When to open long positions on GBP/USD:

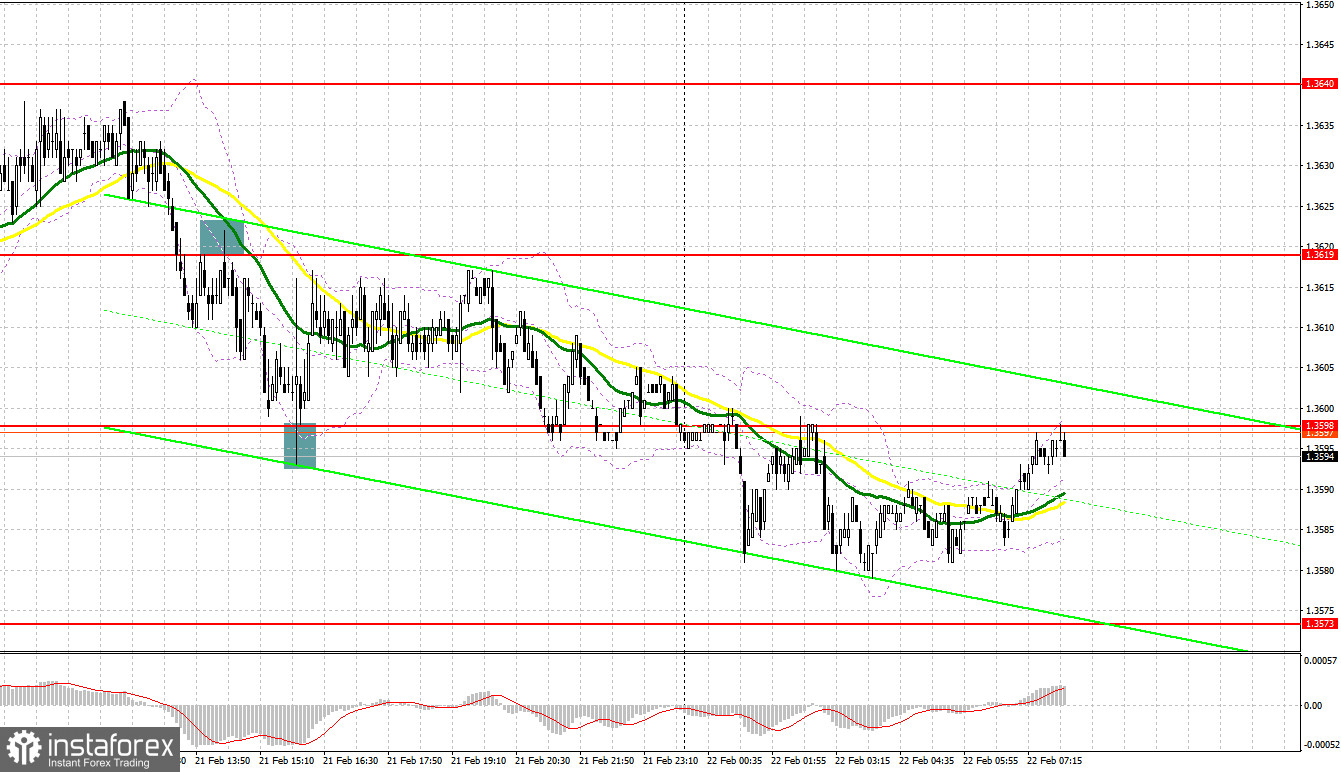

Many entry signals to the market were formed yesterday but not all of them were profitable. Let's switch to the M5 chart and analyze them. Previously, I said you should focus your attention on 1.3627 and consider entering the market from this level. A sell signal was produced in the first half of the day after the pound had recovered to 1.3627 and a false breakout had occurred. However, the bulls took control over this point after strong business activity results had been published in the United Kingdom. Traders had to close their short positions and go long due to a retest of the level of 1.3627 from top to bottom. Nevertheless, no strong uptrend emerged as a result. Traders incurred losses in the second half of the day as the pair gradually moved down from 1.3627. In the North American session, a sell signal was generated after a breakout and a retest of 1.3619 from bottom to top with the target at 1.3595 – a 25 pips profit. A false breakout at 1.2598 sent a signal to buy the pound. Eventually, the pair advanced by just 17 pips. What were the entry points on Tuesday morning?

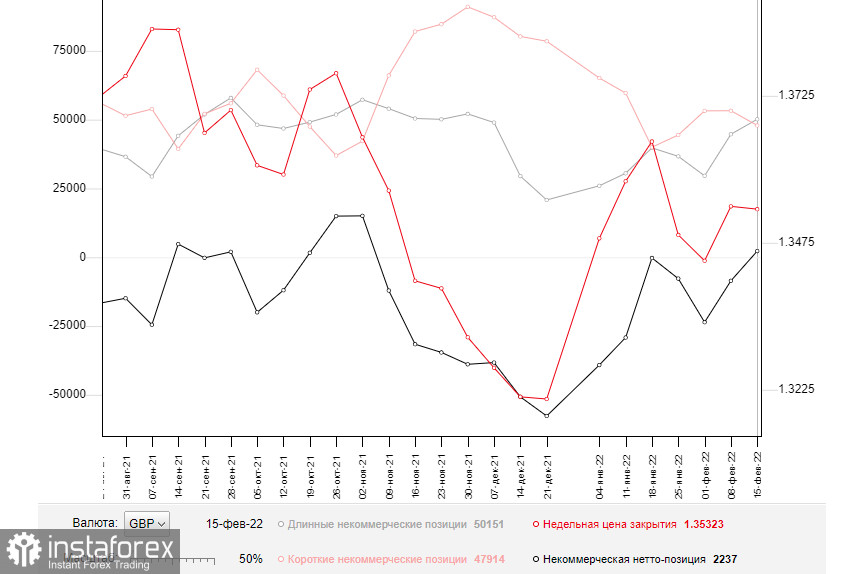

Before we analyze the technical picture of the pound, let's see what has been going on in the futures market. The COT report as of February 15 logged a sharp rise in long positions and a drop in short ones, which led to a positive delta. The outcome of the Bank of England's meeting came as no surprise. However, the regulator clearly hinted at the likelihood of a more aggressive stance on monetary policy thus fueling risk appetite. The pound would strengthen significantly if it were not for the escalation of tensions between Russia and Ukraine. So far, further demand for risk assets is questioned. Given that the British economy is going through tough times, economic growth might slow down at any time. Moreover, a rate hike might harm the recovery in the short term. However, a strong retail sales report in the UK adds optimism. The fact that inflation stayed firm at the same level in January and remained practically unchanged on a yearly basis might somewhat affect the BoE's monetary policy plans. In addition, geopolitical risks and a possible rate hike by the US Fed in March will be weighing on the bulls. Some traders expect the US central bank to hike the rate by 0.5% instead of the planned 0.25% in March, which is a bullish signal for the US dollar. The COT report as of February 15 revealed an increase in long non-commercial positions to 50,151 versus 44,709 and a decrease in short non-commercial positions to 47,914 from 53,254. The total weekly non-commercial net position increased to 2,247 versus -8,545. The weekly closing price remained unchanged at 1.3532 versus 1.3537.

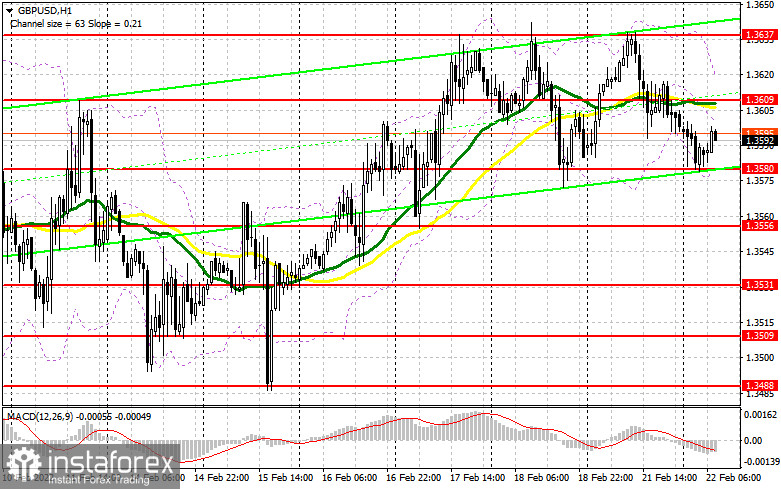

Today, the UK's macroeconomic calendar will be mainly empty. The BoE's Ramsen will deliver a speech. He is expected to talk about the importance of taming high inflation thus boosting the pound, which is unable to leave the wide sideways range. The bulls' goal for today will be to protect the important support level of 1.3580 that formed after a fall on Friday. A signal to buy GBP/USD might be produced in the event of a downtrend and a false breakout at 1.3580 along with strong data on the Confederation of British Industry's order book balance. If so, the uptrend that emerged earlier this week will extend. If this scenario plays out, the target will stand at the resistance level of 1.3609 where the bearish moving averages pass. An additional buy entry point will be formed if the quote breaks through this level and tests it from top to bottom. The targets will be seen at the high of 1.3637, the resistance level of 1.3659, and 1.3683. Traders should consider locking in profits when the price reached the farthest target. If the pair goes down in the European session and the bulls are inactive at 1.3580, traders should not rush to go long because they will no longer be able to trade in the wide sideways range after a test of 1.3556. Therefore, only a false breakout there could produce an entry point with the view of a short-term rise in the pound. It will also be possible to sell the GBP/USD pair on a bounce off 1.3531 or the low of 1.3509, allowing a 20-25 pips correction intraday.

When to open short positions on GBP/USD:

It seems the bears are taking advantage of geopolitical risks. The downtrend might extend as the pair trades below the moving averages. The bulls failed to break the strong resistance level of 1.3640 three times, which indicates the unwillingness of major players to act more aggressively. In this light, it would be wise to sell the pound. The main goal for the bears will be to protect 1.3609 – the bearish pivot point where the moving averages pass. A false breakout at 1.3609 will produce a sell entry point. If so, the bearish correction will continue and the quote will decline to 1.3580. The price failed to break below this mark in the Asian session. The bears and the bulls will both try to gain control over this level as it represents the bulls' last hope for a rebound and the resumption of the uptrend. A breakout and a retest at 1.3580 from bottom to top will push the GBP/USD pair to the lows of 1.3556 and 1.3531. The range of 1.3509 is seen as a farther target where traders should lock in profits. If the pair goes up in the European session and the bears are inactive at 1.3609, short positions could be entered as the price hits the resistance level of 1.3656. Traders could go short after a false breakout there. It would be possible to sell the GBP/USD pair on a bounce off the highs of 1.3659 or 1.3683, allowing a 20-25 pips correction intraday.

Indicator signals:

Moving averages

Trading is carried out below the 30-day and 50-day moving averages, indicating the attempt of the bulls to gain control over the market.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Pressure on the pair could increase if the price breaks through the lower band at around 1.3580. A breakout of the upper band at around 1.3610 could trigger a rise in the pound.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.