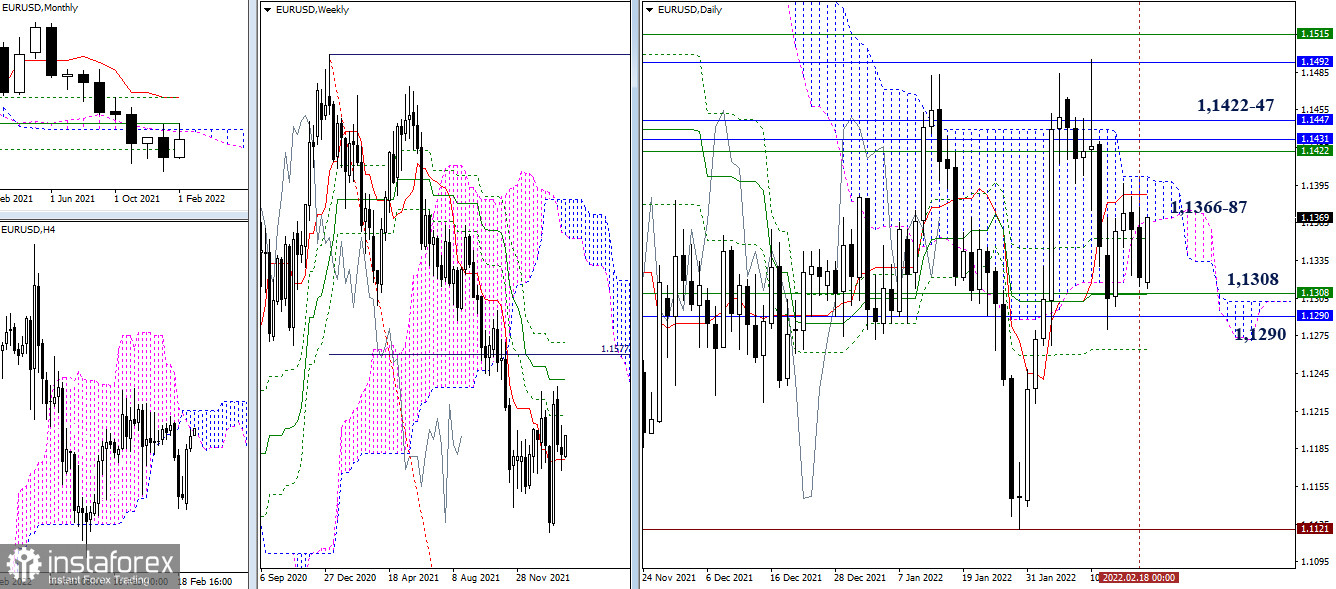

EUR/USD

Last week ended with a candle of uncertainty in the area of supports 1.1290–1.1308, while the attraction of daily levels (1.1352-66-87–1.1401) is still important in this area. Due to the persistence of general uncertainty, the situation continues to remain within the limits of the previously announced possibilities. For bears, the passage of supports 1.1290–1.1308 (daily medium-term trend + weekly short-term trend + monthly Fibo Kijun) and updating the low of 1.1121 are important. For bulls, the result of interaction with resistances 1.1422–47 (monthly cloud + weekly Fibo Kijun) is important, overcoming them will return opportunities for testing the boundaries 1.1492–1.1515 (medium-term trends of the week and month).

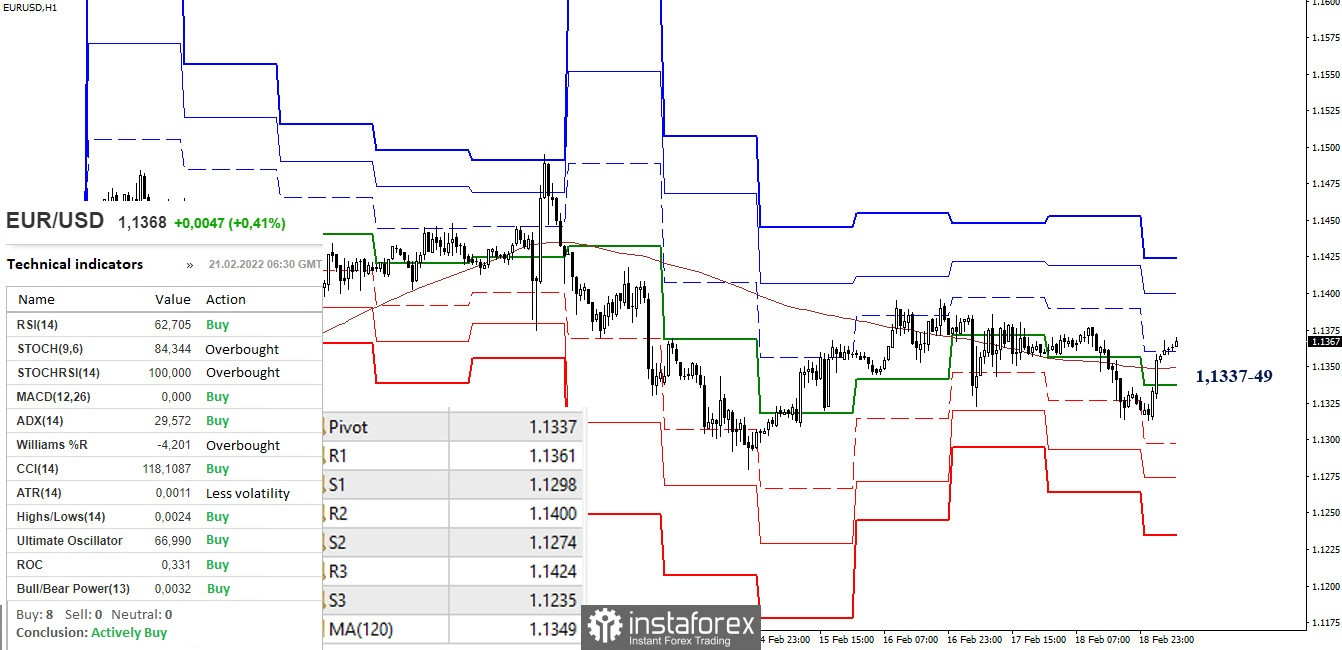

The uncertainty of the higher timeframes affects the results of the achievements of the lower timeframes. Previously, bears, having the advantage, could not achieve anything. Today the situation has changed and at the moment the support of the analyzed technical instruments belongs to the bulls. They are now interacting with the first resistance of the classic pivot point (1.1361), further, if the rise continues, R2 (1.1400) and R3 (1.1424) will serve as reference points within the day. The loss of key levels, which today are at 1.1337-49 (central pivot point + weekly long-term trend), will once again change the current balance of power. Downward references within the day will be the support of the classic pivot points (1.1298 – 1.1274 – 1.1235).

***

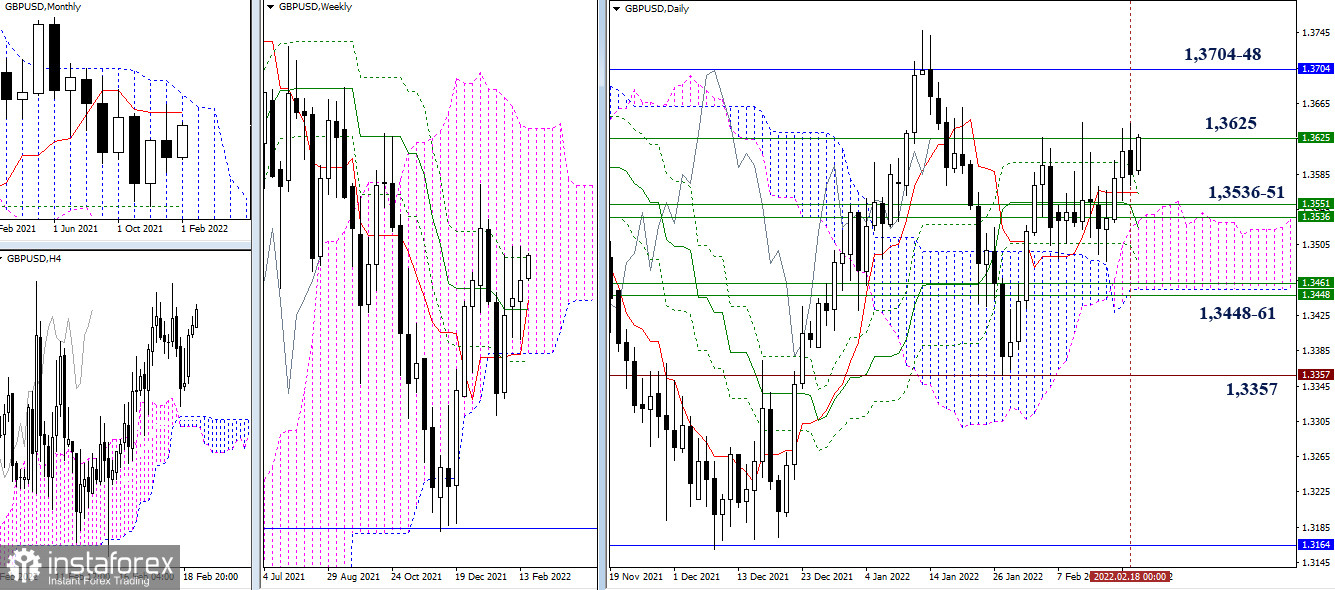

GBP/USD

Last week, the pair remained in the area of the previous consolidation. The center of consolidation is now a cluster of levels, led by the weekly levels (1.3536-51). The benchmarks for bulls, allowing to develop the rise and change the situation, are 1.3625 (weekly Fibo Kijun) - 1.3704-48 (monthly Tenkan + maximum extremum). For the development of bearish sentiment, the boundaries of 1.3448-61 (the lower boundary of the daily cloud + weekly levels) and the update of the low (1.3357) will be important.

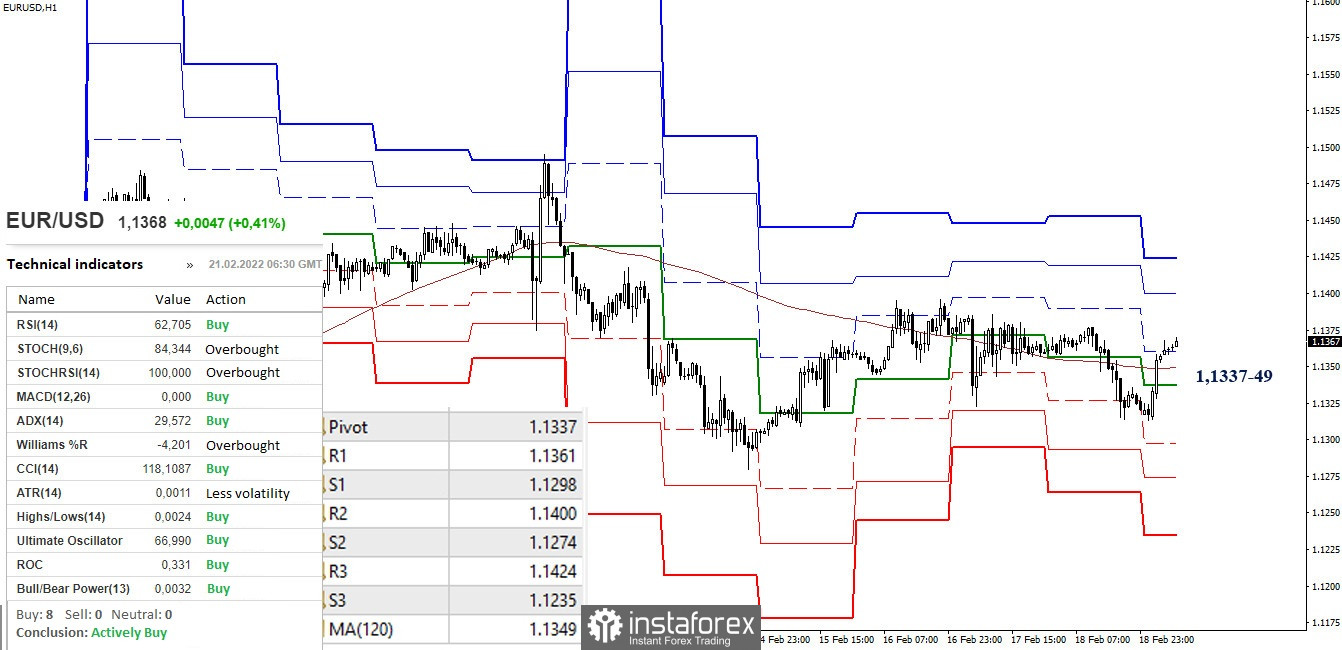

In the lower timeframe, the advantage belongs to the bulls. At the moment they are testing the first reference point from the classic pivot points (1.3627), further reference points will be R2 (1.3670) and R3 (1.3697). The key levels of lower timeframes act as support today and are located at 1.3600 (central pivot point) and 1.3572 (long-term weekly trend). Consolidation below will change the current balance of power. Further support will be the classic pivot points (1.3557 – 1.3530 – 1.3487).

***

Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.