The US stock market was in the "green zone" on Wednesday. All major indexes and stocks of large companies slightly surged by the end of the day. However, this growth cannot be called strong. It was only yesterday evening that the markets learned the contents of the FOMC minutes. They probably counted on more information, since the Fed provided very little of it. The minutes say the regulator may start tightening monetary policy more quickly if inflation remains high. It was also reported there that most managers hope that the imbalance between supply and demand will decrease in 2022, which should lead to lower inflation. Several governors have spoken out in favor of an early start to wind down stimulus programs, as well as start cutting the Fed's balance sheet. According to the minutes, the reason for high inflation is a shortage of labor and supply chain disruptions, which made it impossible for businesses to meet demand. This situation was exacerbated by the emergence of the Omicron strain this winter. Members of the Monetary Committee also noted that the economy is growing at a good pace and most economic indicators continue to improve.

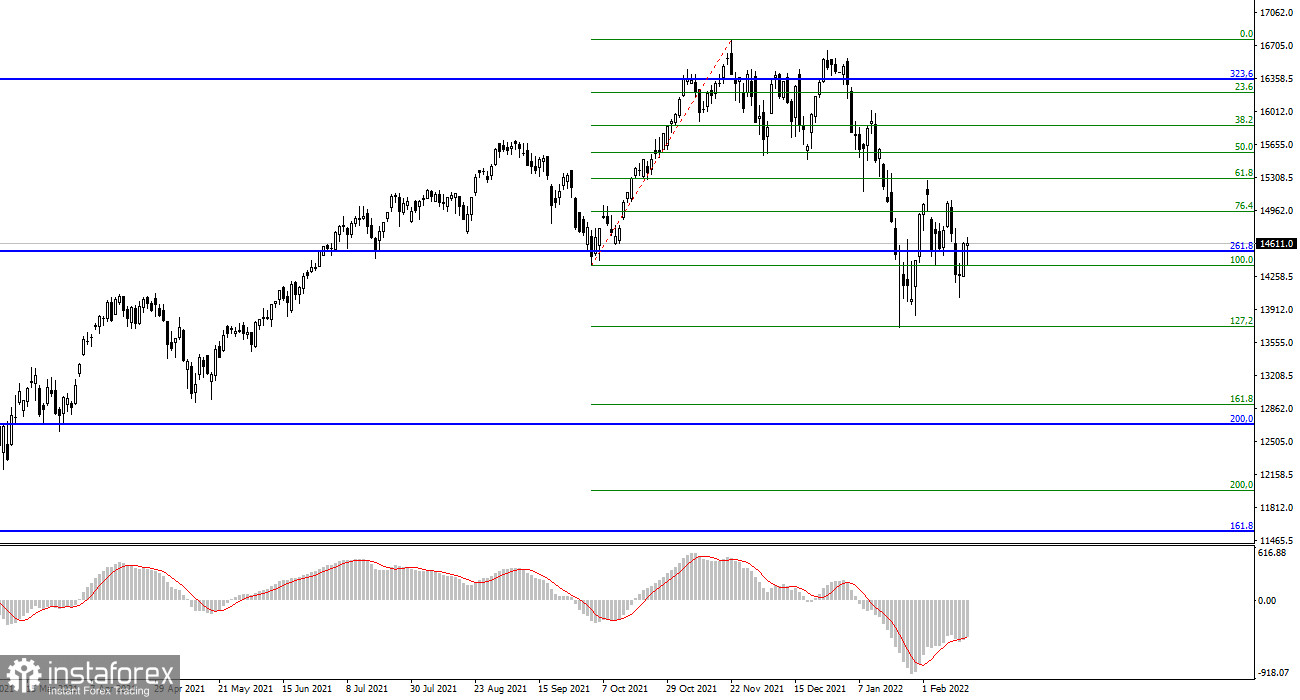

NASDAQ Composite Index

The NASDAQ Composite index increased to 14611 on Wednesday, which is almost unchanged from Tuesday. However, the corrective set of waves continues to form, and much at this time depends on the geopolitical situation in Ukraine. There is no news about the de-escalation of the conflict. Negotiations at the highest political level continue.

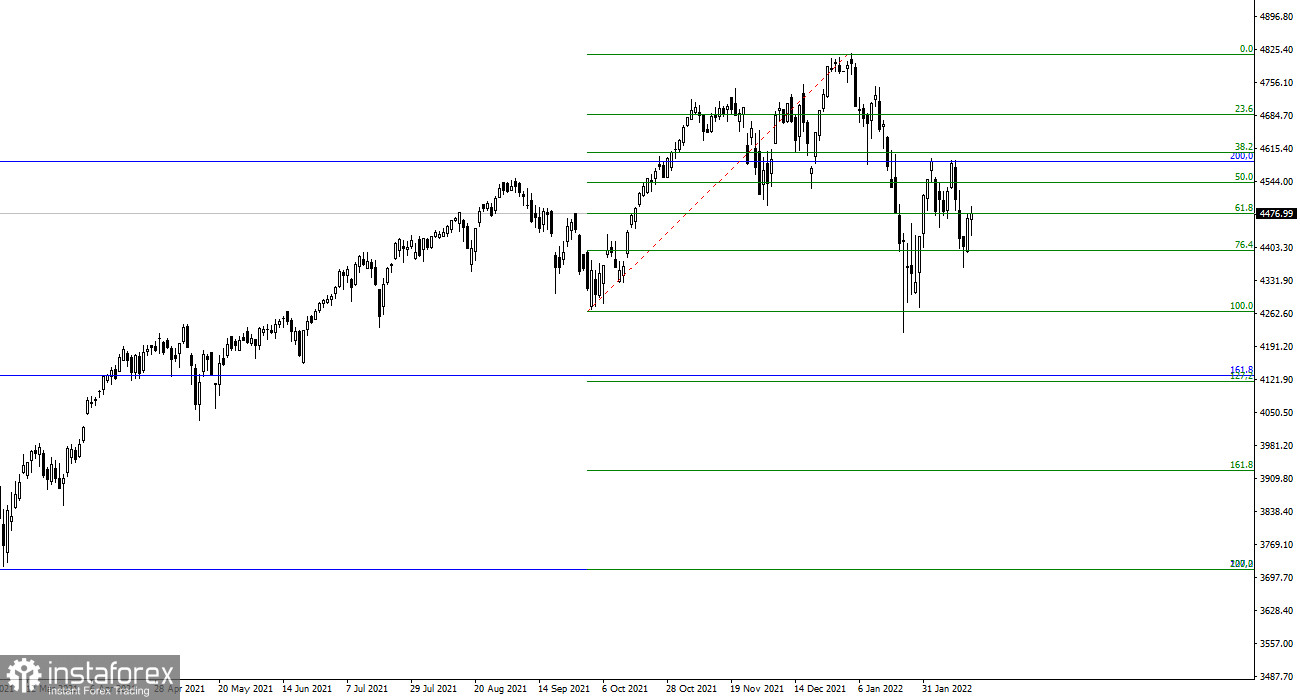

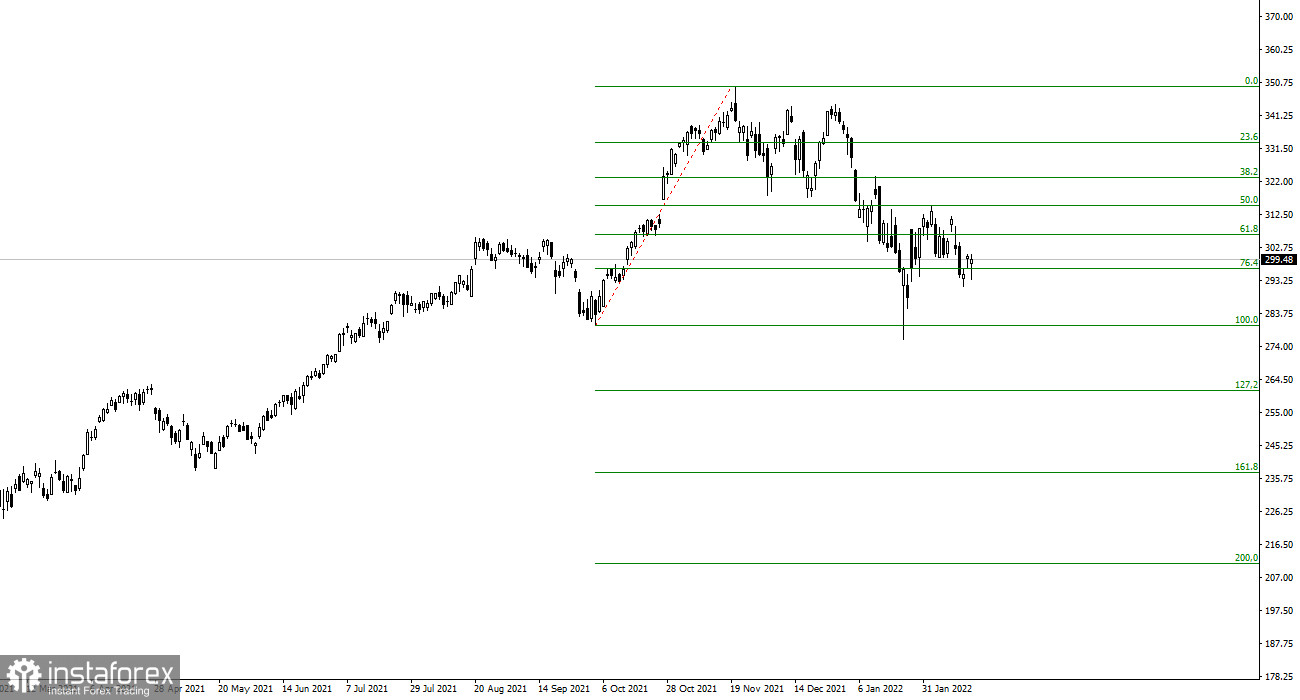

Standard & Poor's 500 index

The Standard & Poor's 500 index rose 20 points on Wednesday and closed at 4,476. Two failed attempts to break through the level of 4586, which corresponds to 200.0% on the upper Fibonacci grid, led to new sales of the instrument. These sales may continue in the coming weeks. The Fed minutes did not give investors new information about what to expect from the central bank in 2022. Several rate hikes and the full completion of the QE program are expected. The market is still reacting with restraint to these plans.

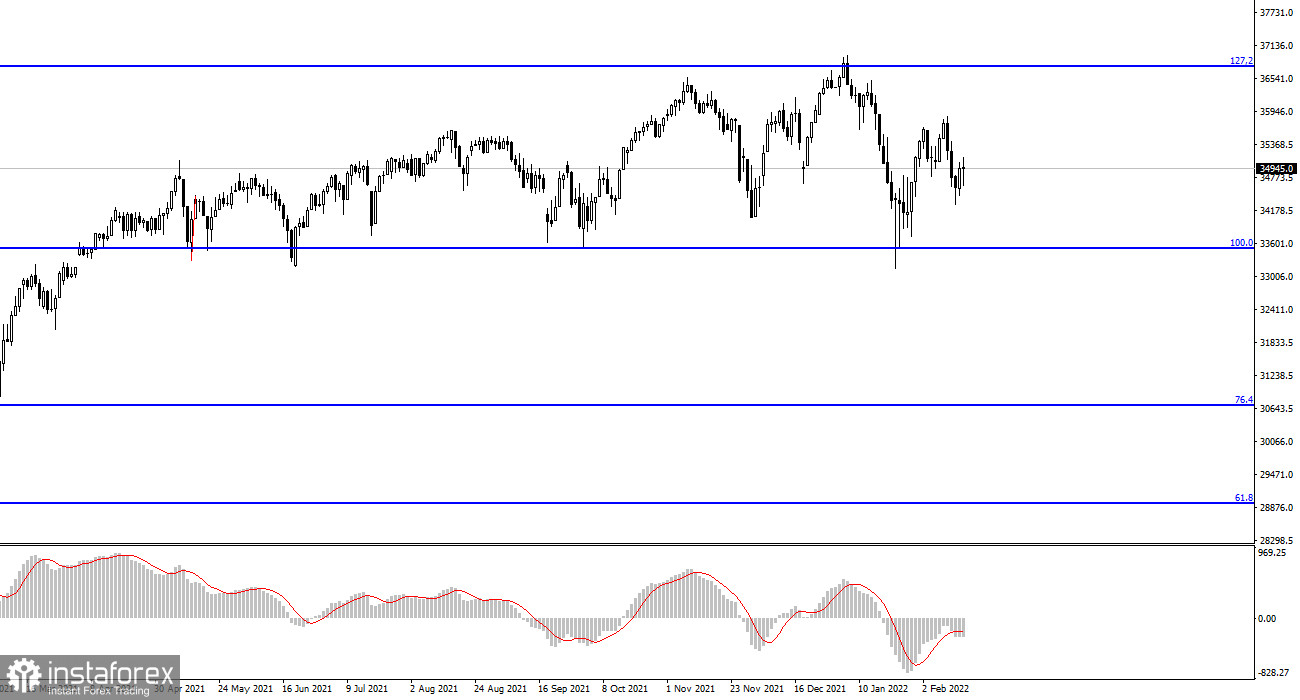

Dow Jones index

The Dow Jones index suffers the least from geopolitical news and the Fed's plans to raise interest rates. Yesterday, it remains close to its maximum value (36948), reached on January 5, 2022. This index has built the weakest corrective wave structure so far.

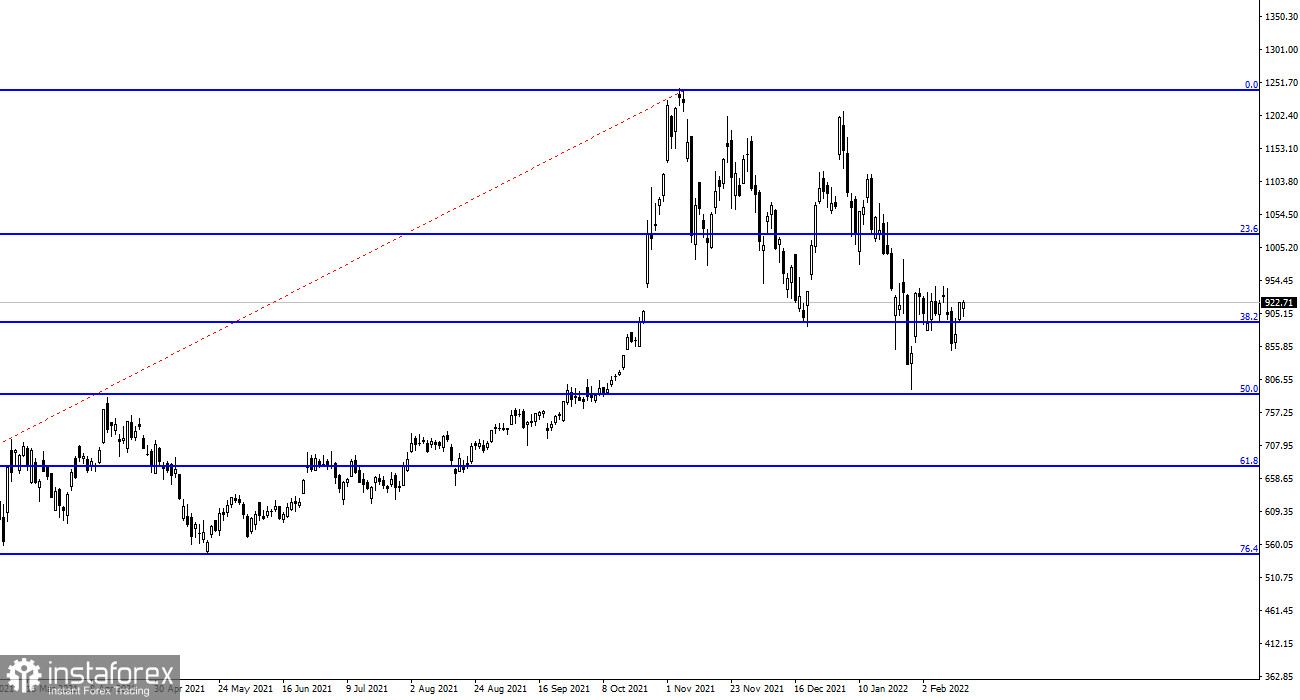

Tesla

Microsoft stock may continue to decline after failing to break through the level of $314, which equates to 50.0% Fibonacci. The nearest target is set at $280. All the main instruments of the stock market are now in the formation of corrective waves and all react to the news background in approximately the same way, so we can expect approximately the same dynamics of their movement.

Apple

Apple stock is doing its best amid the looming crisis. On Wednesday, their cost has not risen and is $172. However, a descending set of waves is also observed for this instrument, so it can be assumed that the decline is not over yet.

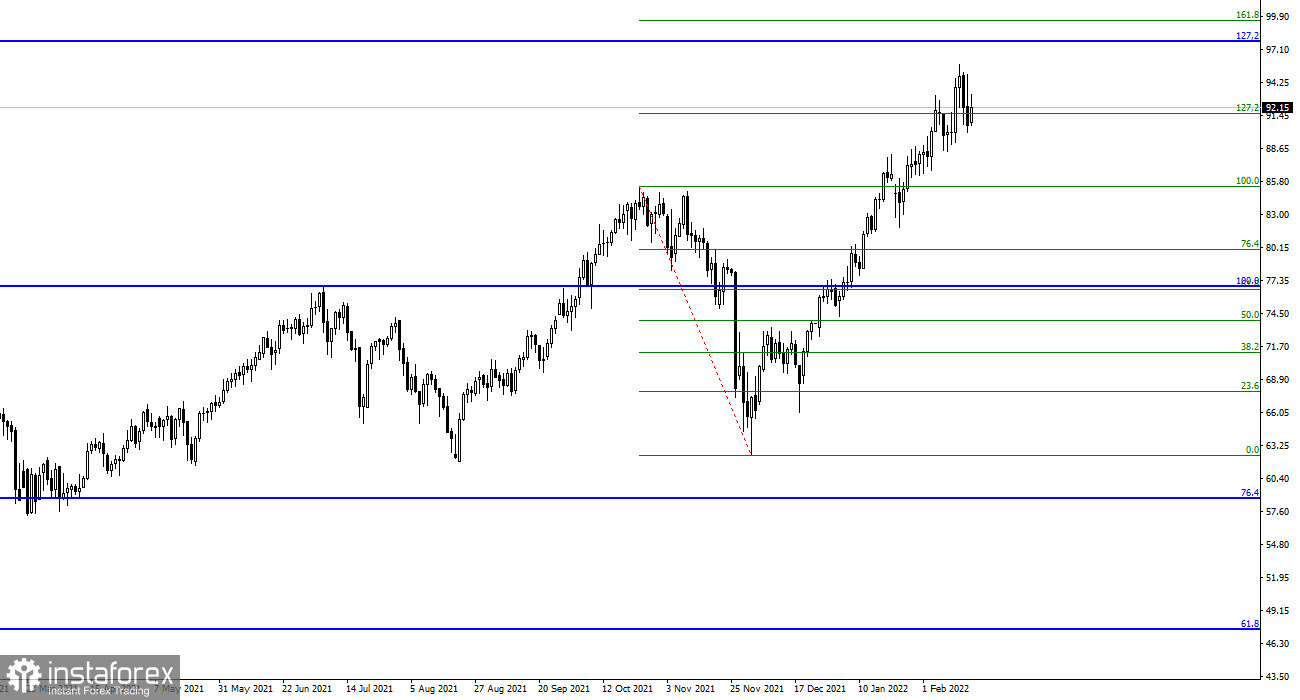

Oil

Oil is the only instrument supported by geopolitical concerns. On Wednesday, its price declined to $90 per barrel on market expectations of a possible de-escalation of the conflict around Ukraine. However, it is too early to talk about the end of the upward set of waves. The target is set at $97.75.