Analysis of transactions in the EUR / USD pair

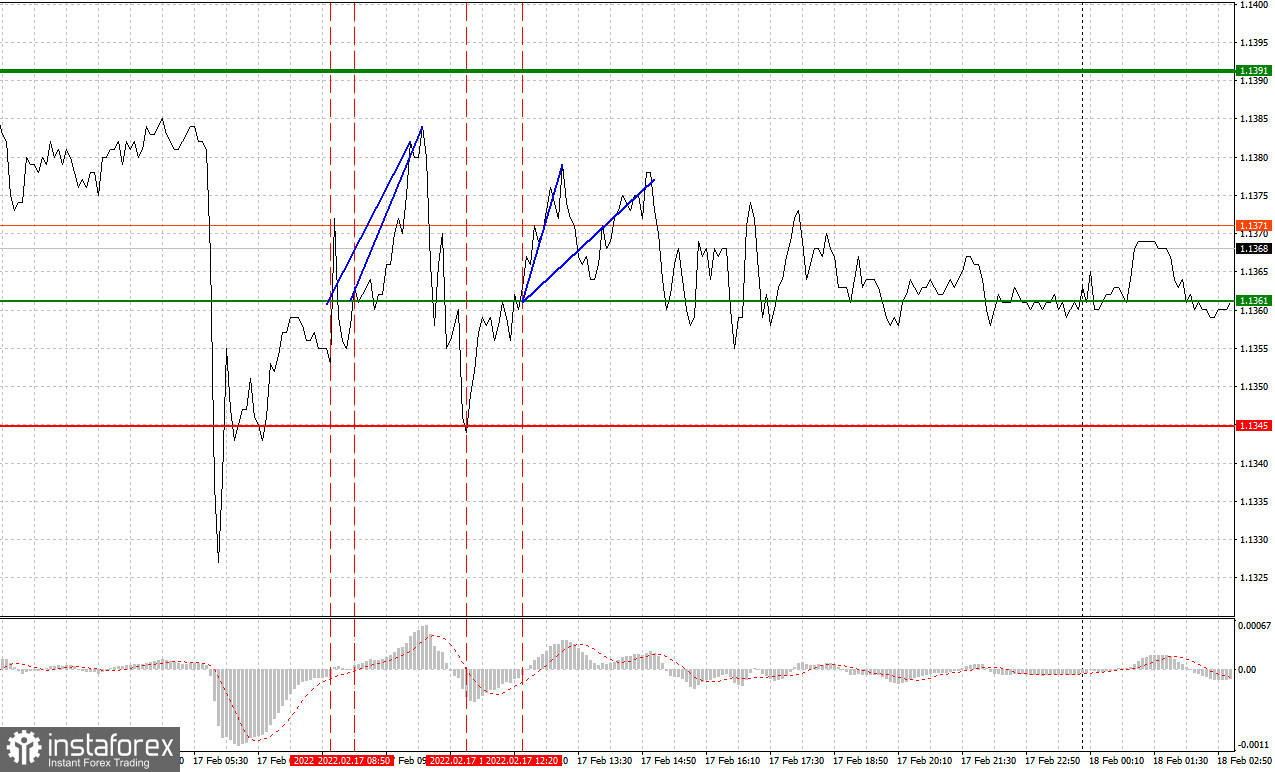

A signal to buy emerged after EUR/USD hit 1.1361. Coincidentally, the MACD line was moving above zero, so the pair rose by 25 pips. But after that was a dip to 1.1391, during which the MACD line had already gone down quite a lot from zero. Surprisingly, there was no strong decline as the pair halted its fall and bounced back to 1.1361. The pair climbed by 15 pips after that, followed by a return to 1.1361.

The speeches made by ECB representatives yesterday did not make an impression on the market, so there was no strong upward movement. Both Isabelle Schnabel and Philip Lane spoke of a more prudent approach to policy change. The jobless claims report in the US also did not make serious changes as everyone focused on another large sell-off in US equities.

Another set of speeches are scheduled for today, but the most important ones are Isabelle Frank Elderson and Fabio Panetta's. CPI data in France, ECB's current account balance and consumer confidence in the whole Euro area are also significant to the market as gains will prompt rallies in EUR/USD. In the afternoon, the US will release data on home sales and leading indicators, but more interesting are the speeches of FOMC members John Williams and Lael Brainard. Their comments may increase volatility and provoke a sell off in the pair.

For long positions:

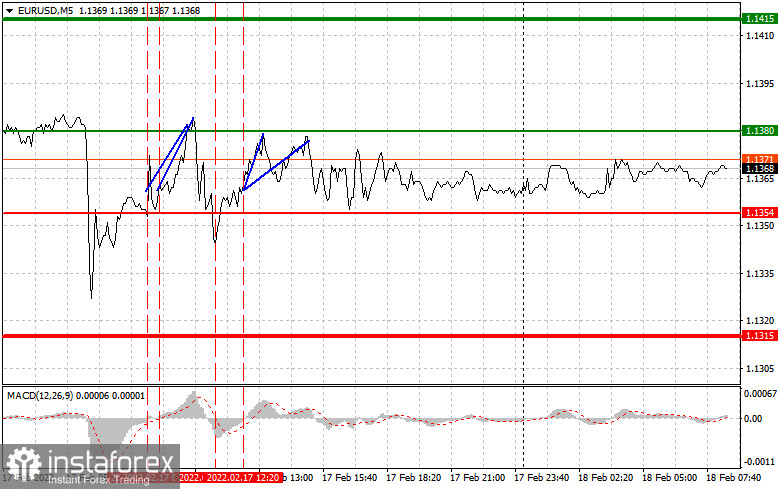

Buy euro when the quote reaches 1.1380 (green line on the chart) and take profit at the price of 1.1415 (thicker green line on the chart). A rally will occur if data from the eurozone exceed expectations and if the ECB says hawkish statements on monetary policy.

But before buying, make sure that the MACD line is above zero or is starting to rise from it before taking long positions. It is also possible to buy at 1.1354, but the MACD line should be in the oversold area as only by that will the market reverse to 1.1380 and 1.1415.

For short positions:

Sell euro when the quote reaches 1.1354 (red line on the chart) and take profit at the price of 1.1315. Pressure will return if data from the eurozone turns out weaker than expected and if the Federal Reserve says hawkish statements on monetary policy.

But before selling, make sure that the MACD line is below zero, or is starting to move down from it. Euro can also be sold at 1.1380, however, the MACD line should be in the overbought area, as only by that will the market reverse to 1.1354 and 1.1315.

What's on the chart:

The thin green line is the key level at which you can place long positions in the EUR/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the EUR/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.