Hi, dear traders!

On Monday, EUR/USD closed in negative territory. However, it remained within the horizontal channel, indicating that trader sentiment remains neutral. Both EUR/USD and GBP/USD have been in a sideways trend recently. GBP/USD has been moving sideways for the past week, while's EUR/USD horizontal movement has been going on for several weeks, if not months. Traders are extremely cautious amid political tensions between Russia and Western nations over Ukraine, which already triggered a stock market crash in Russia yesterday. Russia's decision to recognize the self-proclaimed Donetsk and Luhansk People's Republics is dominating the headlines. The decision was signed yesterday by Russian president Vladimir Putin.

Russian military forces were deployed in these territories yesterday, putting Russia and Ukraine on the brink of war. Ukraine considers Moscow's actions to be a flagrant violation of international law and the Budapest Memorandum, which guaranteed Ukraine's territorial integrity. The Kremlin has stated that the Minsk Agreement has failed. In his address, Putin has accused Kiev of seeking to reacquire nuclear weapons, which would threaten the entire world. Diplomatic efforts have reached a dead end, as both sides strive to push through their own interests. Today, the EU and the United States will impose new sanctions on Russia. The impact of the full-scale war could ripple through European and American markets.

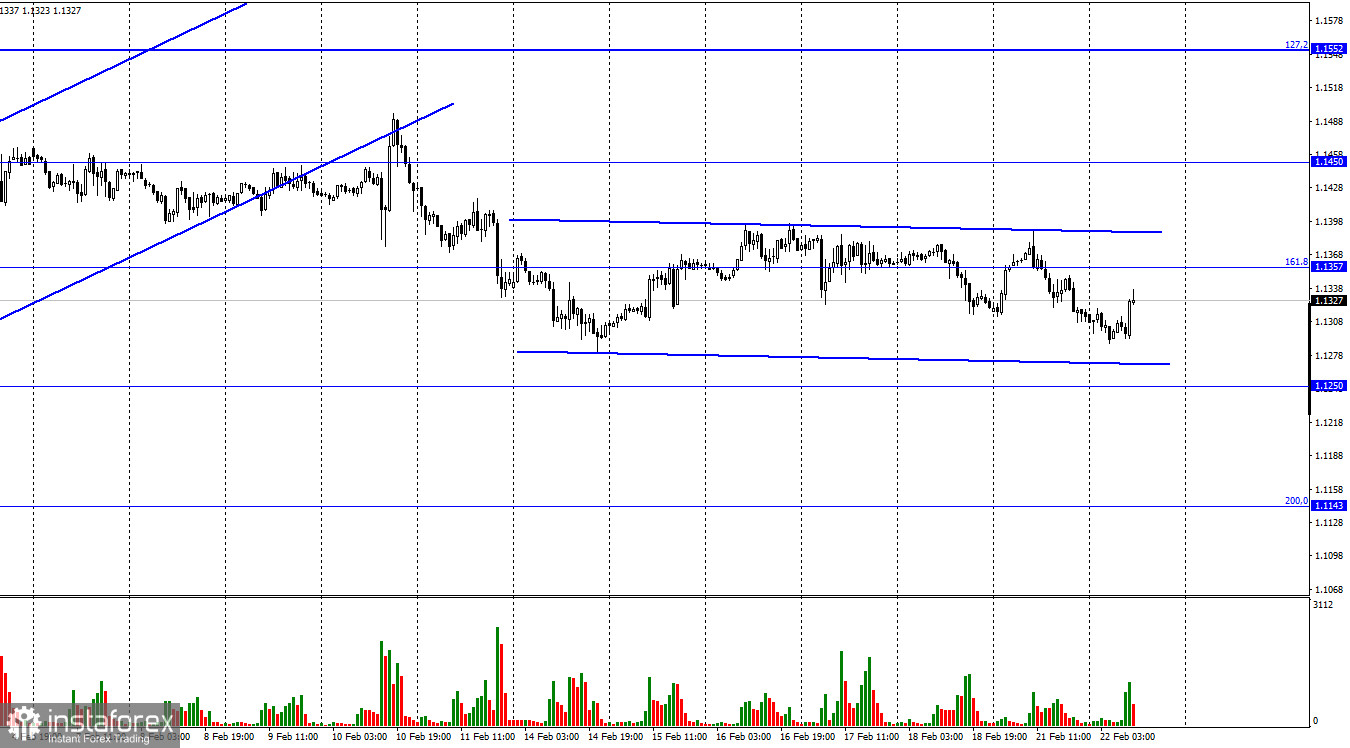

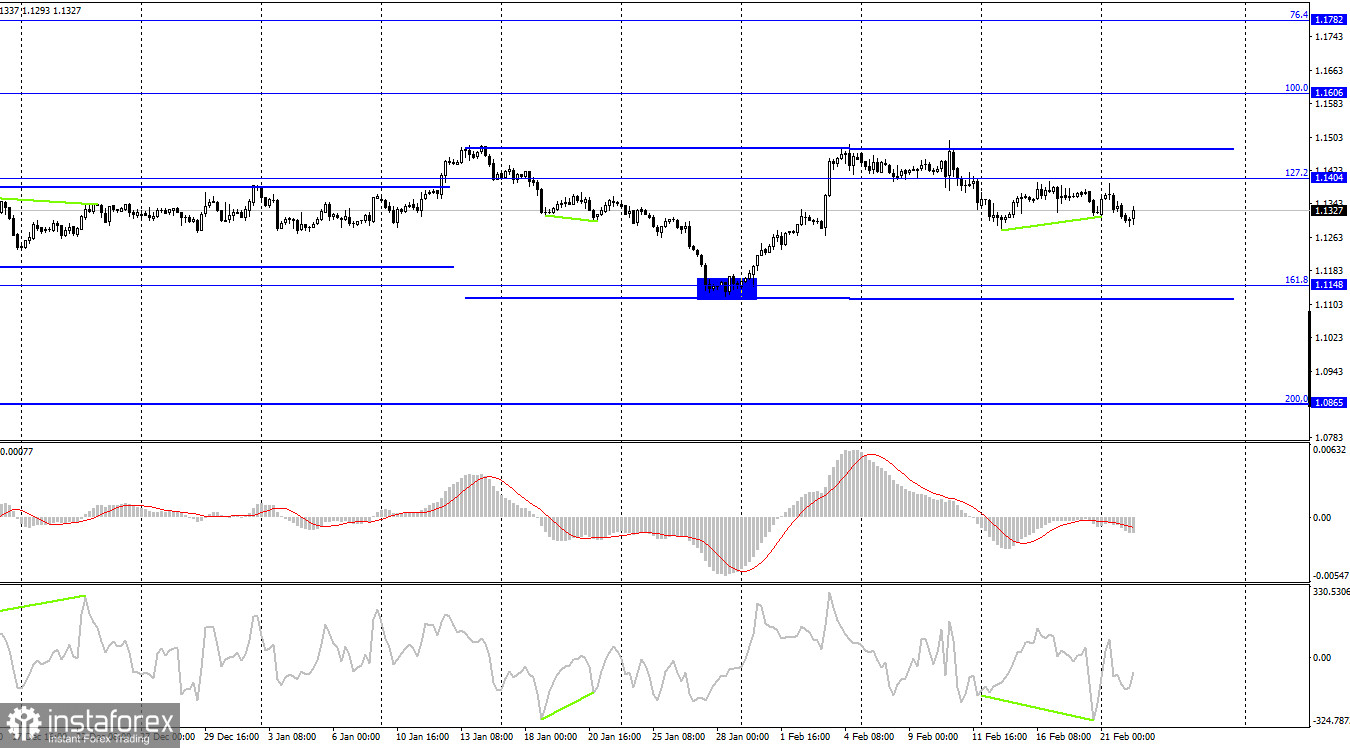

According to the H4 chart, the pair has reversed downwards. However, the current sideways channel is the most important element on the chart. Even though EUR/USD has moved from a narrow price channel to a wider one, its trend would only become clear once the pair breaks out of the channel.

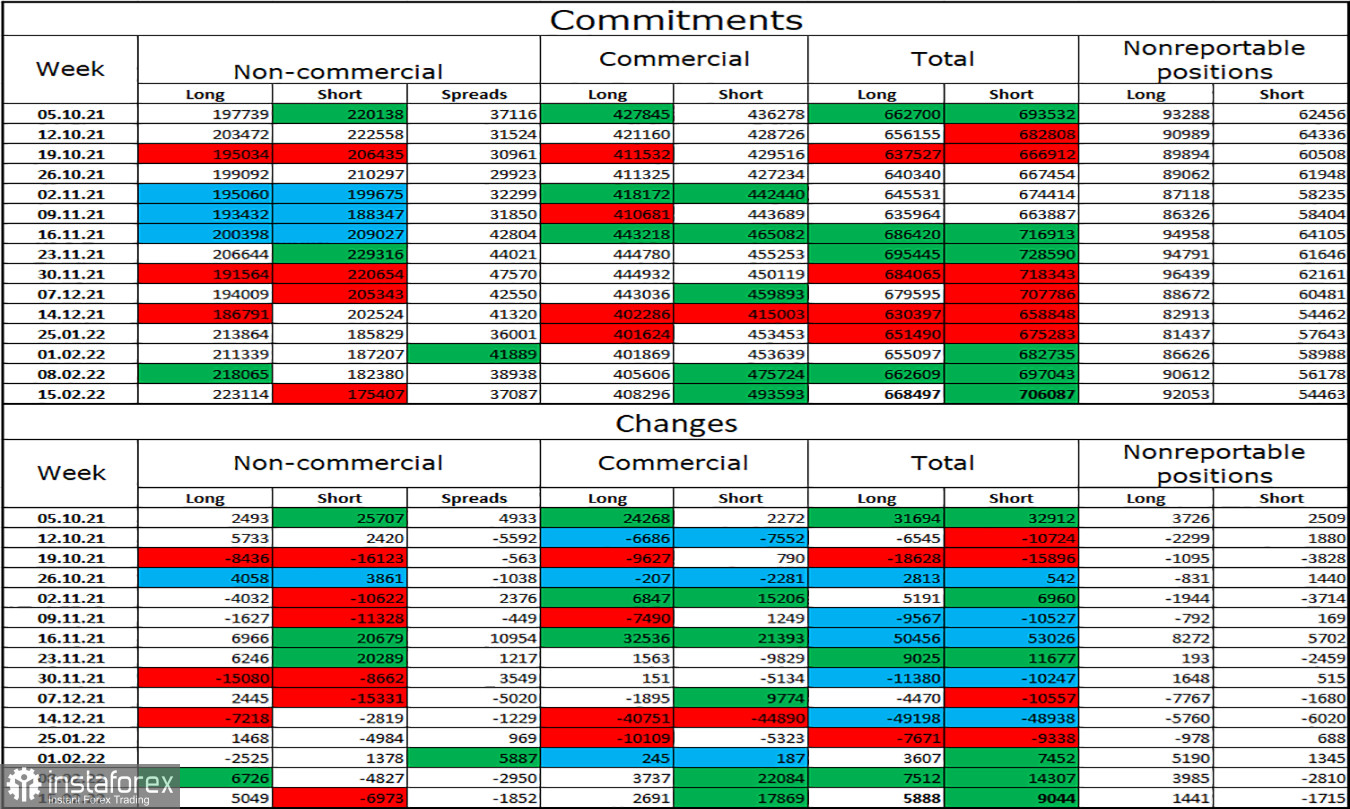

Commitments of Traders (COT) report:

Over the last week covered by the report, traders opened 5,049 Long positions and closed 6,973 Short positions, suggesting trader mood has become increasingly bullish. The total number of open Long positions is 223,000. 175,000 Short positions are currently open. The sentiment of Non-commercial traders is bullish. While it could give support to EUR, the recent news largely favors USD. Overall, the mood of major market players could quickly change due to the tense international situation.

US and EU economic calendar:

US – Manufacturing PMI data (14-45 UTC).

US – Services PMI data (14-45 UTC).

There are no events in the EU today. The two data releases in the US are unlikely to influence traders.

Outlook for EUR/USD:

Earlier, traders were recommended to open new short positions if the pair closes below 1.1404 on the H4 chart, with 1.1357 and 1.1250 being the target. Currently, these positions can be kept open. Long positions could be opened if EUR/USD closes above any sideways channel on any chart.