On Tuesday, the EUR/USD pair continued to trade inside the side corridor, which it has been for the eighth day. Thus, at this time I cannot characterize the mood of traders as "bullish" or "bearish". I assume that the pair may be inside the side corridor for some time because no news is expected this week that can affect the mood of traders. We can say that all the most important news has already been released. And they all concerned geopolitics. Yesterday, it became known that the EU countries, the United States imposed sanctions against the Russian Federation, the DPR, and the LPR. The whole world assessed these sanctions as "weak", which saved the ruble and Russian markets from an even greater fall. But we are more interested in the euro and the dollar. And those are standing in one place and do not know where to move on. So far, traders have shown not that they care about geopolitics, but that they do not care about it at all. Although such behavior can also be described as cautious.

Traders may understand that the geopolitical conflict in Ukraine is only at the very beginning and may continue to get worse. Especially after it became known about the cancellation of the meeting between US Secretary of State Antony Blinken and Russian Foreign Minister Sergey Lavrov. This meeting was supposed to precede the meeting of Presidents Putin and Biden, which was scheduled for tomorrow. However, now the world media say that the meeting will not take place. This means that there is no hope for a quick de-escalation of the conflict. Moscow and Washington have made their moves. Each move signaled to the market that the parties did not intend to give in and were ready to go in their convictions to the very end. But there is no economic news right now, so traders, no matter how much they would like it, cannot shift the focus from geopolitics to the economy. A report on inflation in the European Union will be released today, but it is unlikely to cause a reaction, since this will be the final value for January, and it rarely differs from the preliminary one. Inflation is likely to rise to 5.1% y/y.

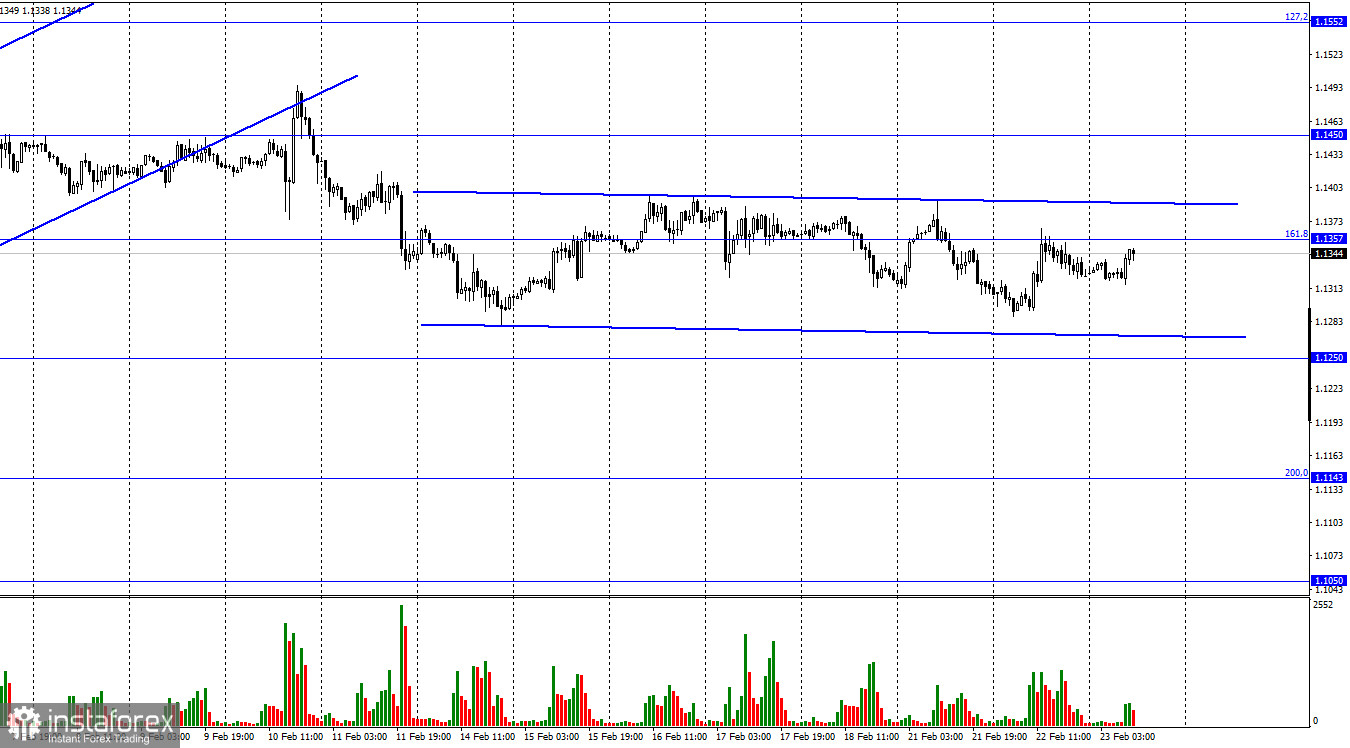

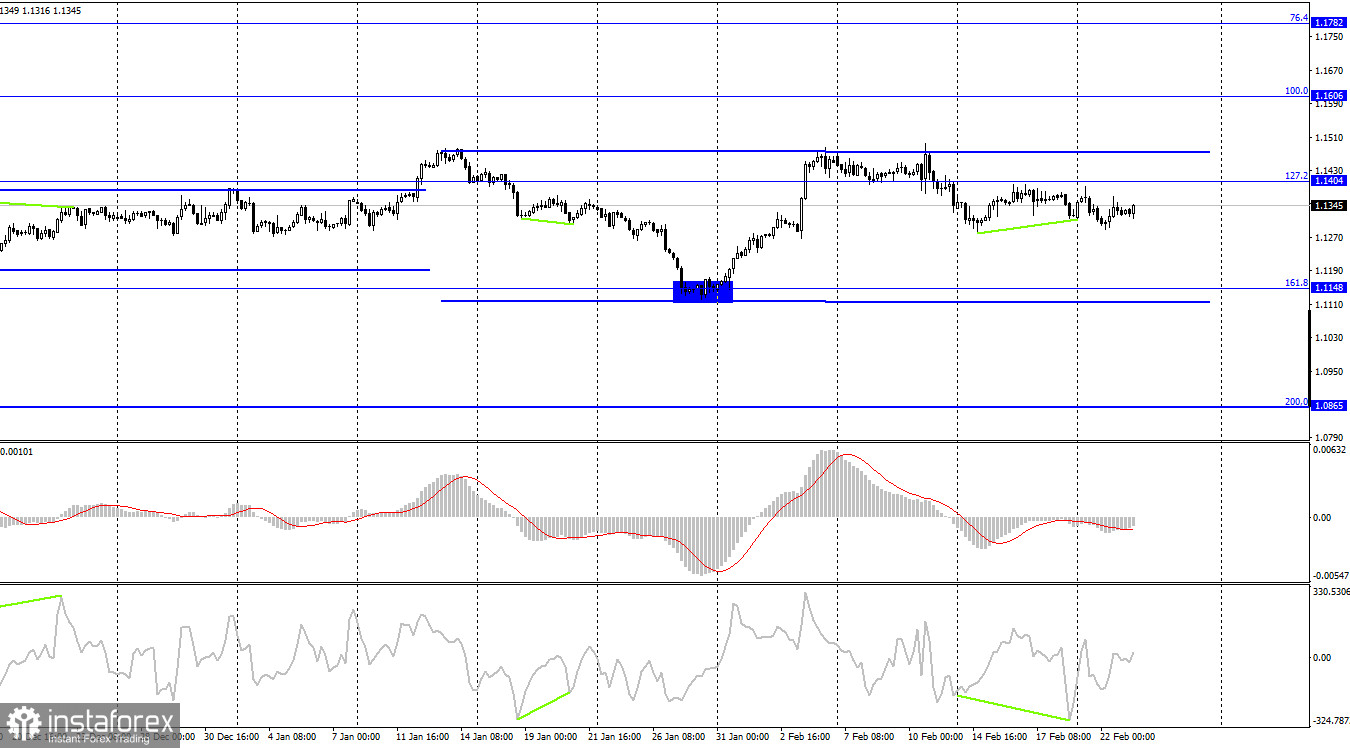

On the 4-hour chart, the pair performed a new reversal in favor of the US dollar and began a very weak process of falling. However, the current side corridor is the main graphical analysis weapon for traders. The picture clearly shows that the pair was first inside one side corridor, and now it is in the second, wider one. However, this does not change the essence of the matter. It will be possible to identify the trend only when the closure is performed above or below the corridor.

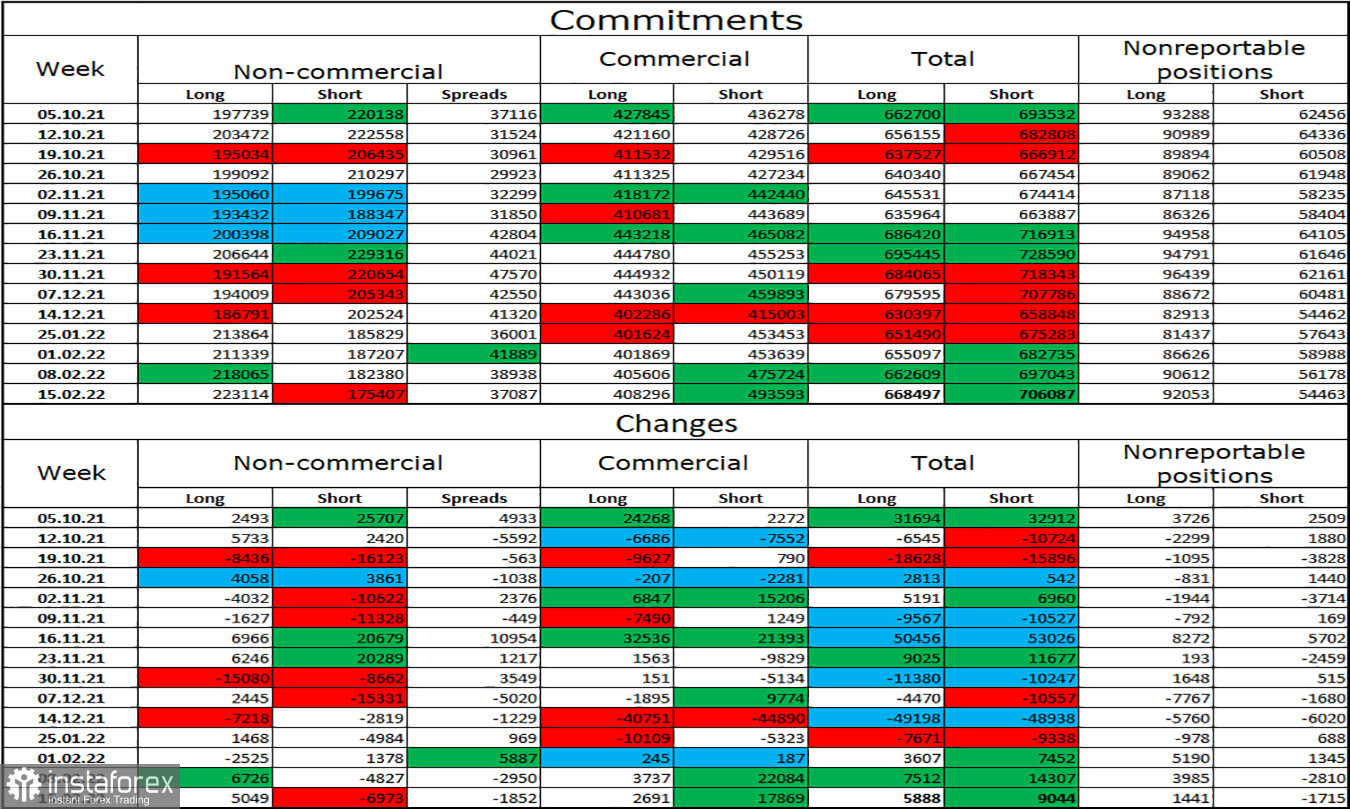

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 5,049 long contracts and closed 6,973 short contracts. This means that the bullish mood has intensified. The total number of long contracts concentrated on their hands now amounts to 223 thousand, and short contracts - 175 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is also characterized as "bullish". This makes it possible for the European currency to count on growth, if not for the information background, which now supports the American currency to a greater extent. I believe that now the data from the COT reports can be neglected since the situation in the world is tense and the mood of major players can change rapidly.

News calendar for the USA and the European Union:

EU - consumer price index (10:00 UTC).

On February 23, the EU calendar contains one weak report. In the USA today, the calendar of economic events is empty. Thus, I do not think that the graphical picture of the euro-dollar pair will change much after today.

EUR/USD forecast and recommendations to traders:

I recommended new sales of the pair with targets of 1.1357 and 1.1250 if a close is made below the level of 1.1404 on the 4-hour chart. Now, these deals can be kept open. I recommend buying a pair if there is a closure over any side corridor on any chart.