Renowned crypto analyst PlanB is confident that BTC will hit $100,000 but does not undertake to set a clear time frame.

Forecast after failure

At the end of last year, the reputation of PlanB, the creator of the Stock-2-Flow (S2F) model, an analyst in a highly unpredictable cryptocurrency ecosystem, was shaken. Not only did bitcoin not hit $100,000 before the end of the year, it also fell from its all-time high of $69,000.

However, ignoring the recent failures of its price forecasts for the main cryptocurrency, PlanB shared a new tweet, talking about the huge potential of the digital currency to reach the price of $100,000. But probably by the end of the year.

Where do these targets come from?

The current price prediction is probably based on data obtained from a combination of S2F and logarithmic regression. The $100,000 target price is more than 226% of the current $44,144 near which Bitcoin trades on Tuesday.

However, the crypto community reacts ambiguously to PlanB's forecasts. For example, Spencer Schiff, son of popular Bitcoin critic Peter Schiff, noted that PlanB may be trying to predict the future by looking in the rearview mirror. His point is that PlanB's BTC forecast for this year should be slightly more than the $100,000 he was expecting last year.

Caution in forecasts

In response, PlanB said he was trying to keep his forecasts low by sharing data on gold, which has an S2F of roughly 50 and a market capitalization of $10 trillion. He also pointed to the real estate industry, whose S2F ratio is pegged at 100 with a market valuation of over $100 trillion.

As a result, PlanB summed up his findings by saying that he would be very surprised if the market value of Bitcoin after the next halving is lower than that of gold, given that BTC S2F is 100+.

Does PlanB's S2F model still work?

PlanB's S2F model rose to prominence in its early days, which gave a lot of accurate forecasts and price flows.

The major crash came last year when Bitcoin ended the year on a bearish note, while many market participants expected the cryptocurrency to hit the $100,000 mark. But the forecast based on this model failed.

PlanB also presented a pessimistic and an optimistic scenario for BTC at the end of last year. He expected the main cryptocurrency to end the year at $98,000 and $135,000. But none of these predictions came true.

Trust in PlanB and its model is rapidly declining. Many urged the analyst to provide a more flexible time frame to carefully observe the S2F data and allow it to be expressed over time, but PlanB refused to do so. He stated that the option available was either to retool the model to accommodate the current low prices, or to let the model run for as long as it wanted.

Difficult long-term, understandable short-term

Long-term forecasts for such a complex asset as cryptocurrency, in an even more uncomfortable environment of uncertainty, are not my forte. In addition, what is more important for a trader is what may happen in the near future, but here everything looks more definite.

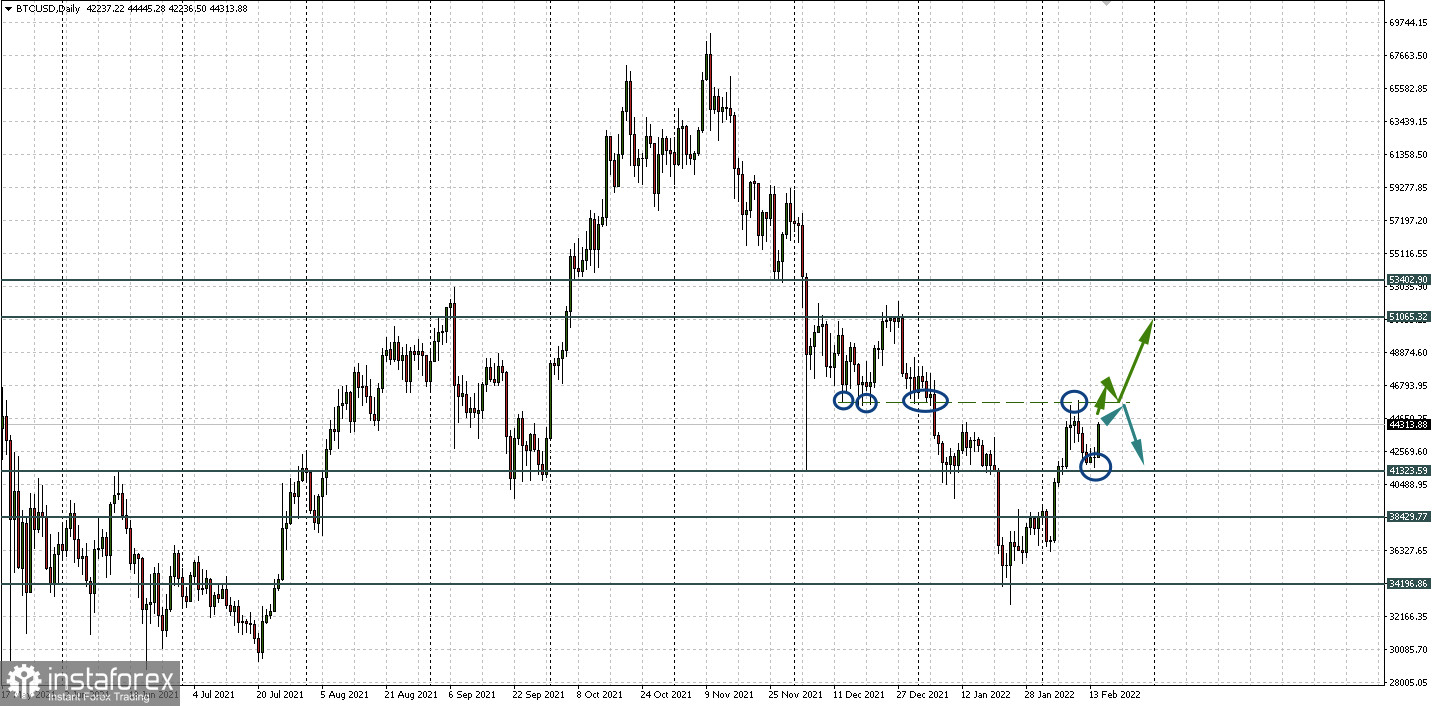

At least BTCUSD is very technical and has perfectly worked out both borders of the flat 41,323.59 - 45,744.38. Now there is a small margin of movement to this resistance. And then there are two options left: a U-turn in the corridor or going up from it.

In the second case, it will be necessary to wait for consolidation above the level of 45,744.38, which will open the way for the main cryptocurrency to the next level of 51,065.32.