Bitcoin was approaching $37.1K but then reversed and recovered above $38K as bulls were actively buying the asset near the key support level. In the short term, this is a positive sign as it reflects bulls' willingness to protect key support. Consequently, the crypto market reversed and added 2.5% to $1.8 trillion thanks to bitcoin bulls.

According to the total cryptocurrency market capitalization chart, the value is moving within the narrow range between $1.64 trillion and $2 trillion. Because of the support level of $1,64 trillion, the market cannot update swing lows. The same goes for most cryptocurrencies, which means the total cryptocurrency market capitalization allows us to see the positions of bulls and bears in the market, including weak positions of bulls that may cause a fall in price in the short term.

The lack of major players is the main reason why the digital asset is trading within the range. An increase in BTC in the daily time frame is associated with an attempt to collect a small amount of liquidity formed due to a large number of stops and shorts above $38k. The market is adjusting to a new reality with low sales volumes and a strong influence from geopolitical risks. Therefore, fear is highly likely to gradually subside, investments to resume, and major events or statements to already be priced in the asset price.

Nevertheless, bitcoin might not show staggering growth. The market is still spooked, and investors are transferring their assets to stablecoins. In the latest report, Tether stated that the company's consolidated assets exceed its consolidated liabilities. This suggests that each USDT is backed by the US dollar thanks to growing demand for the fiat asset. According to Glassnode analysts, crypto is consolidated in the hands of long-term investors. The volume of bitcoin on exchanges has hit the 2-year low with over 9.5 million addresses holding more than 0.01 BTC, reflecting investors' faith in the asset in the long term.

However, under current circumstances, a bullish impulse is highly unlikely as investors are now turning to safe-haven assets such as precious metals. The CEO of CryptoQuant says institutional investors no longer see bitcoin as a safe haven. In other words, at the time of economic and geopolitical upheavals, investors will choose less profitable capital-protected instruments than highly profitable and riskier ones.

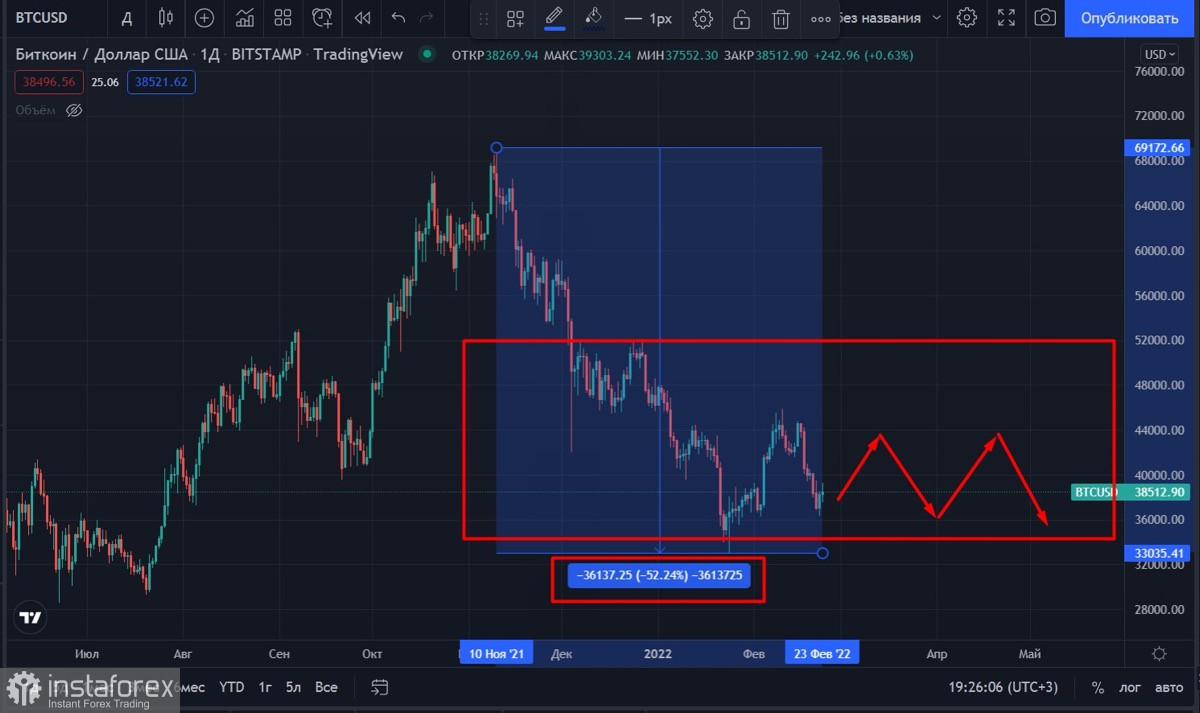

Given these factors, the cryptocurrency market should have consolidated in the range of $35K-$50K. However, as of February 23, bullish sentiment is not strong enough to maintain the sideways movement. The asset has entered the bearish zone and will be gradually approaching the support level of $37.1K. In the H4 time frame, green candlesticks look weak, so there is no guarantee the barrier of $37.1K will be protected.

In the event of a fall below this range, the level of $36.2K will serve as support. If bulls fail to protect this barrier, the price is likely to head towards the range of $32K-$35K and update the swing low. The consolidation stage makes such a movement possible. However, if the price breaks through $30K and settles below it, it will mark the beginning of a bearish market or its deeper stage. If so, the analysis should be reviewed. Bitcoin has lost around 55% since hitting the all-time high. Therefore, the correction should not be seen as a bearish market. Nevertheless, the correction may turn into a bearish market and the quote may fall by another 30% if the price goes down further from the historic fall of 55%.

As long as bitcoin stays above $30K, which is the final important level for interest for market makers, the market is unlikely to turn bearish. In the short term, the quote may increase slightly and then extend the downward movement to the support zone. The digital asset is far from the upper and the lower limits of the current range. Therefore, it is impossible to establish the trend. Bitcoin is hovering in the wide range.