The EUR/USD currency pair resumed its downward movement on Friday and remained below the moving average line. Thus, the bulls' attempt to restore the upward movement was unsuccessful. However, we have already said earlier that three price rebounds from the level of 1.1475 at once clearly speak in favor of the fact that the bulls are not ready for powerful purchases of the European currency. This is not surprising, since for the first time in a very long time there was a situation in which there was no reason for the growth of the euro currency. At the same time, this is indicated by factors from the European Union, factors from the United States, and the general fundamental background. In principle, we have already said many times that the key factor in the growth of the dollar now is the difference in approaches to monetary policy between the ECB and the Fed. If the ECB is not going to raise the rate and, at best, will complete the quantitative stimulus program by the end of the year, then the Fed has already completed this program, and the rate is going to increase 4-7 times this year. For the national currency, the factor of tightening monetary policy is favorable, so we are waiting for further growth of the US currency. In addition, in the last few weeks, a new factor of support for the dollar has appeared - geopolitics. At this time, without embellishment, we can say that Europe is on the verge of a military conflict. Of course, not all countries will be involved in it, and we hope that there will be no conflict. However, the very fact that a huge amount of equipment and fighters of the Russian army are being pulled to the Ukrainian borders speaks volumes. Western media continue to claim that Moscow's attack on Kyiv will take place "from day to day," but they have been repeatedly accused of general hysteria and whipping up from scratch. Therefore, we believe that it is still necessary to react on facts, not on speculation. The same opinion seems to be held by the market itself, since last week the dollar did not have a clear advantage, and traders did not trade too willingly.

What does the new week have in store for us?

Macroeconomic statistics are now frankly in the background. Many reports are frankly ignored, which is not surprising, given the level of tension due to geopolitics. Nevertheless, it is necessary to consider all the important events planned for this week, as some of them may have an impact on the movement of the pair. On Monday, the European Union will publish indices of business activity in the services and manufacturing sectors for February. The index for the service sector is of particular concern, as it fell to 51.1 points in January. If it goes below 50.0, the market may react with new sales of the euro currency. On Wednesday, the EU will publish the consumer price index for January in the second assessment. Thus, traders are already ready for the value of 5.1% y/y and are unlikely to react to this report. Nothing else interesting is planned in the EU for next week. There will probably be a speech by Christine Lagarde, who usually gives interviews every week, but what can she tell the markets now? Everyone has been familiar with her rhetoric for a long time, as well as possible. It is unlikely that this rhetoric has changed in a week and has become more "hawkish". This means that there will not be any support for the euro currency. There will be a little more statistics in the States, but in general, there will also be no overly important reports and events.

Thus, we assume that in the new week, much, if not everything, will again depend on geopolitics. The only question is whether it will be like rumors, speculation, forecasts, and hysteria, or whether it will be concrete facts, decisions, actions, and events. In the first case, the market may continue to ignore most of the geopolitical background. Only the Russian ruble will react. In the second case, with the escalation of the conflict in Ukraine, the US currency may get an additional reason to continue its growth, since many will use it as a protective asset.

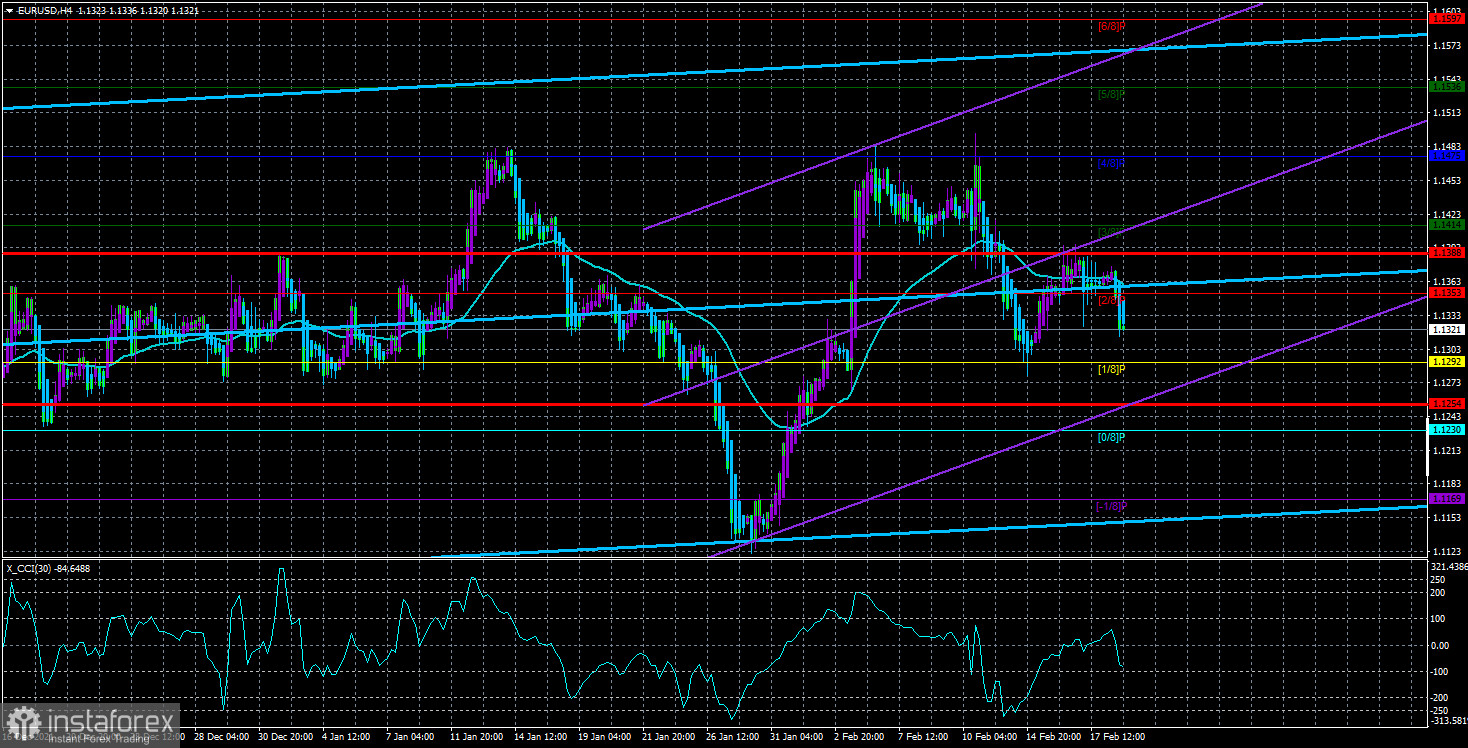

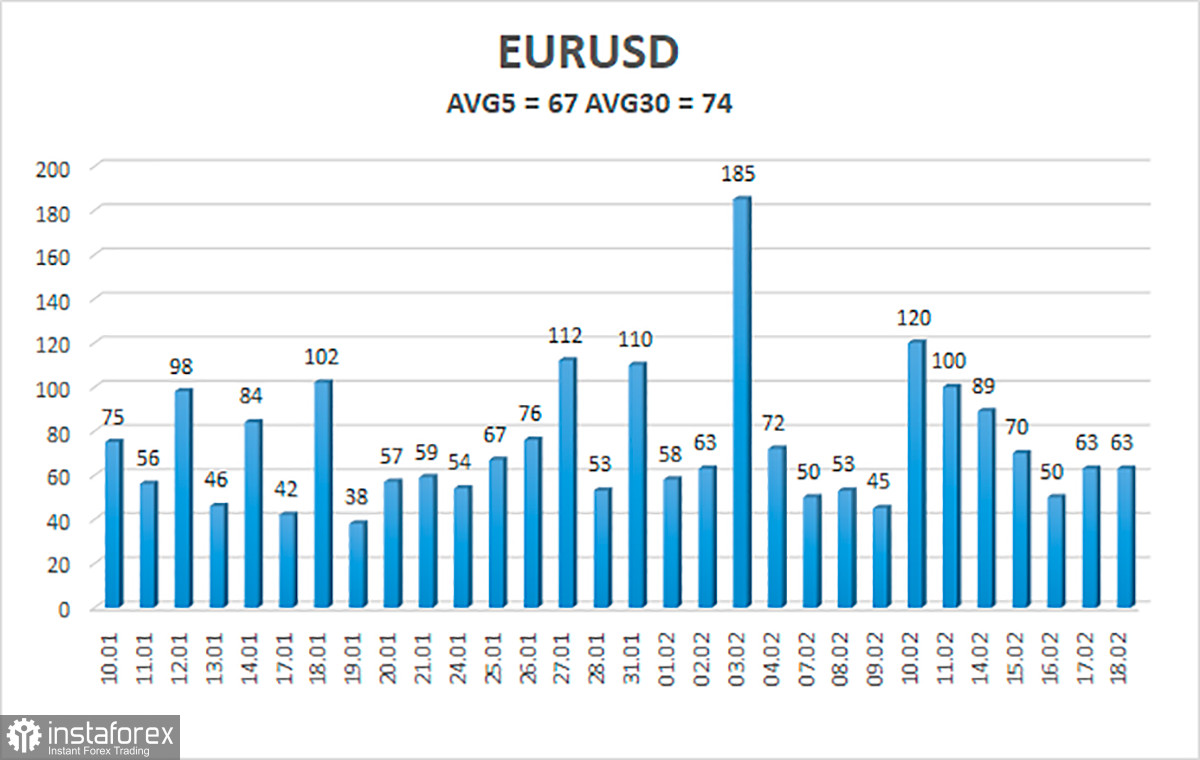

The volatility of the euro/dollar currency pair as of February 21 is 67 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1254 and 1.1388. The upward reversal of the Heiken Ashi indicator signals a round of upward correction.

Nearest support levels:

S1 – 1.1292

S2 – 1.1230

S3 – 1.1169

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1414

R3 – 1.1475

Trading recommendations:

The EUR/USD pair is trading below the moving average line. Thus, it is now possible to stay in short positions with targets of 1.1292 and 1.1254 until the Heiken Ashi indicator turns up. Long positions should be opened no earlier than fixing the price above the moving average with targets of 1.1388 and 1.1414. In both cases, it should be taken into account that there is a possibility of a flat.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.