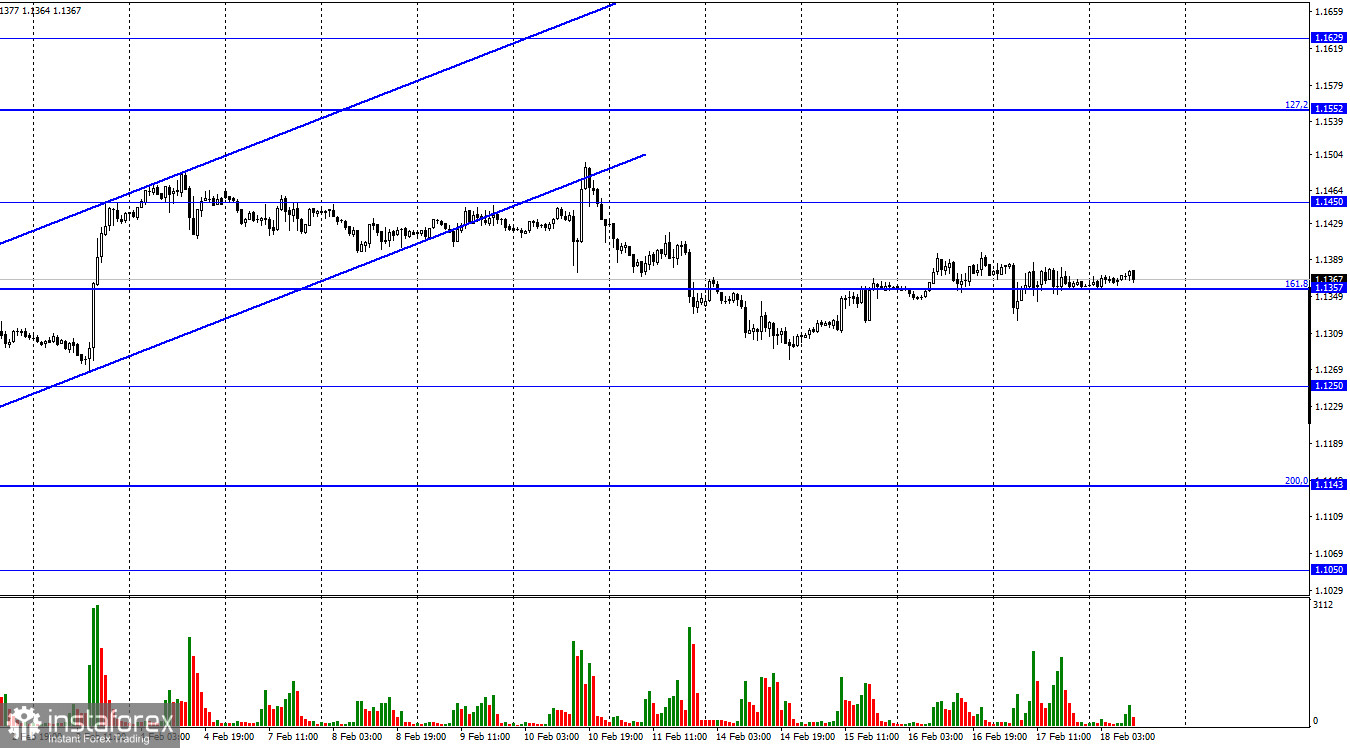

The EUR/USD pair showed neither growth nor decline on Thursday. It was only early in the morning that bear traders attempted a "blitzkrieg", but it ended very quickly with the retreat of the bears themselves from the market. The bulls did not even wake up and were absent from the market all day. The pair moved strictly along the corrective level of 161.8% (1.1357) almost all day. And continues to do so today. Moreover, I cannot say that there has been no important economic news in recent days. There were, and not one. However, now there is such a situation that the geopolitical background does not give traders the desire to trade, but, on the contrary, stifles any desire at the root. Hence, there is a situation in which there is an information background - both economic and geopolitical, but the market has frozen in place. From my point of view, the stronger the geopolitical background is now, the less willing traders will show to trade. I am talking primarily about the so-called "news that supports uncertainty."

It is this type of news that prevails now in the information space. What is this news? These are news that escalates the situation, but at the same time do not reflect any officially adopted decisions by the parties to the conflict. All yesterday, there were reports that guns had started working again in the Donbas and battles were being fought along the entire LPR/DPR border. However, what does this mean for traders? Only that there is no de-escalation of the conflict, but there is no escalation either since in recent weeks everyone has been talking about a full-scale invasion of Russia into Ukraine, and in the Donbas, to one degree or another, the shooting has been going on for the eighth year. Moreover, officially, local separatists or militants are fighting in the Donbas, but not the Russian army. Accordingly, all the fighting in the Donbas cannot be qualified as an aggravation of the Ukraine-Russia conflict. Nevertheless, the whole world understands that the intensification of fighting in Ukraine right now cannot be a mere coincidence. Therefore, the degree of uncertainty is growing.

On the 4-hour chart, the pair closed under the corrective level of 127.2% (1.1404) and may continue to drop quotes in the direction of the Fibo level of 161.8% (1.1148). Brewing divergences are not observed in any indicator today, but they are not required with the information background that exists now. The new side corridor characterizes the mood of traders as neutral. Now neither bulls nor bears have an advantage.

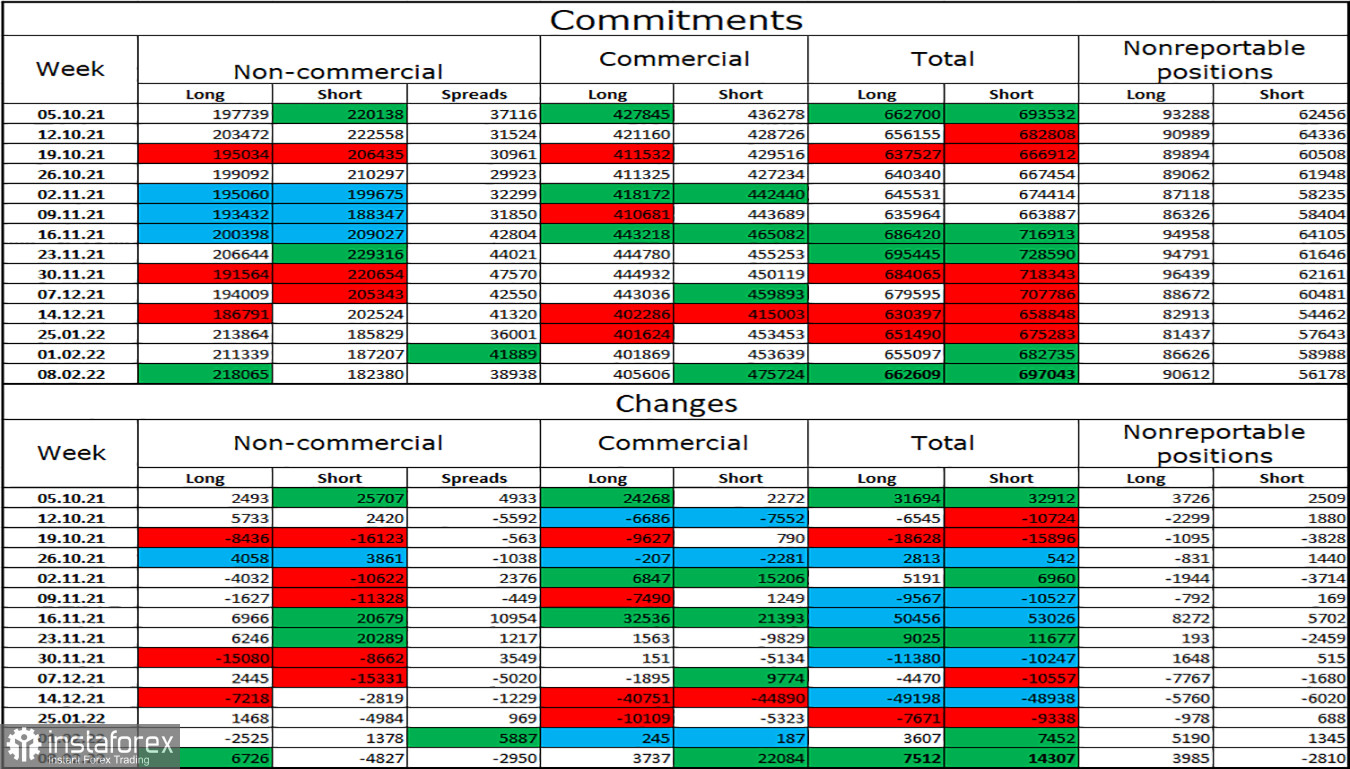

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 6,726 long contracts and closed 4,827 short contracts. This means that their mood has become more "bullish". The total number of long contracts concentrated on their hands is now 218 thousand, and short contracts - 182 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is characterized as "bullish". This would allow the European currency to count on growth, if not for the information background, which now fully supports the American currency. I believe that this week the data from the COT reports can be ignored since the situation in the world is tense and the mood of major players can change rapidly.

News calendar for the USA and the European Union:

On February 18, the calendars of the European Union and the United States are empty. Thus, the influence of the information background will be absent today, which will further kill the desire of traders to trade.

EUR/USD forecast and recommendations to traders:

I recommended new sales of the pair with targets of 1.1357 and 1.1250 if a close is made below the level of 1.1404 on the 4-hour chart. Now, these deals can be kept open. I do not recommend buying a pair right now, as the probability of continuing the fall is too high.