EUR/USD

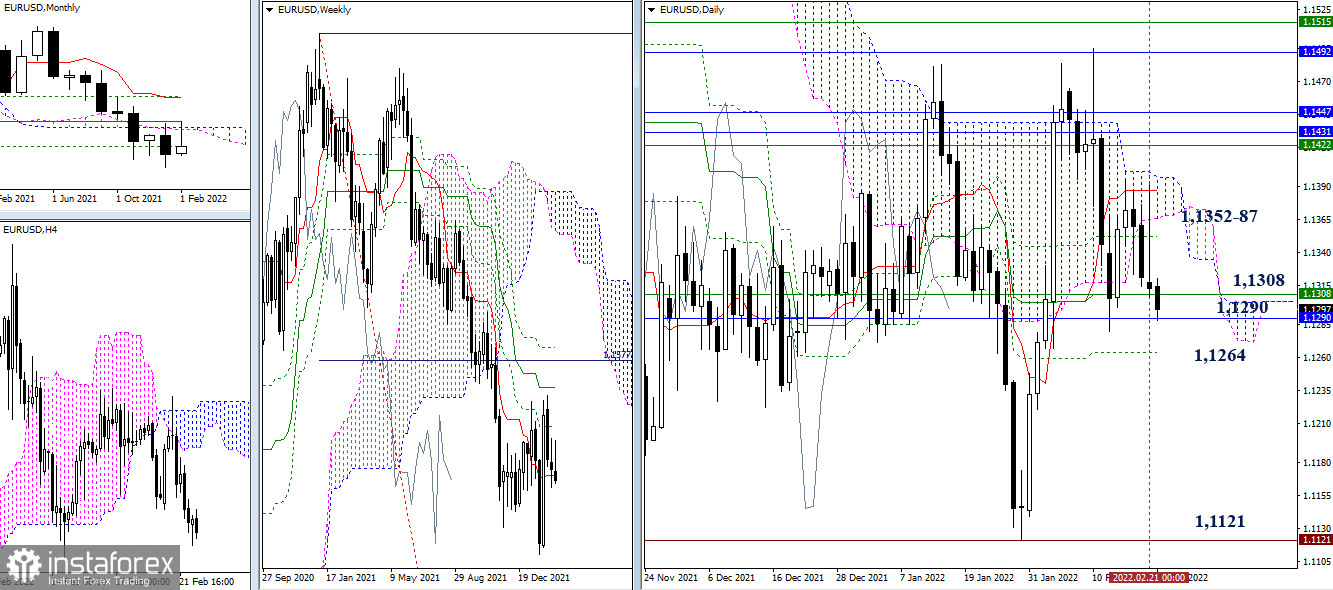

Yesterday, the euro again came close to the important support zone of the area of 1.1290 - 1.1308. Today we are witnessing another testing of levels. The breakdown will allow more active consideration of the bearish scenario. In this case, bears will have to eliminate the daily golden cross (1.1264), and then the main task will be to restore the weekly downward trend and update the January low (1.1121). The rebound from the supports will return the pair to the zone of the previous consolidation, with the center from the daily levels (1.1352-87).

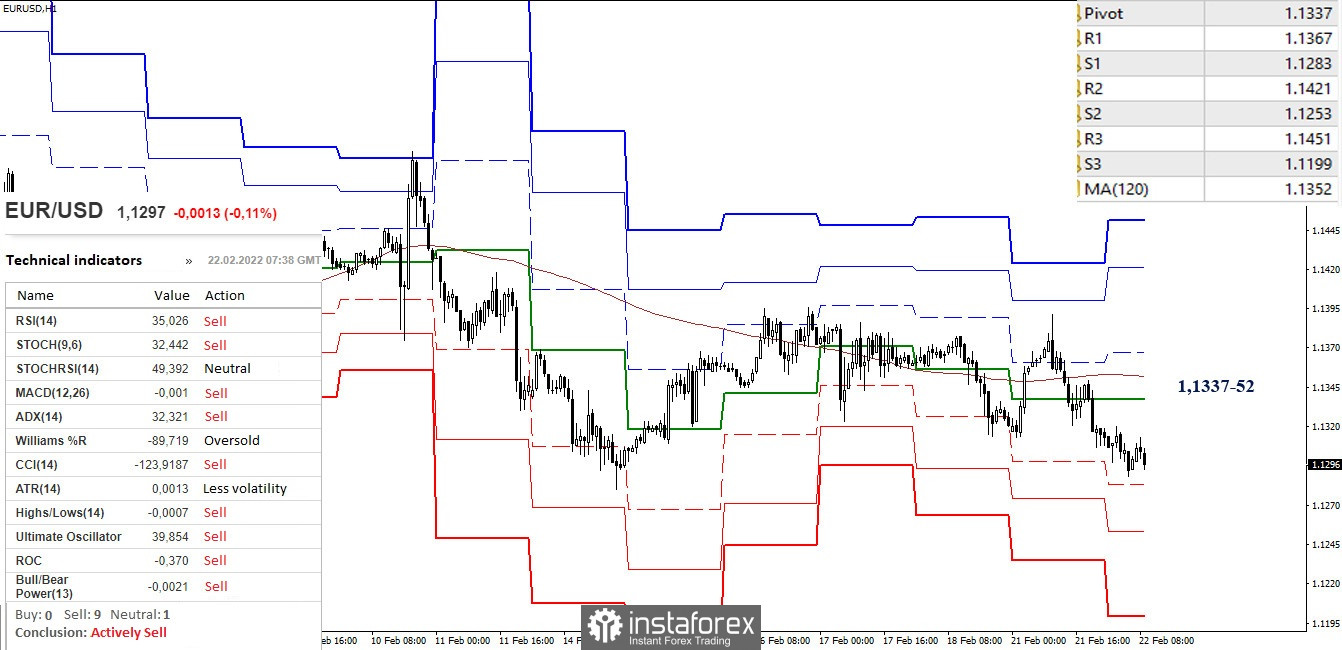

At the time of writing, the advantage of the lower timeframes belongs entirely to bears. Reference points for the intraday decline are the support of the classic pivot points, which today are located at 1.1283 - 1.1253 - 1.1199. A change in the balance of power can be expected with the rise and consolidation above the key levels of 1.1337 (central pivot point) and 1.1352 (long-term weekly trend). Such a result, confirmed the other day, will serve as the basis for the formation of a rebound from the met and currently tested supports of the higher timeframes (1.1290 - 1.1308).

***

GBP/USD

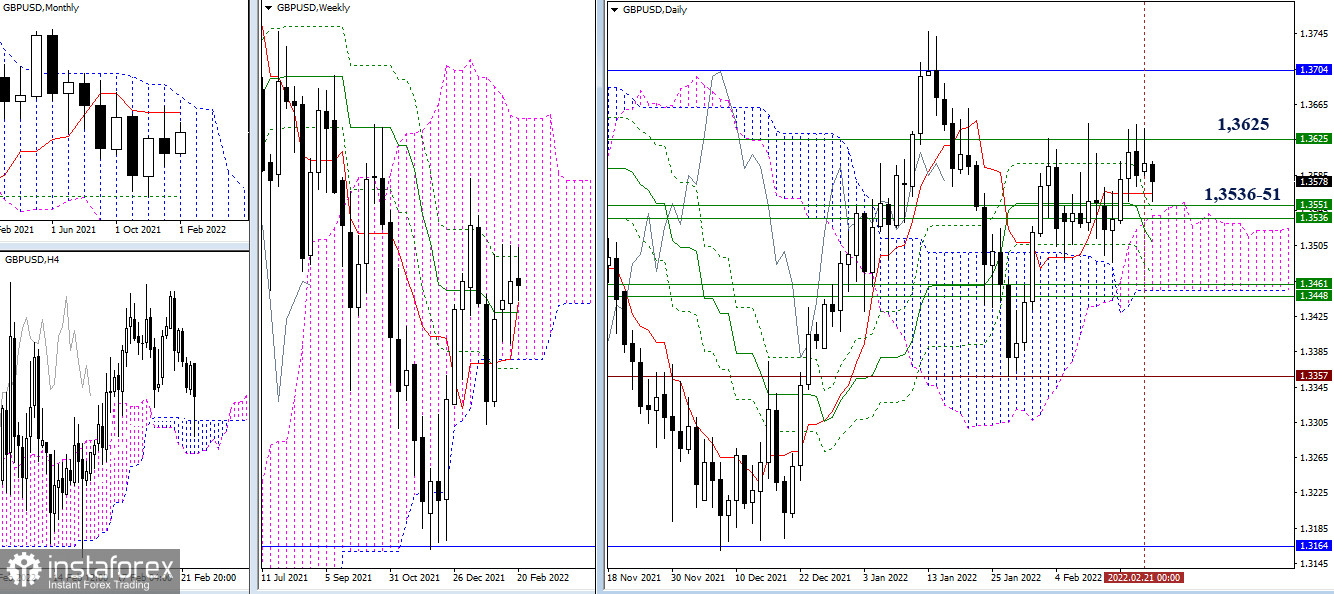

Another struggle for possession of the weekly level (1.3625) did not bring victory to the bulls. The pair is working in the consolidation zone and is again close to its center (1.3536-51). Therefore, the situation still remains in the same forecasts and expectations. The main levels, which are landmarks, have also not changed their location and values yet.

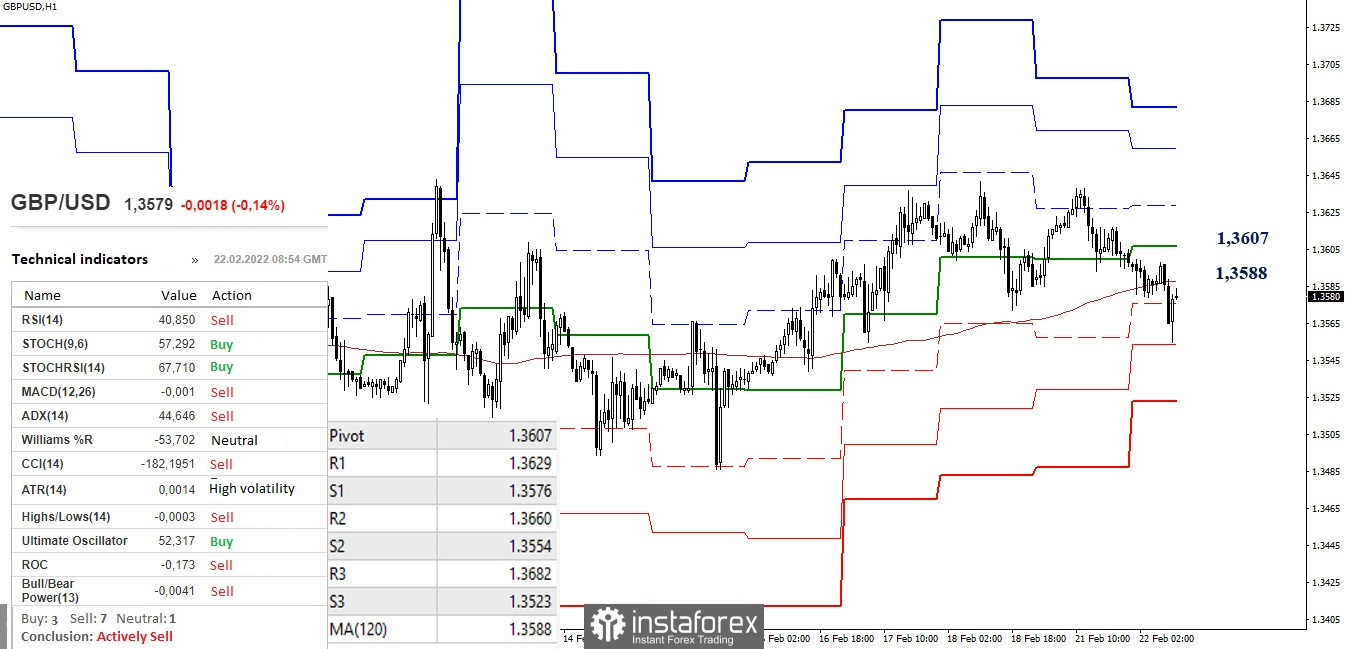

The key levels of lower timeframes are consolidating their efforts today in the area of 1.3588 - 1.3607 (central pivot point + weekly long-term trend). The work below the levels and the reversal of the moving average will strengthen the bears. Consolidation above will change the current balance of power and bring the pair back to testing the weekly Fibo Kijun (1.3625). The supports of the classic pivot points today are located at 1.3576 - 1.3554 - 1.3523, and resistances are at 1.3629 - 1.3660 - 1.3682.

***

Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as Classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.