Analyzing trades on Thursday

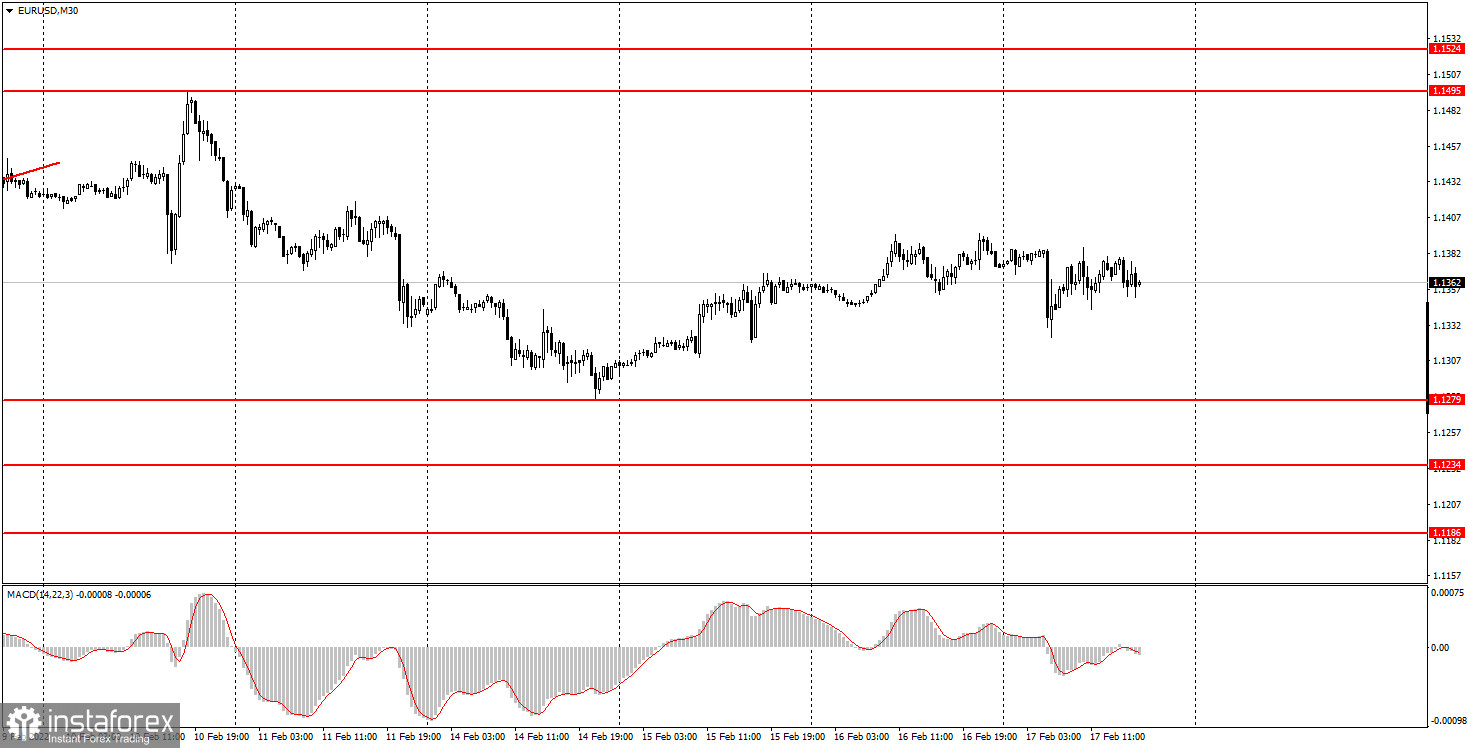

EUR/USD on 30M chart

On Thursday, the EUR/USD trade was far from perfect. Unfortunately, the pair has been trading mixed for several days in a row now. As a result, some of the levels that have not been used by traders have been canceled. That is why there are currently no levels in the area where the price is holding now. This serves as the best illustration of the current movement. In the last three days, the pair has been correcting against the supposed downtrend. The downtrend is vague because there is no trendline or descending channel at the moment. This means that there is simply nothing to develop a correction against. The euro managed to grow by 100 pips, while traders downplayed almost all macroeconomic reports and fundamental events. Today, there was no significant news during the day. However, on Wednesday, the FOMC meeting minutes were published together with the data on retail sales. Yet, they also failed to move the market. At the moment, traders seem to pay little attention to geopolitical risks although the situation in Ukraine remains tense.

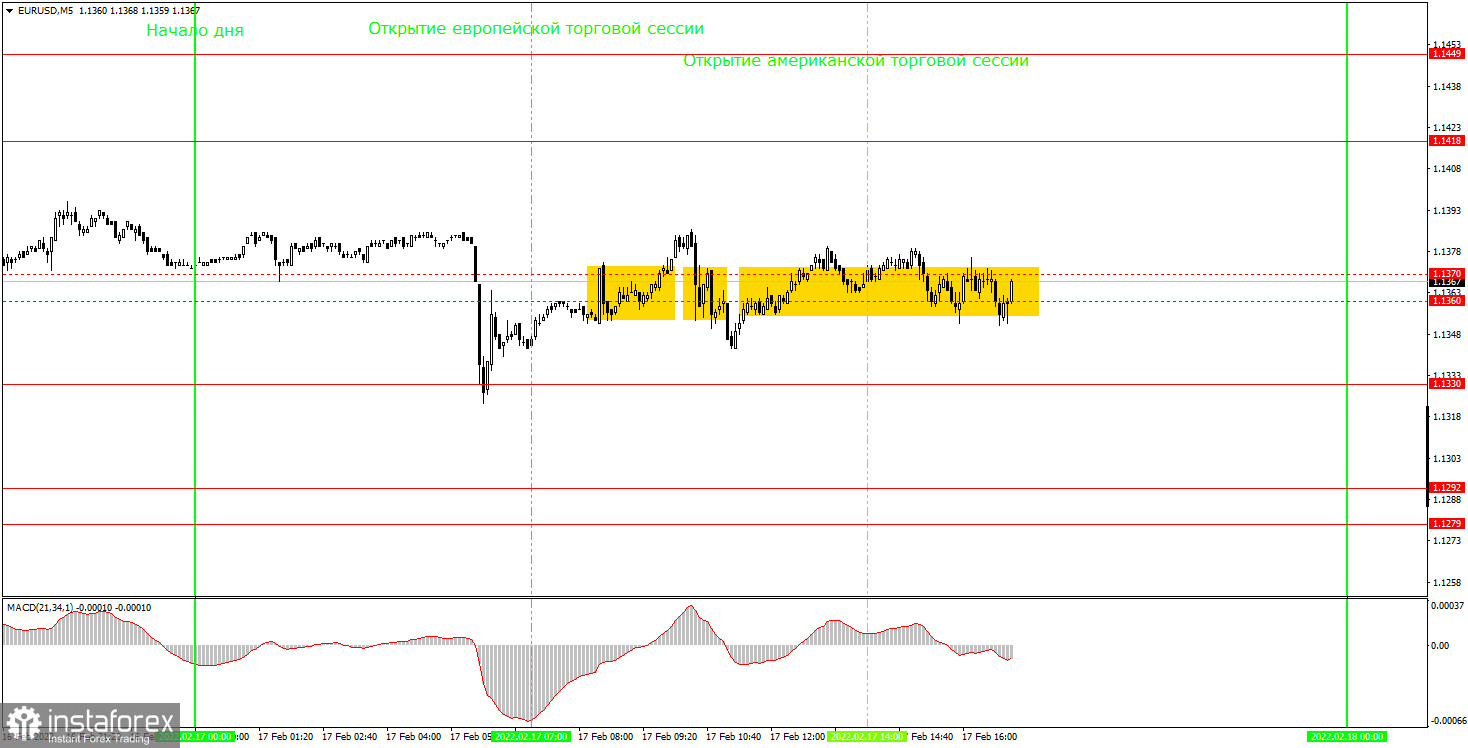

EUR/USD on 5M chart

On the 5-minute time frame, the pair's trajectory is difficult to describe. Before the European session, the price fell by 50 pips to 1.1330 and rebounded from there. However, this signal was formed at night, so traders could not follow it. By the start of the European trade, the quote had already moved away from this level. For the rest of the day, the pair was hovering around the area of 1.1360-1.1370. So, this was a clear flat movement, which was natural due to the lack of any important news. But we know that a flat movement is not the best condition for traders. Therefore, several trading signals that were formed during the day should have been ignored due to the uncertain movements of the pair. Novice traders could have missed this fact and opened a buy position when the price consolidated above the level of 1.1370. Yet, the fact that a Stop Loss was triggered should have served as a warning sign for them. On Thursday morning, markets were disappointed by the news about the Russia-Ukraine conflict saying that fighting around Donbas resumed. It is important to monitor the geopolitical situation now as it may greatly affect the market.

Trading tips on Friday

On the 30-minute time frame, the uptrend was canceled as the pair failed to break through the level of 1.1483. However, neither a trendline nor a channel can be formed at this time, so it is difficult to define a trend now. The pair has been falling for several days after rebounding from the level of 1.1483. Currently, it has been moving up for a few days in a row. Therefore, the movements are very hard to predict, especially when traders tend to downplay the fundamental data. On the 5-minute chart on Friday, it is recommended to trade at the levels of 1.1279-1.1292, 1.1330, 1.1418, and 1.1449. As soon as the price passes 15 pips in the right direction, you should move a Stop Loss to breakeven. On Friday, no key publications are scheduled either in the US or in the EU. There will be only a few minor reports that are unlikely to impress the market. The pair's movement may stay weak unless new geopolitical factors emerge.

Basic rules of the trading system

1) The strength of the signal is determined by the time it took the signal to form (a rebound or a breakout of the level). The quicker it is formed, the stronger the signal is.

2) If two or more positions were opened near a certain level based on a false signal (which did not trigger a Take Profit or test the nearest target level), then all subsequent signals at this level should be ignored.

3) When trading flat, a pair can form multiple false signals or not form them at all. In any case, it is better to stop trading at the first sign of a flat movement.

4) Trades should be opened in the period between the start of the European session and the middle of the US trading hours when all positions must be closed manually.

5) You can trade using signals from the MACD indicator on the 30-minute time frame only amid strong volatility and a clear trend that should be confirmed by a trendline or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 pips), they should be considered support and resistance levels.

On the chart

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place a Take Profit near these levels.

Red lines are channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trendlines).

Important announcements and economic reports that can be found on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exiting the market in order to avoid sharp price fluctuations.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management is the key to success in trading over a long period of time.