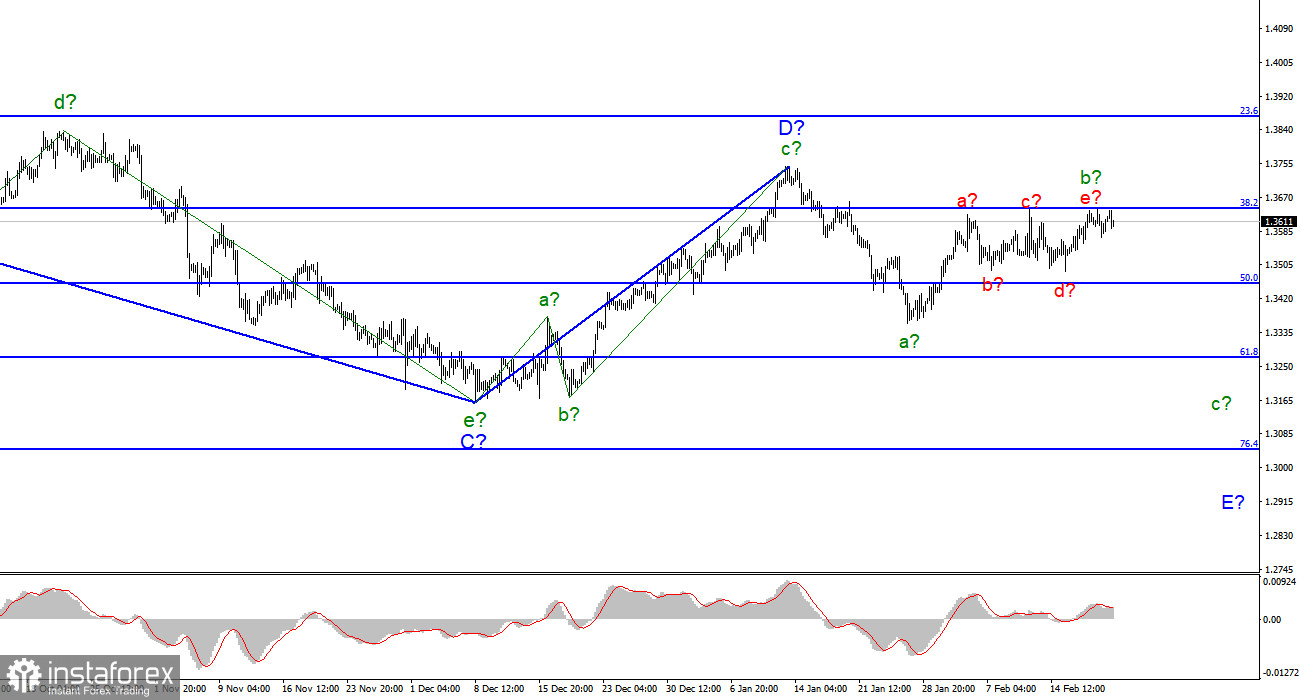

For the pound/dollar instrument, the wave markup continues to look very convincing, but in the near future, it may become somewhat more complicated. The increase in quotes last week complicates the expected wave b and it turns out to be longer than wave a. Since three internal waves are already being viewed inside wave b, this wave should be completed soon. However, it is not yet completed, and the decline of the instrument does not begin. Based on this, I assume that wave b can take an even more extended form. However, there are no internal waves visible in wave a-E, so this complication of wave b looks rather strange. At the same time, a three-wave structure is visible inside wave D, so it cannot be the first impulse wave of a new upward trend segment. And the entire downward section of the trend, which originates on June 1, 2021, can be both three-wave and five-wave. Thus, the wave picture is ambiguous now, but I am still inclined to believe that another descending wave E will be built.

Important statistics did not interest the market.

The exchange rate of the pound/dollar instrument during February 21 first increased by 50 basis points and then decreased by about the same amount. Market activity was low, but the market is in tension due to geopolitics. There will be almost no interesting economic reports in the UK this week. To be more precise, all of them have already left this morning. The business activity index for the manufacturing sector amounted to 57.3 points in February, which coincides with the value of January, and the index for the service sector increased from 54.1 points to 60.8. I can't say that the market was overjoyed to see this data. After their release, the pound managed to add about 15 points, after which it began to decline. Thus, this week, it will now be possible to pay attention to only two speeches by the Governor of the Bank of England, Andrew Bailey, on Wednesday and Thursday. Let me remind you that the Bank of England has already overtaken the Fed in raising the interest rate and is not going to stop there and bring the rate to 1%. So far, these are market expectations, but Bailey can either confirm or refute them. Especially now, when Europe is on the verge of a military conflict that will affect all participants of the global market to one degree or another. In the US, business activity indices, an important report on GDP for the fourth quarter, and a report on orders for long-term goods will also be released this week. Another important event will be the meeting of Joseph Biden and Vladimir Putin on February 24. While the market is trying to keep calm, this calmness does not allow the instrument to move in accordance with its wave markings.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the construction of a wave E. The construction of the proposed wave b is completed, or this wave is not b. The instrument made two unsuccessful attempts to break through the 1.3645 mark, and wave b acquired a five-wave appearance. Already today or tomorrow, a decline in quotes should begin, and I believe that a wave c-E will still be built. Therefore, I advise now selling with targets located around the 1.3272 mark, which corresponds to 61.8% Fibonacci, until a successful attempt to break through the 1.3645 mark. Otherwise, the wave pattern will require additions.

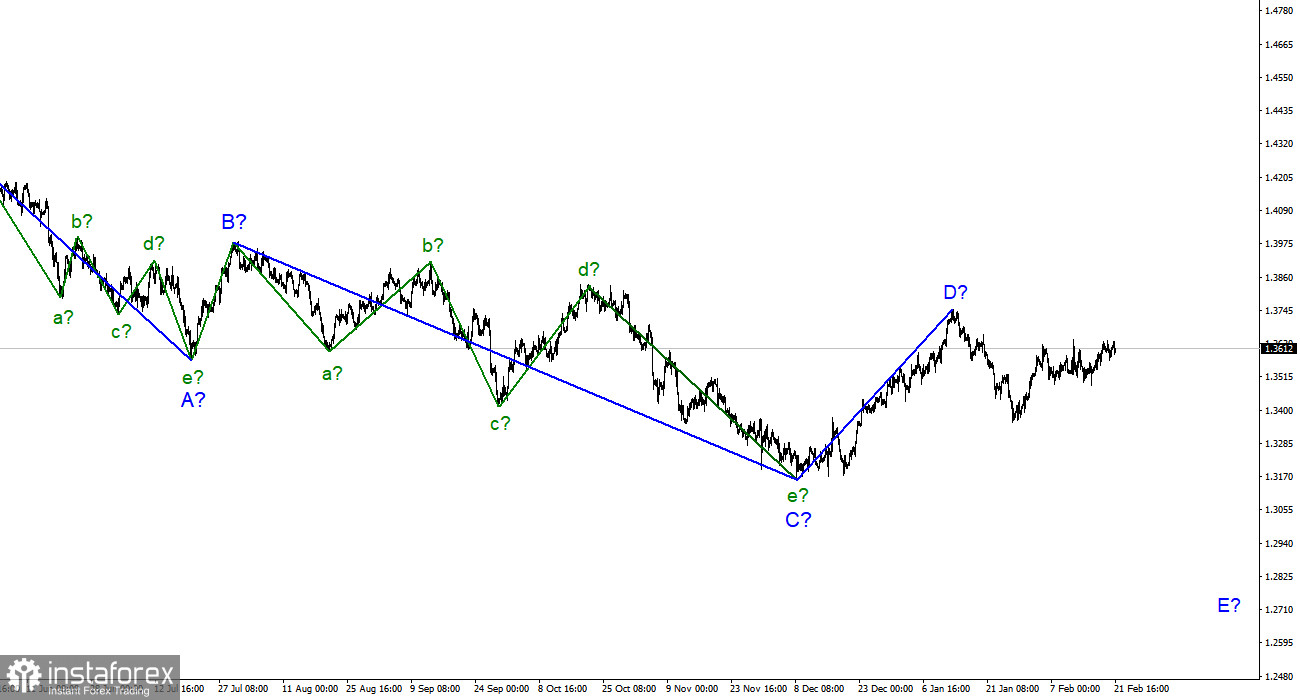

On the higher scale, wave D also looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect a resumption of the decline of the instrument with targets below the low of wave C. Wave D turned out to be a three-wave one, so I cannot interpret it as wave 1 of a new upward trend segment.