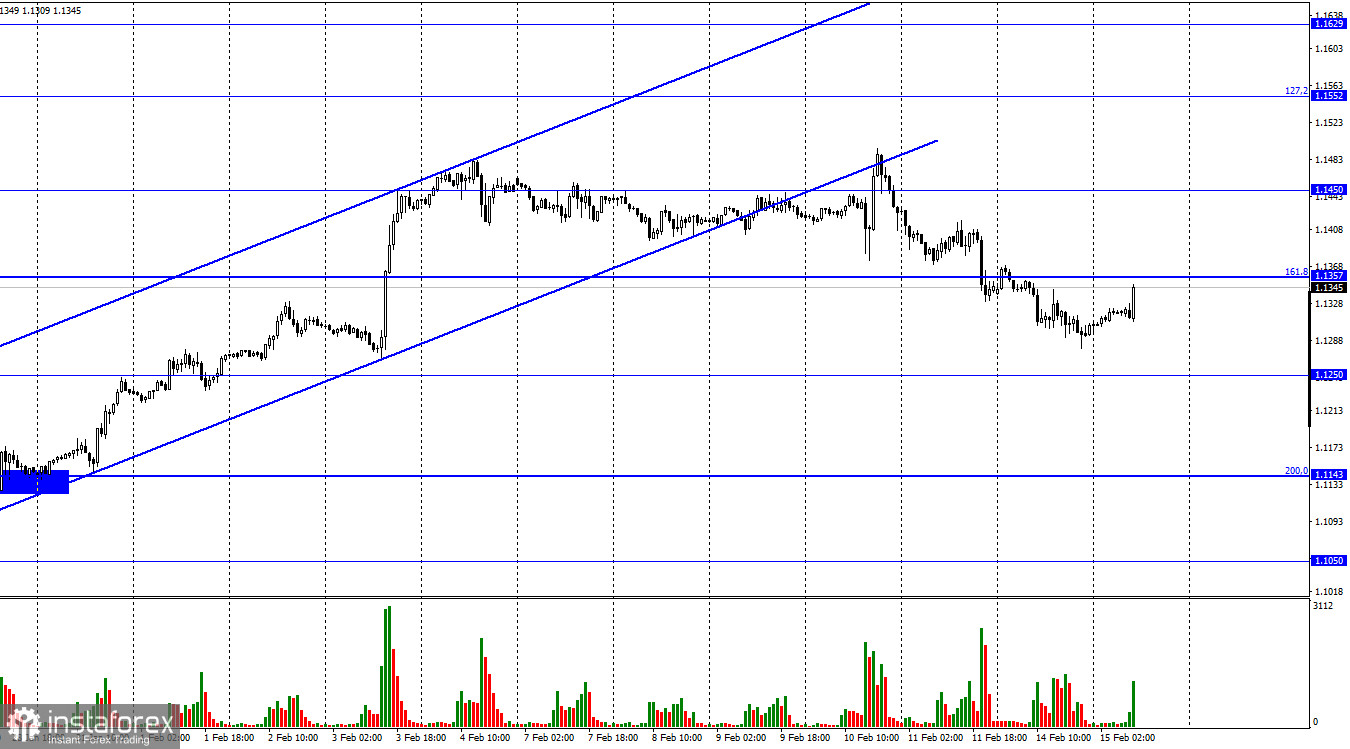

On Monday, the EUR/USD continued to decline towards the level of 1.1250 after settling below the correction level of 161.8% - 1.1357. The activity of traders was low, but the European currency was still steadily falling. The information background on Monday was quite poor. Apart from the Fed's unscheduled meeting, there was no major news. This morning, it was reported that the results of the meeting will not be revealed. If this is true, then the Fed is unlikely to raise the rate secretly. In this case, traders should wait for the next Fed meeting, which will be held on March 15-16. At the same time, James Bullard, the president of the St. Louis Federal Reserve and one of the most ardent supporters of monetary tightening, supported a 1% rate hike by July 1, 2022. In his opinion, the Fed's expectations that inflation would start to slow down without the intervention of the central bank did not come true. He noted that the last four reports on inflation turned out to be "depressing," and confidence in the Fed is declining since the organization itself is not taking any measures to curb price growth and return inflation to the target level of about 2%. Bullard also believes that the time when the Fed could afford to prepare the markets for a rate hike is over. Now the regulator needs to act clearly and quickly, but the final word will be with Fed President Jerome Powell. Bullard himself considers his proposal a good one and will try to convince other FOMC members to support his plan. Thus, the situation around the Fed interest rate is now being escalated in much the same way as the situation around Ukraine. The European currency is influenced by this background, unlike the British pound. However, the situation is much less favorable for the euro compared to the US dollar since the ECB is not going to raise the rate this year, and the Bank of England has already done it twice.

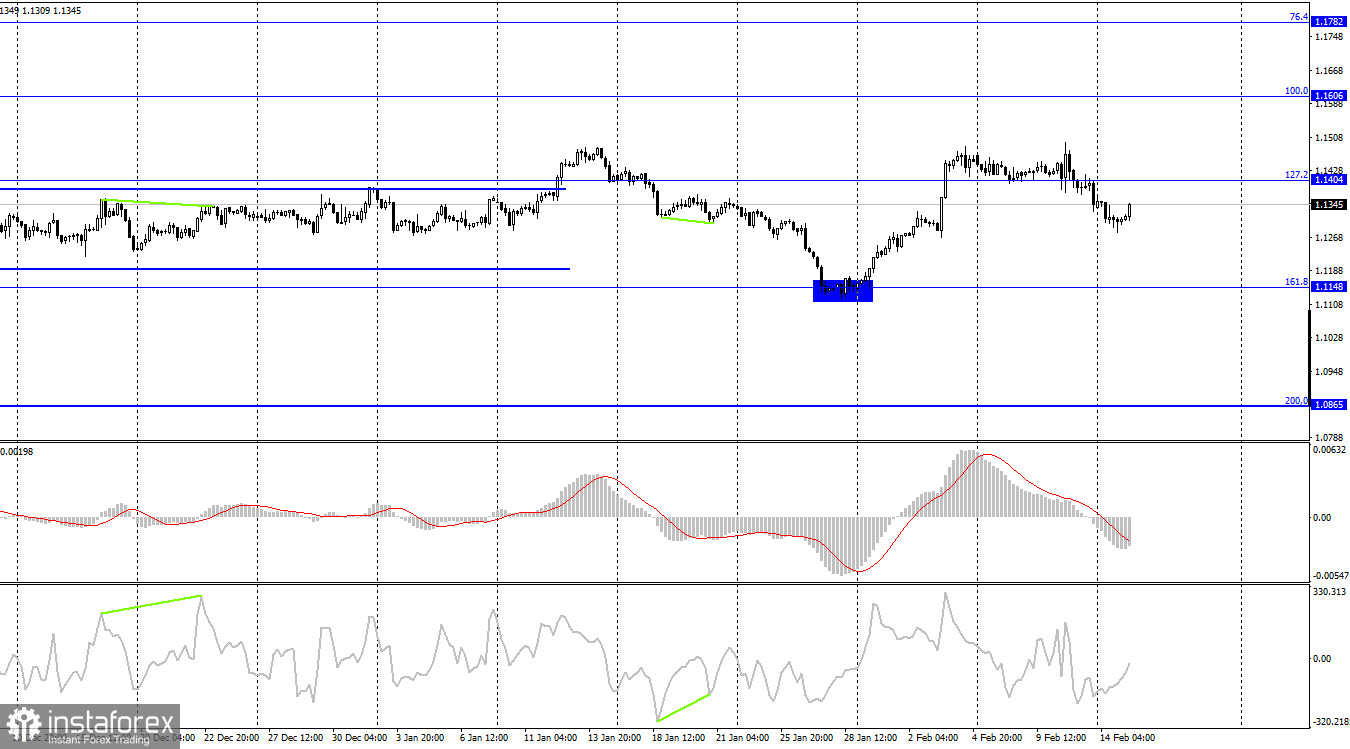

On the 4-hour chart, the pair settled below the retracement level of 127.2% - 1.1404 and continues to decline towards the 161.8% Fibonacci level which corresponds to 1.1148. At the moment, there are no emerging divergences today shown by any indicator. Yet, there is no need for them given the current information background.

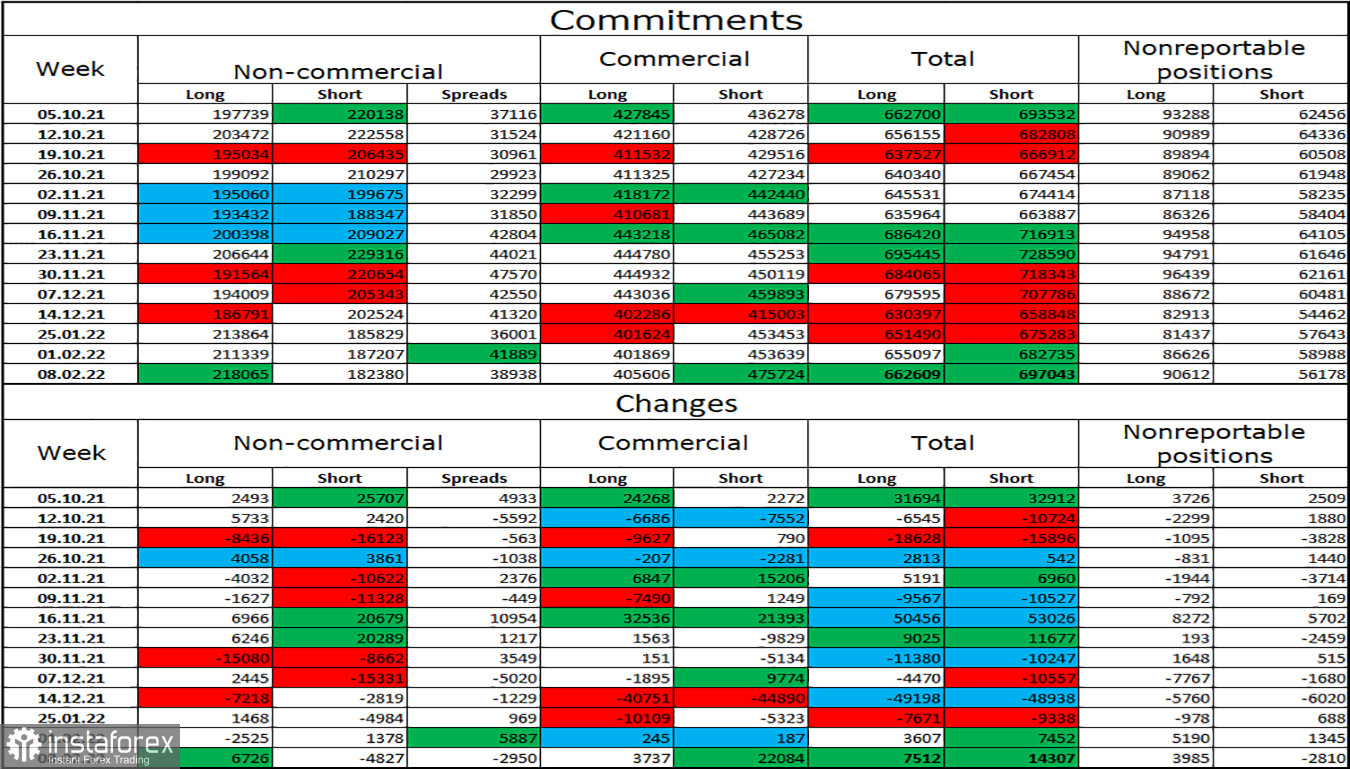

COT report:

Over the last reporting week, speculators opened 6,726 long contracts and closed 4,827 short contracts. This indicates a bullish shift in their sentiment. The total number of open long contracts is 218,000 and short contracts - 182,000. Thus, the overall mood of the non-commercial category of traders is characterized as bullish. This would enable the euro to grow if not for the information background which fully supports the US currency. I believe that this week, the COT report may not be taken into account as the situation in the world is tense and the mood of major players can change rapidly.

Economic calendar for US and EU:

European Union - ZEW Economic Sentiment (10-00 UTC).

European Union - GDP growth (10-00 UTC).

US - Producer Price Index (13-30 UTC).

On February 15, the economic calendar for the US and the EU has several events none of which can be considered important. Today's news background can have only a small impact on the market.

Outlook for EUR/USD and trading tips:

I recommended opening new short positions with the targets at 1.1357 and 1.1250 if the price consolidates below 1.1404 on the 4-hour chart. At the moment, these trades can be kept open. Buying the pair is not advisable now as the likelihood of a continued decline is still high.