Analysis of transactions in the EUR / USD pair

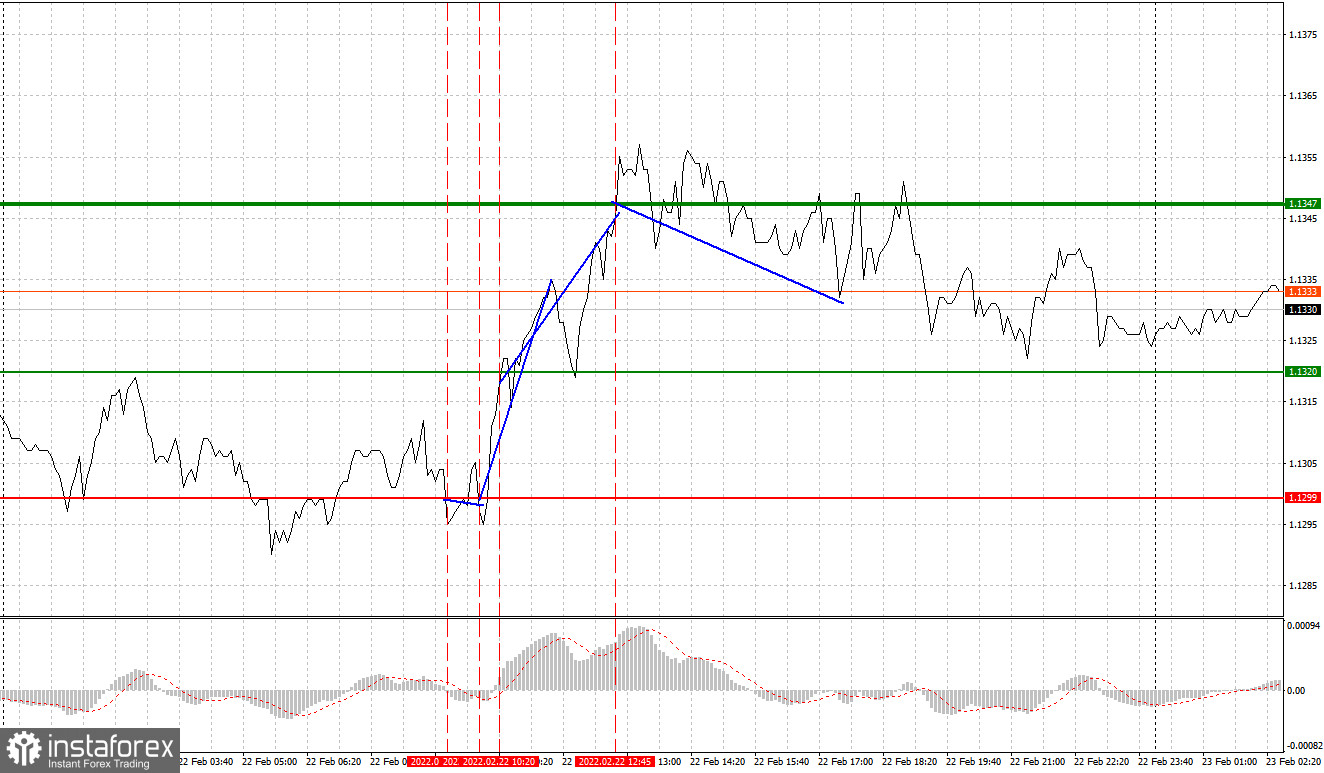

A signal to sell emerged after EUR/USD hit 1.1299. However, there was no decrease because strong statistics from IFO helped euro rally on Tuesday. Some time later, the pair rose again as the MACD line went to the oversold area. That allowed euro to climb 35 pips from 1.1299 to 1.1320, followed by another 25-pip increase to 1.1347. After that was a pull back of about 10 pips.

Strong data from the IFO helped euro rise yesterday, however, the rally did not last long as the report on US consumer confidence limited the growth of EUR/USD. Business activity in the US manufacturing and services sectors also exceeded expectations.

Several reports are scheduled to be released today, namely the leading consumer climate index in Germany and January inflation in the Euro area. If the data coincides with the forecasts of economists, it is better to sell the euro as such will allow the ECB to take the high inflationary pressure more calmly. ECB Executive Board member Frank Elderson will also speak today, though his speech is unlikely to seriously affect the direction of the foreign exchange market. Meanwhile, no statistics are planned for the afternoon, so the market will be closely watching the actions of the White House and the sanctions that the Joe Biden administration may resort to in response to the issue in Ukraine. In any case, the bullish trend in dollar has not gone away, so be careful when buying risky assets.

For long positions:

Buy euro when the quote reaches 1.1337 (green line on the chart) and take profit at the price of 1.1377 (thicker green line on the chart). A rally will occur if there is a sharp jump in inflationary pressure and if data from the eurozone exceed expectations.

But before buying, make sure that the MACD line is above zero or is starting to rise from it before taking long positions. It is also possible to buy at 1.1319, but the MACD line should be in the oversold area as only by that will the market reverse to 1.1337 and 1.1377.

For short positions:

Sell euro when the quote reaches 1.1319 (red line on the chart) and take profit at the price of 1.1275. Pressure will return if data from the eurozone turns out weaker than expected and if tension in Ukraine escalates.

But before selling, make sure that the MACD line is below zero, or is starting to move down from it. Euro can also be sold at 1.1337, however, the MACD line should be in the overbought area, as only by that will the market reverse to 1.1319 and 1.1275.

What's on the chart:

The thin green line is the key level at which you can place long positions in the EUR/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the EUR/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.