The outcome of the trading day on Friday revealed that the single European currency needs weighty reasons to grow. EUR slipped a bit amid the empty economic calendar. It was unable to grow. So, the main market catalyst for the time being is expectations of an increase in interest rates of the Federal Reserve. At the same time, the ECB sent a clear message that it would not take any actions towards monetary tightening in the near future.

Today, US financial markets are closed on occasion of the federal holiday, President's Day. In this context, EUR is set to tread water. Commonly, the market trades flat when American speculators are away from the trading floors. Nevertheless, the single European currency is likely to edge down in the face of the future drastic action of the US monetary authorities.

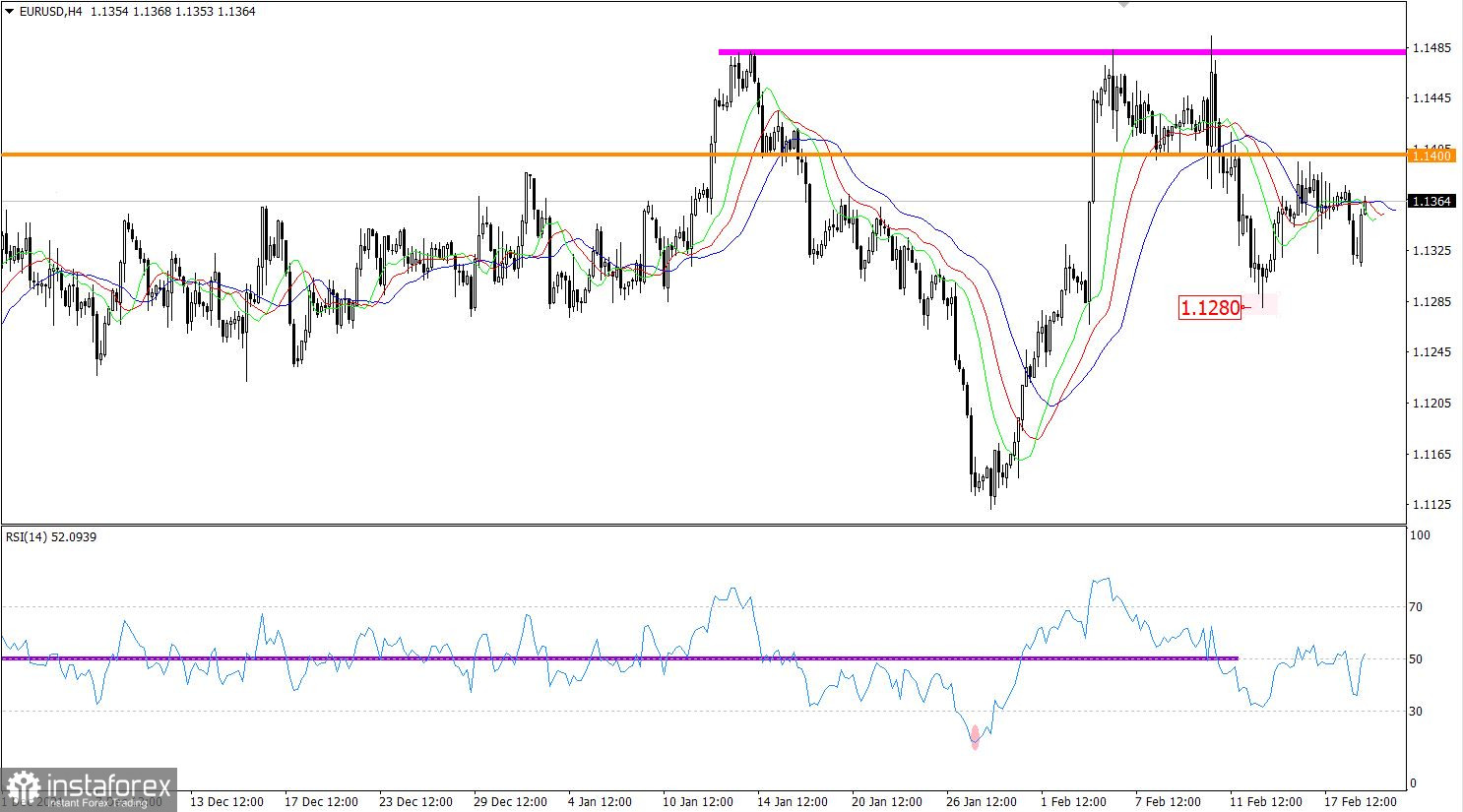

EUR/USD is trading below resistance of 1.1400 that indicates prevailing traders' interest in short positions. Importantly, we should not neglect a series of doji candlesticks that appeared in the days of January 16-17. Their accumulation confirms that the pair is facing resistance.

The RSI technical instrument is moving in the indicator's lower area on the 4-hour chart. It signals that traders are focused on a downward move.

We see that moving averages on the Alligator indicator intersect each other multiple times on the 4-hour chart. It means a consolidation that has caused the flat market.

Outlook and trading tips

Under such market conditions, traders are poised to open short positions until the price stays below 1.1400. A new bearish wave with short positions is expected when the price settles below 1.1280, a local low of February 14. When it comes to the bullish scenario, I would expect local price jumps like in the early Asian session today. Traders will increase their long positions on condition EUR/USD stays above 1.1400 at least on the 4-hour chart.

Complex indicator analysis signals buying in the short term amid a local price spike. The chart is generating a mixed signal for the medium term on the back of a price consolidation.