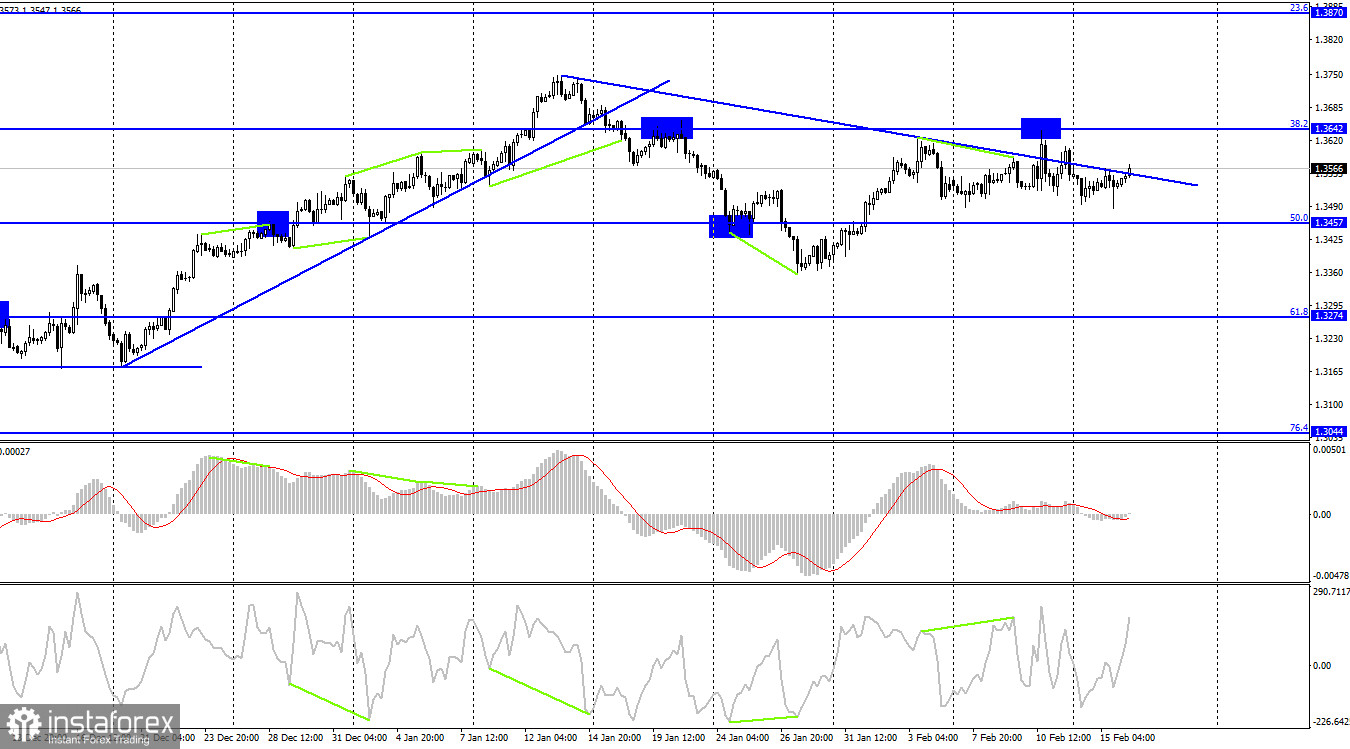

Good afternoon, dear traders! On the 1H chart, the GBP/USD pair extended losses on Friday, which allowed us to build an ascending trend line. However, we can also see the sideways channel on the 4H chart. I did not indicate it on the chart as it is clearly seen that the pair is trading between the levels of 1.3457 and 1.3642. Thus, an ascending trend line signals bullish sentiment in the market. However, it may be an unfolding trend within the sideways channel. If the price holds below the trend line, the US dollar will strengthen. As a result, the pair perform a downward reversal. Currently, the pound sterling is almost immune to new releases. The US and UK unveil various reports but they rarely affect the British currency. The greenback was projected to climb as a safe-haven currency amid geopolitical tensions. For some reason, the pound sterling has been growing instead for the last few days amid the escalation of the conflict. I believe that market participants do not pay much attention to this news.

In the morning, the pound sterling kept rising. However, it resumed growth at night It means that better-than-expected Manufacturing and Services PMI reports did not impact the pound sterling at all. Joe Biden and Vladimir Putin agreed in principle to hold a summit on the Ukraine crisis. It will take place on February 24. Emmanuel Macron initiated the meeting, offering a possible way out of one of the most dangerous European crises in decades. This summit is sure to be the main highlight of the week as Biden and Putin will have greater leverage in the conflict. Therefore, the future development of events will largely depend on the results of this meeting. Earlier, US, Russian, and EU officials held numerous negotiations but they did not bring any results. If Biden and Putin do not reach a mutual agreement on February 24, there might be further escalation of the conflict.

On the 4H chart, the pound/dollar pair returned to the Fibonacci correction level of 38.2% - 1.3642. Earlier, it performed several rebounds from this level. The price is likely to try again to consolidate above this level. If so, it is likely to climb to the next Fibonacci level of 23.6% - 1.3870. It will also signal a breakout of the sideways channel. If the pair is unable to break above the indicated level, the pair will remain in the sideways channel. Shortly after, it may slide down to the Fibonacci correction level of 50.0% - 1.3457.

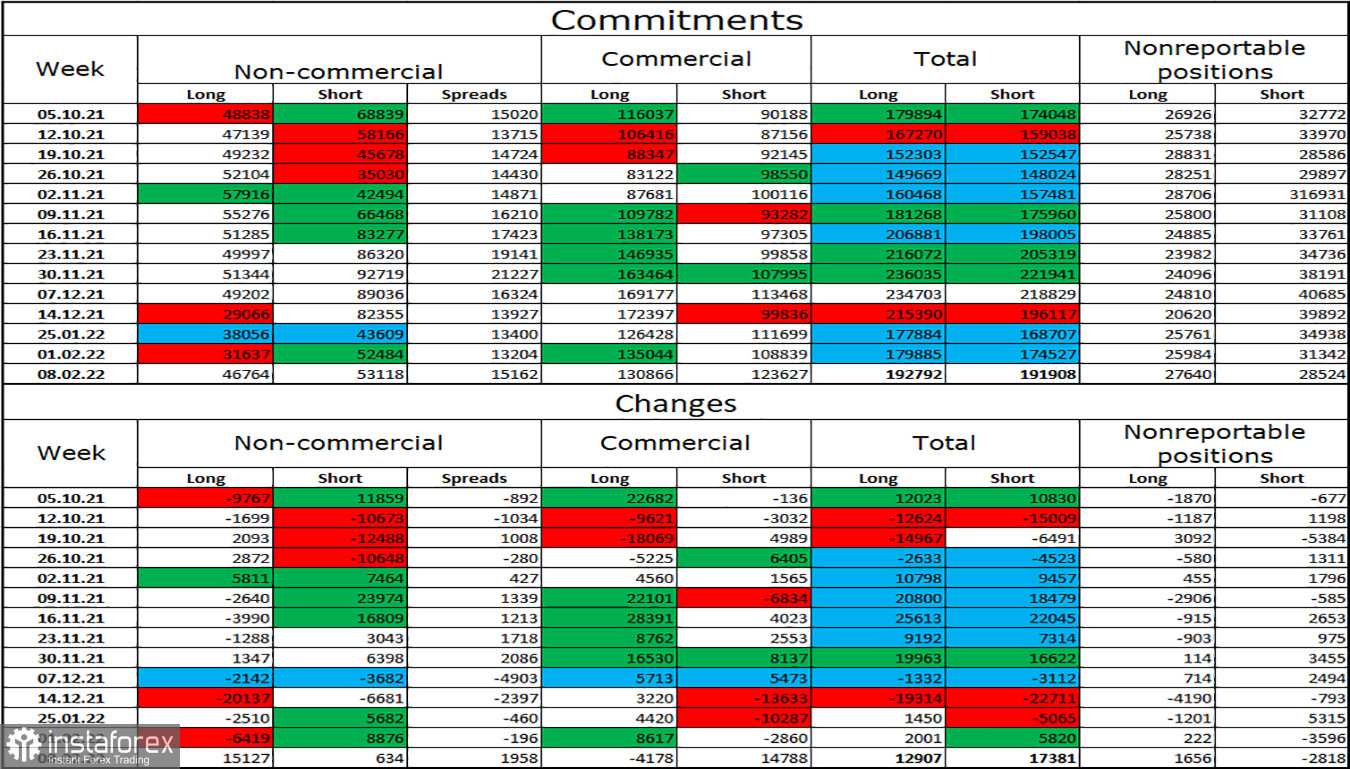

COT report (Commitments of Traders):

The mood of the "Non-commercial" category of traders has changed dramatically over the last reporting week. In the last two weeks, speculators have been increasing the volume of Long positions that totaled 20,000. In the last reporting week, they closed many Short positions. Therefore, bullish sentiment is quite strong now among large market players. However, at the same time, it remains bearish as the total number of Long positions does not exceed the total number of Short ones. The pound sterling has demonstrated modest growth in recent weeks, which is in line with the COT reports.

Macroeconomic calendar for the US and UK

On Monday, the economic calendar for the UK and US is completely empty. Today, there will be no fundamental drivers. Traders are also unlikely to receive any news on the Russia-Ukraine conflict as now traders are anticipating the meeting between Putin and Biden.

Outlook for GBP/USD and trading recommendations:

It is recommended to open short positions on the pound sterling if it drops from 1.3642 on the 4H chart with the target levels of 1.3599 and 1.3552. On the hourly chart, I would advise you to sell the instrument if it closes below the trend line. It is better to open long positions if the pound sterling rises above the level of 1.3642 with the target level of 1.3731.