Market participants continue to assess the prospects for the Fed's monetary policy. After last week's US inflation report pointed to its next increase, the consumer price index (CPI) rose by 0.6% in January (+7.5% in annual terms after rising by 7.0% in December), the Fed interest rate futures market indicated a 20% chance of a rate hike before the March meeting, as well as a 70% chance of another 50 basis point hike at the March meeting.

In this regard, market participants will carefully study the minutes of the January FOMC meeting in order to understand what to expect from the Fed in the coming months.

At the end of the January meeting, Fed leaders confirmed the decision to accelerate the reduction in asset purchases in order to complete the QE program in March 2022 and begin raising interest rates. Although some Fed officials express their private opinion that a tougher approach is needed, most of them consider it reasonable to raise interest rates three times in 2022.

Probably, such a prospect is already taken into account in the dollar quotes and it will continue to gradually strengthen, provided that the Fed manages to bring the rising inflation under control.

Minutes from the Fed's January meeting ("FOMC minutes") will be published at 19:00 (GMT).

Of the important macro data, which will also be published today, it is worth noting the publication at 13:30 (GMT) of information on retail sales in the US and consumer price indices in Canada, which reflect the dynamics of retail prices of the corresponding basket of goods and services. The inflation target for the Bank of Canada is in the range of 1%-3%. The rising CPI is a harbinger of a rate hike and positive for the CAD. The core consumer price index rose in December 2021 by +4.0% (annualized). Data better than previous values will strengthen the Canadian dollar. Forecast for January: +4.6% (annualized) for core CPI and +4.8% (annualized) for CPI. As we can see from the statistics, inflation in Canada is also accelerating, but not as much as, for example, in the United States.

If the expected data turns out to be worse than the previous values, then this will negatively affect the CAD, and the USD/CAD pair will grow in this case.

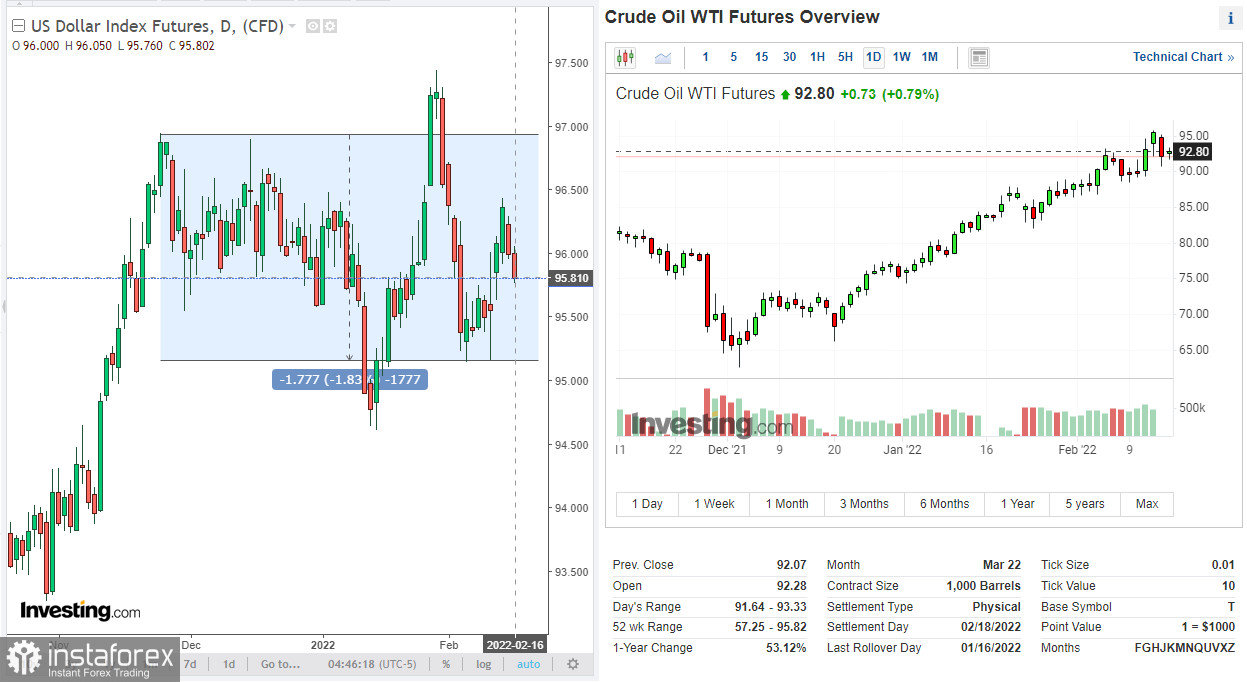

However, CAD may receive support today from the publication (at 15:30 GMT) of the US Department of Energy's weekly report (oil market analysts predict a decrease in US oil inventories by -1.572 million barrels). Oil prices have been fluctuating lately, both amid news of Iran nuclear deal talks and tensions between Russia and Ukraine. Market participants are also evaluating data from the American Petroleum Institute (API), released on Tuesday. According to these data, oil reserves in the US in the reporting week decreased by -1.076 million barrels. This is a positive factor for oil prices and CAD, and we see that in the first half of today's trading day, oil prices and CAD quotes are growing, including against the backdrop of a weakening USD.

At the time of writing, futures for the dollar index (DXY) are trading near 95.81, 62 points below the local maximum reached earlier this week.

Technical analysis and trading recommendations

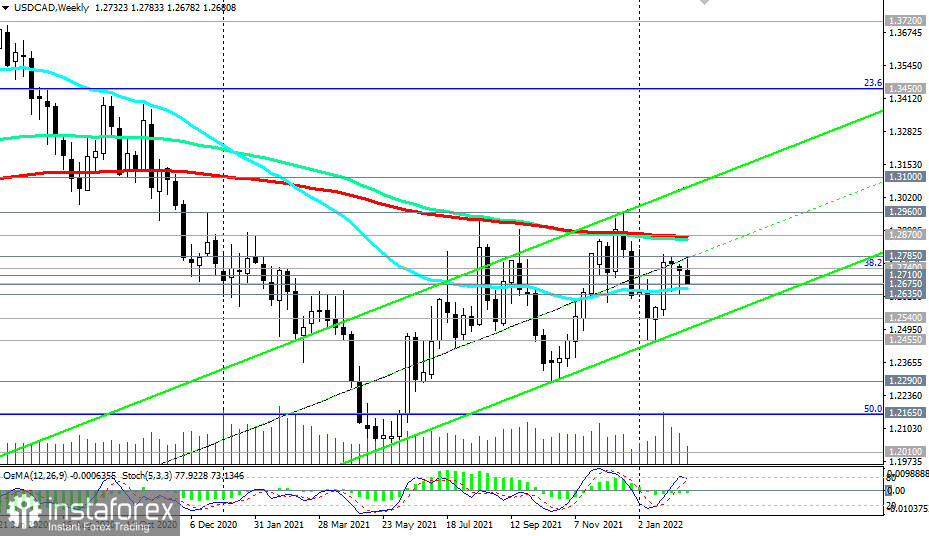

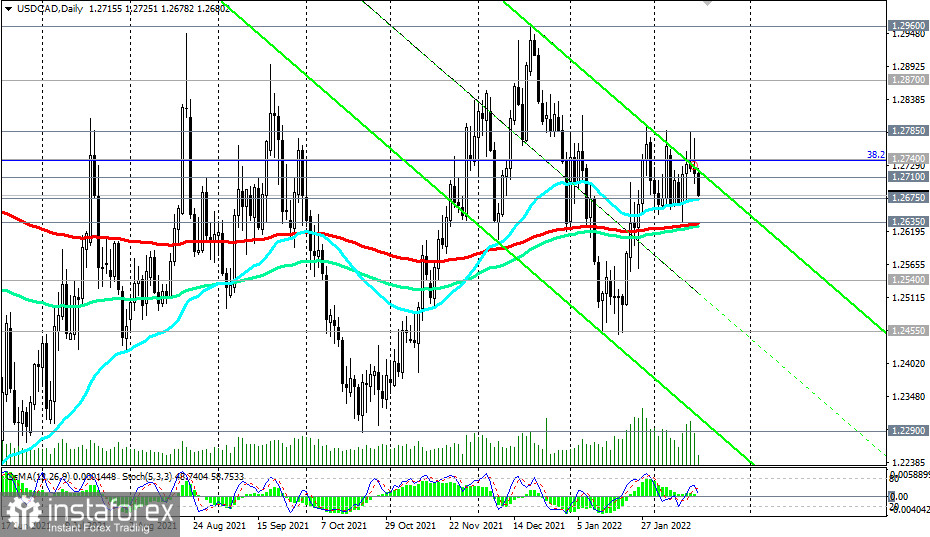

In the meantime, in general, the positive dynamics of USD/CAD remains. The pair remains in the bull market zone, trading above the key support levels 1.2540 (200 EMA on the monthly chart), 1.2635 (200 EMA on the daily chart).

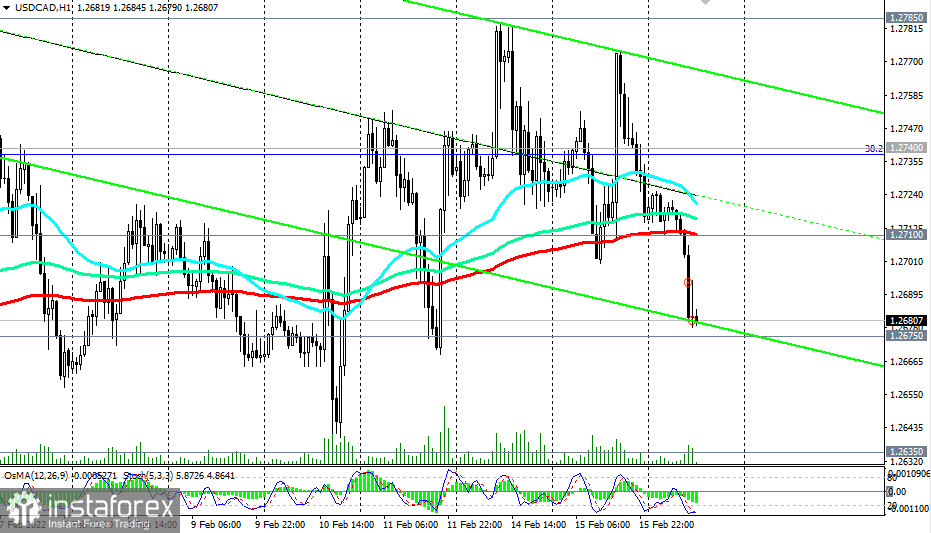

Upon resumption of growth and after the breakdown of the local resistance level of 1.2785, USD/CAD will head towards the long-term resistance level of 1.2870 (200 EMA on the weekly chart). Its breakdown will lead to a complete recovery of the USD/CAD bullish trend with the prospect of growth towards the upper border of the ascending channel on the weekly chart, passing through the level of 1.3100, and the first signal for the implementation of this scenario will be a breakdown of the important short-term resistance level of 1.2710 (200 EMA on the 1-hour chart).

In the alternative scenario, USD/CAD will continue to decline towards the key support level of 1.2635. Its breakdown may reinforce the negative dynamics of USD/CAD, sending the pair inside the descending channel on the daily chart. Its lower border passes through 1.2290.

Support levels: 1.2675, 1.2635, 1.2600, 1.2540, 1.2455, 1.2290, 1.2165, 1.2010

Resistance levels: 1.2710, 1.2740, 1.2785, 1.2870, 1.2900, 1.2960, 1.3100

Trading recommendations

Sell Stop 1.2665. Stop-Loss 1.2730. Take-Profit 1.2635, 1.2600, 1.2540, 1.2455, 1.2290, 1.2165, 1.2010

Buy Stop 1.2730. Stop-Loss 1.2665. Take-Profit 1.2740, 1.2785, 1.2870, 1.2900, 1.2960, 1.3100