As expected, the UK's inflation accelerated from 5.4% to 5.5%. The pound began to gradually strengthen its positions after this news, which also became quite expected. After all, a further rise in inflation hints at a continued increase in the refinancing rate of the Bank of England. It was this expectation that became the driving force of the British currency.

Inflation (UK):

The Euro currency also showed growth, although noticeably more modest than the British currency. This is all about industrial production, whose decline of 1.4% was replaced by an increase of 1.6%, with the forecast slowing down the decline to 0.6%. But as the US trading session opened, it returned to the values it had before the publication of data on industrial production. It can be said that industry data is still of secondary importance.

Industrial production (Europe):

The US dollar was expected to strengthen from the opening of the US trading session, but it declined instead. The reason was the retail sales data, the growth rate of which slowed down from 16.7% to 13.0% in annual terms against the expected 15.0%. Such a strong difference frightened investors, so they continued to get rid of the US dollar. But after a while, everything returned to normal.

At the opening of the Asian session, market participants remembered the effect of a low base, which distorts the annual data, and paid attention to the monthly ones. Sales in the monthly term grew by 3.8% instead of the expected 1.5%. So in the end, the US dollar returned to the values it was at before the opening of the US trading session.

Retail Sales (United States):

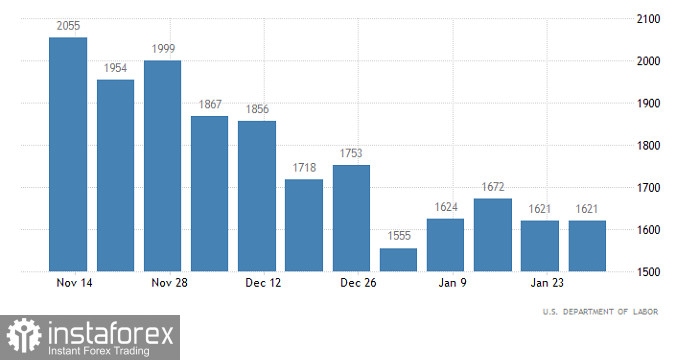

Today's macroeconomic calendar is almost empty unlike yesterday, and the only thing worth noting is the claims for unemployment benefits in the United States. However, they will not affect anything due to extremely minor changes. The number of initial applications should be reduced by 3 thousand, while repeated applications by another 4 thousand. The changes will be purely minimal, which is clearly not enough to set the market in motion.

Number of repeated applications for unemployment benefits (United States):

The EUR/USD pair completed the pullback stage around the level of 1.1400, where there was a slowdown at the beginning after the price rebounded. Based on market cycles, the price remains interested in short positions, which may lead to the restoration of dollar positions relative to the recent pullback. This signal will be confirmed if there is no breakdown of the 1.1400 level.

The GBP/USD pair has been moving in the range of 1.3500/1.3600 for quite a long time. This can lead to an accumulation of trading forces, which will eventually cause an acceleration in the market. Therefore, the trading strategy is focused on the method of breaking through the control levels relative to the flat. Traders consider the levels of 1.3480 and 1.3630 as a signal value.