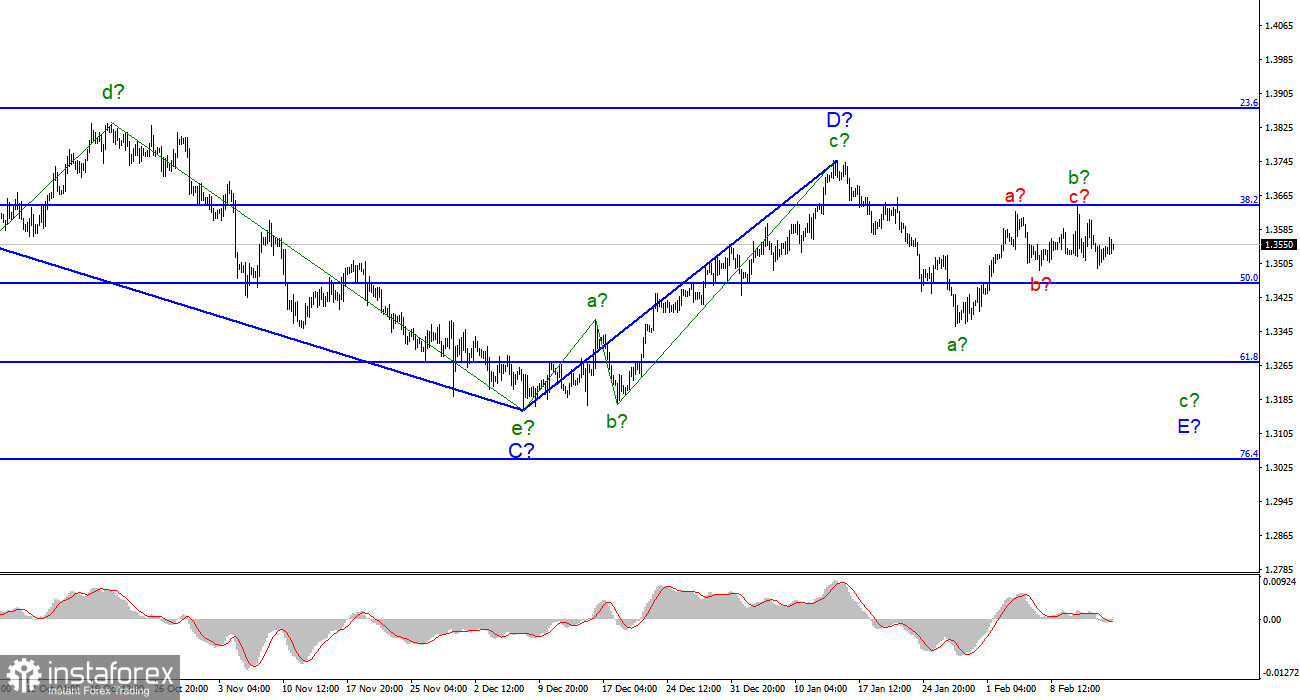

For the pound/dollar instrument, the wave markup continues to look very convincing, but in the near future, it may require changes. The increase in quotes last week complicates the expected wave b and it turns out to be longer than wave a. This conclusion suggests that the instrument is still trying to build a new upward section of the trend, and not to continue building a downward correction. In this case, the assumed wave D will be interpreted as the first wave of the correction section of trend A, since it is still three-wave, therefore, it cannot be wave 1. A successful attempt to break through the 1.3642 mark will indicate the readiness of the market to buy the instrument, which may lead to the exit of quotes beyond the peak of the assumed wave D, which will lead to the need to clarify the wave markup. At the same time, until this happens, the current wave marking retains its integrity and assumes a decrease within the wave c-E.

The geopolitical situation is improving slightly, negotiations are underway.

The pound/dollar exchange rate decreased by 10 basis points during February 15. As the day before, it may seem that the activity of traders was zero (with such a price change), but this is not the case. Today, the instrument increased by 45 basis points, then decreased by 80, and is recovering again by the end of the day. Although these movements cannot be considered "active", nevertheless, the instrument does not stand in one place. At the same time, these movements have practically no effect on the current wave marking. Unless the supposed wave b can become even more complicated and take a five-wave form. Meanwhile, talks between German Chancellor Olaf Stolz and Russian President Vladimir Putin took place in Moscow. No specific decisions were made, the parties simply once again indicated their commitment to their original requirements. However, we are pleased with the fact that at least the negotiations themselves are continuing, which gives hope for a positive outcome of the Ukrainian-Russian crisis.

At the same time, the president of the St. Louis Fed, James Bullard, said that he considers it necessary to raise the Fed's interest rate by 1% until July 1. He said that inflation in the last four months has shown very strong growth and the Fed can no longer stay away from this process. He noted that citizens' trust in the Fed is at stake, and it cannot yet meet the 2% inflation target. Bullard calls his action plan "good" and believes that he will be able to convince his colleagues at the Fed to vote for him at the next meetings. I would also like to note that the unscheduled meeting of the Fed and its results remain secret and, it seems, they are not going to be made public. The interest rate will not be raised in February. Thus, there are a lot of news topics now, but there is little concrete and useful information.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the construction of a wave E. The construction of the proposed wave b is completed, or this wave is not b. The instrument made an unsuccessful attempt to break through the 1.3645 mark, and wave b acquired a three-wave appearance. But there was no continuation of the increase in quotes, so now I believe that a wave c-E will be built. Therefore, I advise selling now with targets located around the 1.3272 mark, which corresponds to 61.8% Fibonacci.

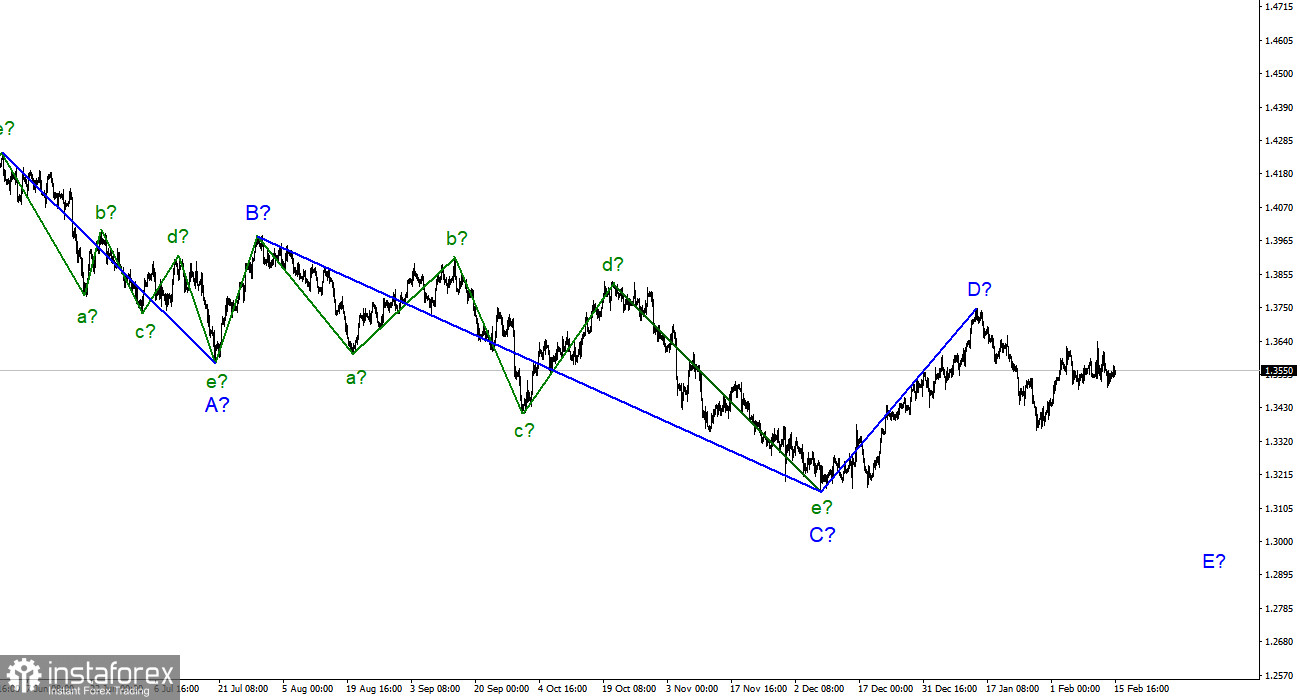

On the higher scale, wave D also looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect a resumption of the decline of the instrument with targets below the low of wave C. Wave D turned out to be a three-wave, so I cannot interpret it as wave 1 of a new upward trend segment.