Also on Monday, a comment by British Prime Minister Boris Johnson added fuel to the fire. He called the situation in Ukraine "very, very dangerous."

All these factors led to panic and a major sell-off on the world stock markets. Yesterday, the shares of many companies fell sharply.

Now investors are moving away from risky instruments to protective assets. One of the best shelters is considered to be gold.

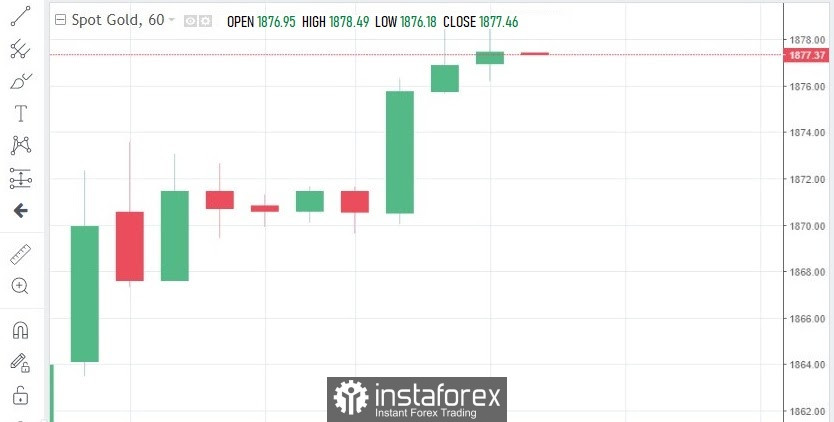

At the beginning of the new working week, bullion showed impressive dynamics. During the day, they rose by 1.5% (for comparison: over the past seven days, the quotes rose by 1.9%).

In monetary terms, the difference from the previous close was more than $27. Gold finished trading on Monday at the highest mark in three months at $1,869.40, and $1,872.80 became the daily high.

Analyst David Russell believes that a close above $1,870 will stimulate gold bulls to reach a new goal faster. The next psychologically important mark for a yellow asset is $1,900.

The expert warns that in the near future, the movement of quotes will strongly depend on the news background. Even a slight heating up of the conflict and the growing uncertainty around the situation in Ukraine will contribute to an increase in prices for the precious metal.

At the same time, any sign of a thaw in relations between Russia and the West could trigger a fall in the yellow asset.

Yesterday, by the way, UN Secretary-General Antonio Guterres called on world leaders to step up diplomacy in order to calm the situation as soon as possible. He said he was deeply concerned about the "growing speculation" regarding the military conflict.

Another negative factor for gold now is the hawkish rate of the US Federal Reserve. On Monday, the central bank held an unscheduled meeting at which officials continued to argue about how aggressively to approach an interest rate hike in March.

The president of the Federal Reserve Bank of St. Louis, James Bullard, who is entitled to vote at FOMC meetings this year, advocates speeding up the process. He intends to convince his colleagues to raise rates by 100 bps by the beginning of July.

Meanwhile, Commerzbank analysts consider this unrealistic. In their opinion, further escalation of the Russian-Ukrainian conflict will keep the Fed from raising interest rates by 50 bps in March, as this may cause excessive turmoil in financial markets.