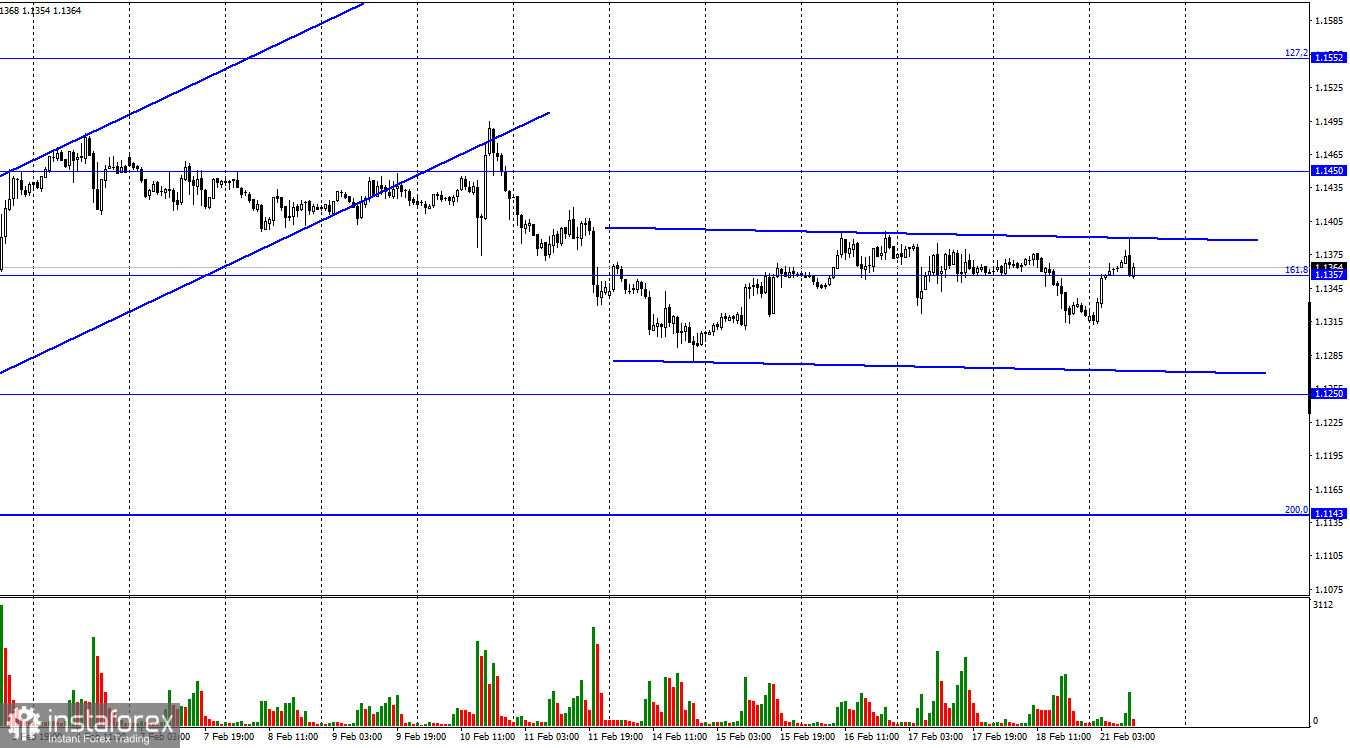

Hello, dear traders! On Friday, the euro/dollar pair fell from 1.1357, the correction level of 161.8%. However, the pair has returned to this mark today. For now, many levels are ignored, no signals are formed around them. The level of 1.1357 can be seen as a good example. The pair is trading within a sideways channel on the hourly chart. This indicates that market sentiment is currently neutral. Such a movement has been persisting for several months, which can be confirmed by the 4-hour chart. Friday's macroeconomic calendar was bereft of any important releases from the US and the euro area. As a result, traders were forced to closely monitor the geopolitical situation, but even it failed to make them trade more actively. Of course, the focus of market participants is on the Russia-Ukraine conflict. Tensions may mount at any moment.

The point is that neither Kiev and Moscow, nor the West and Moscow can come to an agreement. So far, the situation has escalated only in the Donbass. Thus, thousands of the region's residents began to leave for Russia under a mass evacuation announced last week. However, it is not a large-scale operation. It is known that about 30,000-40,000 people arrived in the south of Russia, which is 1-2% of the total number of the Donetsk and Lugansk People's Republics. As for shelling, the armed forces of both sides are blaming each other over intense shelling using large-caliber artillery guns. On the one hand, it can be concluded that the geopolitical situation has deteriorated, especially considering thousands of Russian troops at the Ukrainian border. On the other hand, there is no invasion of Ukraine. Although the Western media continue to warn that Russia would invade the neighboring country in the near future. Russia's media continue to claim that the state does not have any plans to launch an offensive, saying that the massed troops are just conducting military exercises.

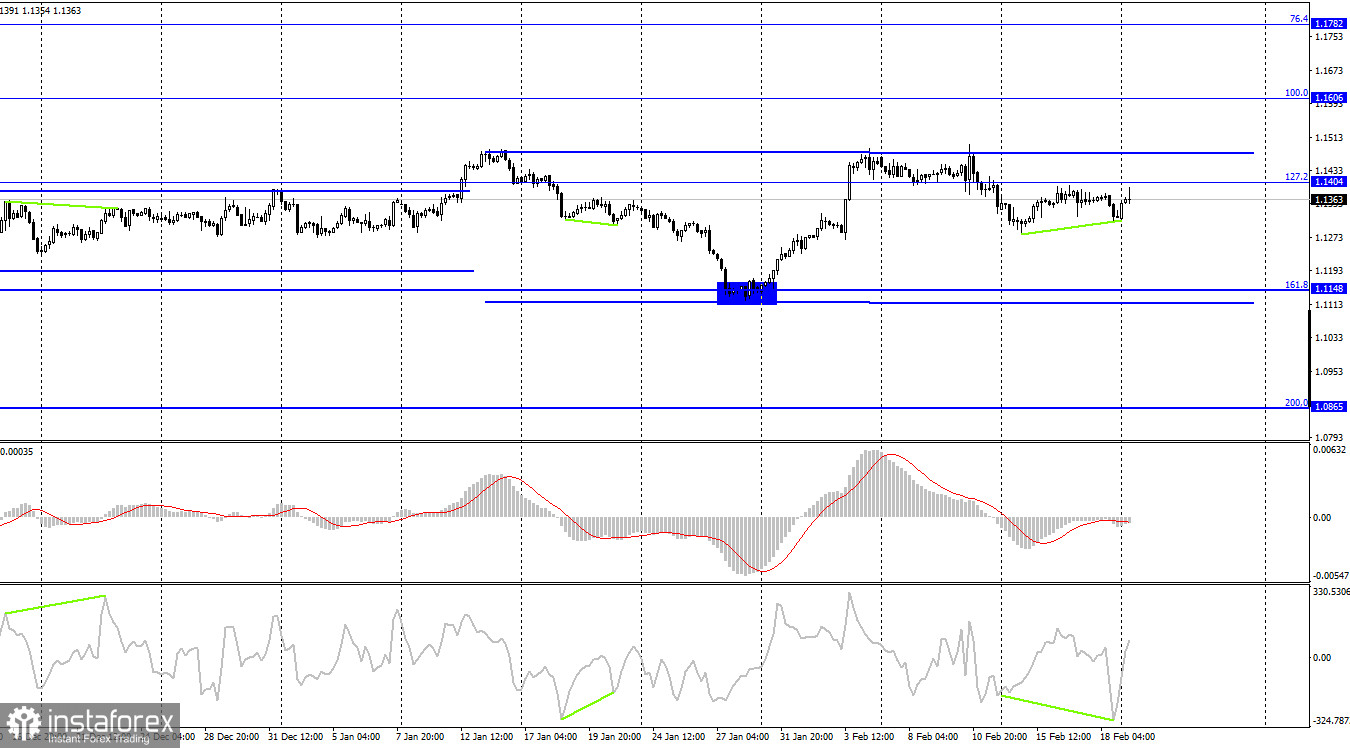

According to the 4-hour chart, the euro/dollar pair reversed and started to recover. Nevertheless, the current sideways channel is the main graphical analysis tool for traders. The chart clearly shows that the pair moved to another sideways range, a wider one. However, this does not change things. It will be possible to define a trend only when the price closes above or below the range.

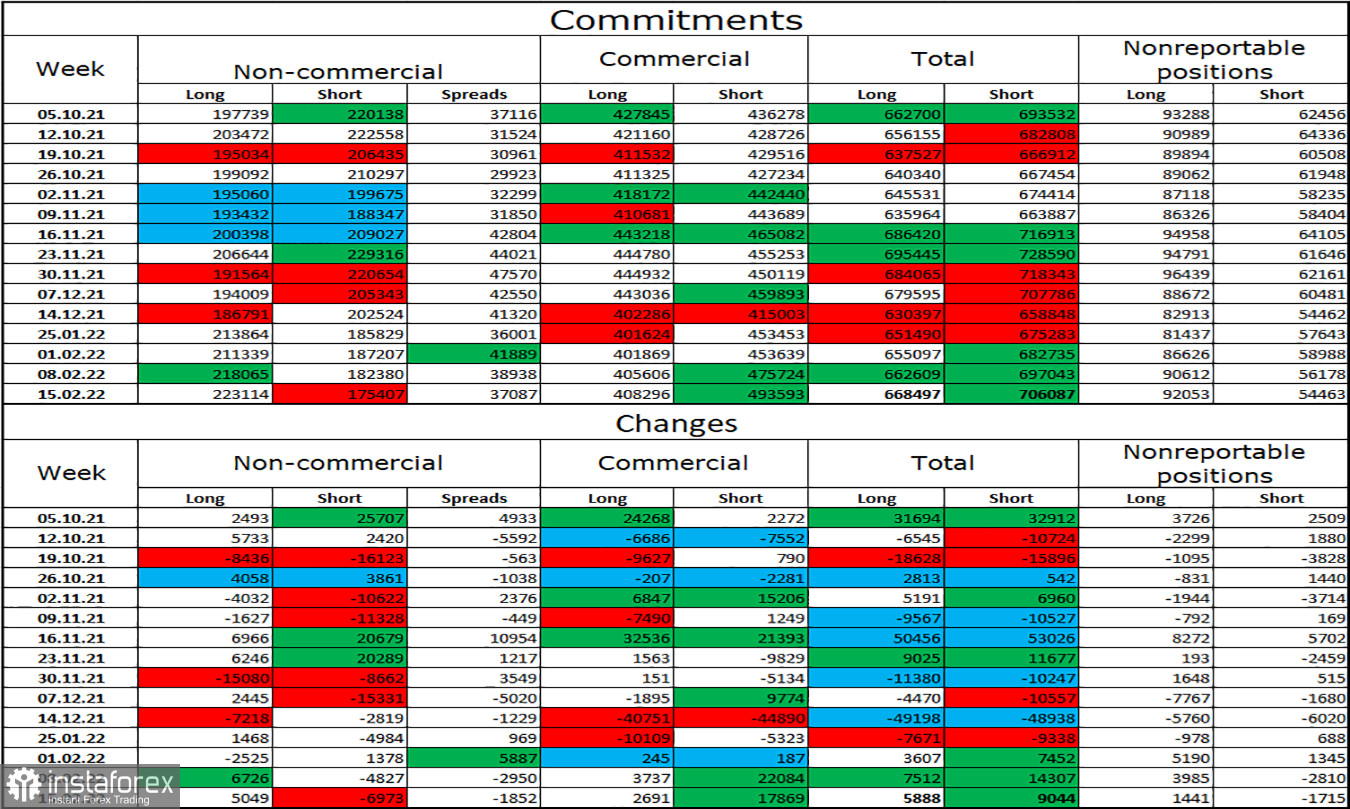

Commitments of Traders (COT) report:

Last reporting week, speculators opened 5,049 Long contracts and closed 6,973 Short contracts. This means that bullish sentiment has increased. The total number of Long positions is currently 223K, while that of Short ones is 175K. Thus, the mood of non-commercial traders is also bullish. Against this background, the European currency has every chance of gaining value. However, the US currency is being supported by fundamental factors. Therefore, I think that data on COT reports can be neglected due to the tense situation in the world and a possible change in the mood of major market players.

News reports from the US and the euro area:

Today's macroeconomic calendar is bereft of any important releases from the euro area and the United States. Thus, trading activity is expected to be subdued. So the quotes will hardly be able to leave the sideways channel today.

Outlook for EUR/USD and trading recommendations:

In case of the price fixation below 1.1404 on the 4-hour chart, I recommended opening new short positions with a view to reaching the target levels at 1.1357 and 1.1250. These positions can be kept open as the pair is trading in the upper area of the sideways channel. Long positions can be considered if the price consolidates above the upper boundary of the sideways range on any chart.