Global markets froze in anticipation of a Fed rate hike and an end to geopolitical tensions around Ukraine. At this time, Bitcoin is very clearly correlated with other risky assets.

However, despite the recent drop and current correlation-uncertainties, the BTC mining sector is growing rapidly. Glassnode data highlights the sharp rise in bitcoin hash rate. And this is one of the most important indicators of network activity of the main cryptocurrency.

Mining speed breaks records

According to Glassnode, on February 15, the mining speed rose to another all-time high of 194 EH/s. This is 100% more than the lows of July last year. Compared to the beginning of 2022, the hashrate jumped by more than 16%.

What happened in July 2021? China has imposed a ban on all cryptocurrency mining activities. Leading regional miners have moved their operations elsewhere. In the process of their migration, the hash rate of bitcoin has decreased significantly.

However, growing global demand for BTC has contributed to an earlier-than-expected recovery, and mining speed has increased along with earnings.

Why hash rate is so important

Security is a critical component of any network. Increased security makes the network more resilient and makes attacks more difficult.

The hash rate is a measure of the processing power required to mine blocks on the Bitcoin network. The higher speed makes it much more difficult for one person to try to control the network.

The method by which miners authenticate transactions and secure the network is called crypto mining. That's why the increase in computing power makes it more secure.

The recent increase in the hash rate of the Bitcoin network adds another layer of protection against so-called double spending. This is the practice of canceling transactions on the blockchain, which accounts for more than 50% of the hash rate.

Combined with the all-time high difficulty of bitcoin mining, the rising hash rate is a fairly optimistic sign that miners are becoming more willing to invest long-term resources in cryptocurrency infrastructure.

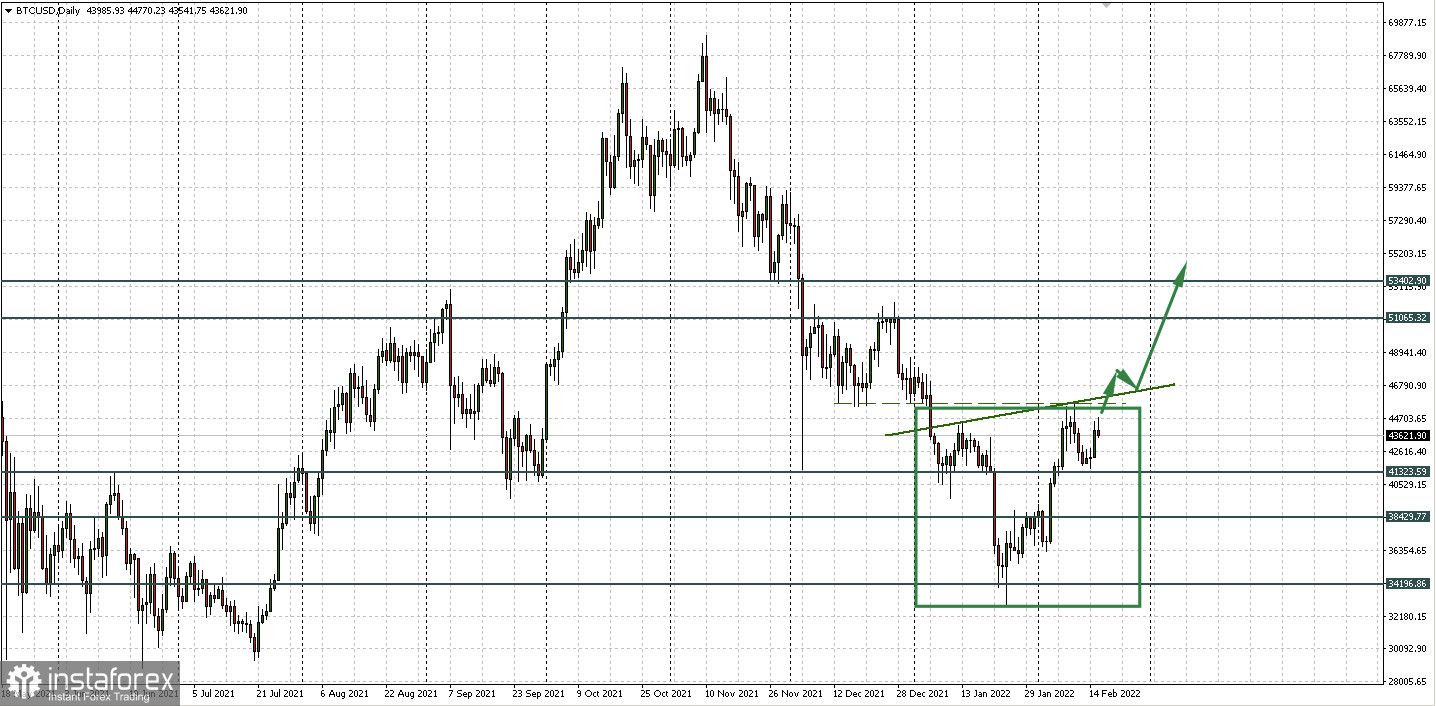

Is it the head and shoulders?

In the meantime, an Inverted Head and Shoulders reversal pattern is suspiciously looming on the BTCUSD daily chart. And it formed, as expected, at the bottom of a long downward trend.

Against this background, we can assume that the breakdown of the neck line, located at an angle upwards, will give BTCUSD a significant upside potential. And the upward movement reserve, judging by the classics of working out the figure, can send it to the area of $53,000 per coin.