The EUR/USD currency pair made an impressive somersault on Thursday, falling by 50 points at night. However, during the day, it managed to recover all the losses. It should also be noted that the Russian ruble also "flew" from side to side during the day. Based on this, we conclude that the reasons again lie in geopolitics. We do not undertake to say 100%, but perhaps this is how the market reacted to the morning news about the escalation of the conflict in Eastern Ukraine. In the morning, reports of fighting in the Donbas began to arrive, but by lunchtime, this news flow stopped and the market breathed more freely. False alarm. It is noteworthy that the growth of the dollar happened at a time when there was no news about new battles in the Donbas. Therefore, we do not undertake to say 100% that these two events are related to each other. Nevertheless, early in the morning, when even the European markets were still closed, there was simply no other news. Thus, the foreign exchange market, which does not show much desire to move this week, still reacts to geopolitics. Based on this, we believe that this topic can continue to be the main topic for the whole world. And if so, then any news about the escalation of the conflict or its de-escalation may lead to movements in the market.

What do all these events have to do with the dollar at all? The causal relationship is quite simple. The US dollar has long been the reserve currency for the whole world. It is used to withdraw capital from a particular country, to place foreign capital on the territory of the EU or the USA, as well as offshore. How does it work? If the situation, for example, worsens in Ukraine, then investors, local or foreign, begin to withdraw money from the country. They do this, of course, not in hryvnia, so the demand for the dollar is growing, respectively, the rate of the American currency is also growing. The same applies to many other countries where there has been or is geopolitical tension.

Traders do not know how to trade further.

The stalemate we wrote about yesterday remains in force. In other words, all parties to the conflict and their allies only verbally express their readiness to solve the problem diplomatically. No one is ready to make concessions, and some countries are only adding fuel to the fire. For example, the West, whose media has even called the date of the alleged invasion of the Russian Federation in Ukraine - February 16. There was no attack on that day, so now the American media are sure that the date of the attack is February 20. The comments of the self-proclaimed President of Belarus Alexander Lukashenko, who said that Moscow should deploy not only nuclear but also "super-nuclear" weapons on the territory of the country, if the West continues to exert pressure on Ukraine and threaten the security of Belarus and the Russian Federation, also do not contribute to improving the situation. Lukashenko also said that provocations by the Ukrainian authorities are possible, which both Belarus and Russia should be ready for. In general, the situation will bend over and it is completely unclear who benefits from this at all? Lukashenko also allowed himself to call Ukrainian President Vladimir Zelensky "headless" in a recent interview. I wonder what kind of relations the countries of the world will have with each other if their leaders insult each other? In general, from our point of view, there is no question of any de-escalation of the conflict now. And the markets are in tension.

The euro/dollar pair has been in the last few days exactly between the high of 2022 and the low of 2022. Thus, it has found a point of equilibrium. But the point of equilibrium is not based on market mechanisms, but because of the utter uncertainty that has developed in Europe now. Of course, we cannot say that the world is on the verge of a third world war, but the threat of a military conflict is on the face. No one knows what will happen if it does start.

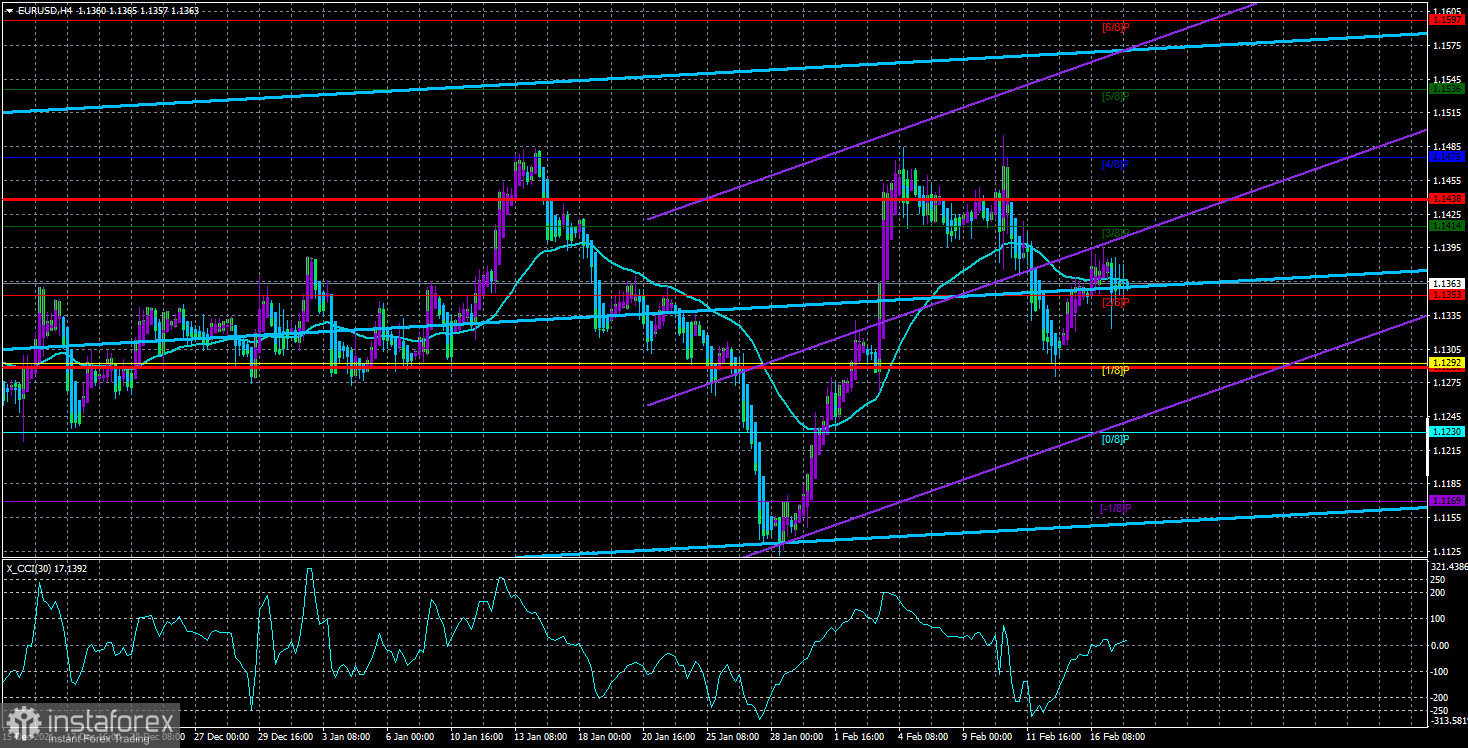

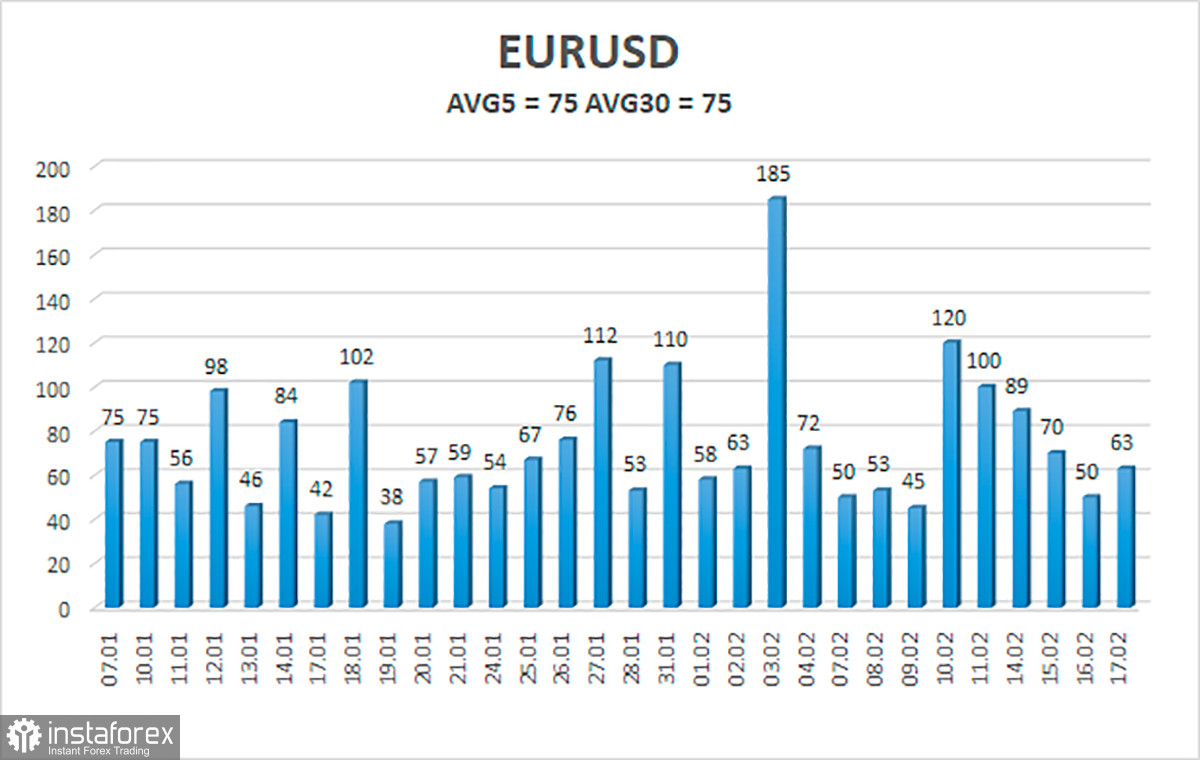

The volatility of the euro/dollar currency pair as of February 18 is 75 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1288 and 1.1438. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement.

Nearest support levels:

S1 – 1.1353

S2 – 1.1292

S3 – 1.1230

Nearest resistance levels:

R1 – 1.1414

R2 – 1.1475

R3 – 1.1536

Trading recommendations:

The EUR/USD pair is trading along the moving average line. Thus, it is now possible to stay in short positions with a target of 1.1292 until the Heiken Ashi indicator turns up. Long positions should be opened no earlier than fixing the price above the moving average with a target of 1.1414. In both cases, it should be borne in mind that there is a high probability of a flat.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.