S&P500

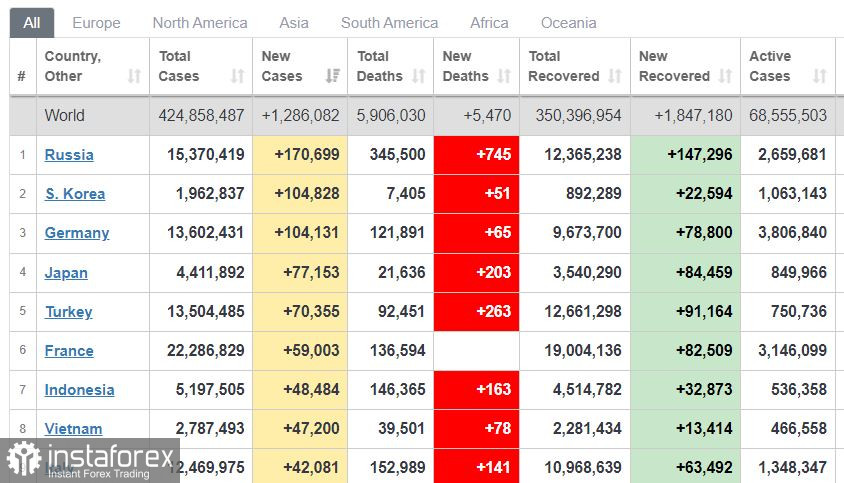

Omicron stats for February 21

Stock markets are declining due to geopolitical tensions

The main US stock indices fell at the close of the week. The Dow declined by 0.7%, the NASDAQ Composite dropped 1.2%, and the S&P 500 lowered by 0.7%.

On Monday morning, Asian markets are trading in the red. Japan's stock indices lost 0.8%, China's ones decreased by 0.75%.

As for the commodity market, crude remains at high levels, slightly below the yearly highs. Brent Crude is trading at $93 per barrel.

Now, market participants are mulling over the possibility of a military conflict between Russia and Ukraine at any moment. Last week, stock markets slumped because of it. Over the weekend, tensions have also increased. On Saturday, Ukraine's east saw the worst shelling since 2014-15. Separatist authorities in Donetsk and Luhansk announced a mass evacuation of people to neighboring Russia. Reportedly, at least 40,000 civilians have been evacuated. However, on Sunday, Macron and Putin had a conversation. As a result, Putin agreed to meet with Biden to talk about the crisis in Ukraine. Biden is also ready to return to the negotiation table. The meeting will take place before the meeting between Lavrov and Blinken on February 24 in Europe. Thus, there will definitely be no war before the meeting between Putin and Biden. Therefore, stock markets may revive. The office of French President Emmanuel Macron said that Biden had accepted the meeting "in principle" but only "if an invasion hasn't happened." However, nerves were further frayed when Russia decided to extend military drills in Belarus that were due to end on Sunday.

The S&P 500 is trading at 4,349. It is expected to stay in the range of 43,30 - 4,390

The US trading floors are closed on the occasion of Presidents' Day.

The EU is filing a lawsuit against China at the WTO. The bloc believes that China is violating the WTO's agreement on trade-related aspects of intellectual property rights (TRIPS).

The European Commission intends to introduce legal requirements for EU countries to ensure minimum gas reserves for the heating season. According to the media, the United States may become the main supplier of liquefied natural gas (LNG) to the EU. The block may face a gas shortage as Russia is squeezing supplies due to the conflict. Earlier, Germany stated that the Nord Stream 2 pipeline will not move forward if Russia invades Ukraine.

The Omicron outbreak has subdued. There are approximately 2-2.5 times fewer cases after the January highs. There were 1.3 million new cases in the world with Russia taking the lead 170,000 new cases. Germany reported 104,000 cases yesterday.

The FDA approved Merck's new drug - Merck's molnupiravir for the treatment of mild-to-moderate COVID-19 in certain adults.

The economic calendar for this week does not include crucial economic reports. On Thursday, the US GDP report for the 4th quarter is due. However, the US will unveil a revised reading. This is why traders are likely to ignore these stats. On Friday, the US will release the personal income report as well as PCE inflation data. The latter will show whether there are signs of a decline in inflation.

The US dollar index is trading at 95.70. It is likely to stay in the range of 95.40 - 96.00. The US dollar slid down on Monday as tensions eased.

The USD/CAD pair is trading at 1.2720. It is forecast to remain in the range of 1.2600 - 1.2800.

Conclusion

The stock market may grow today amid reducing tensions over Ukraine. Analysts are sure that there will be no war until the summit between Putin and Biden.