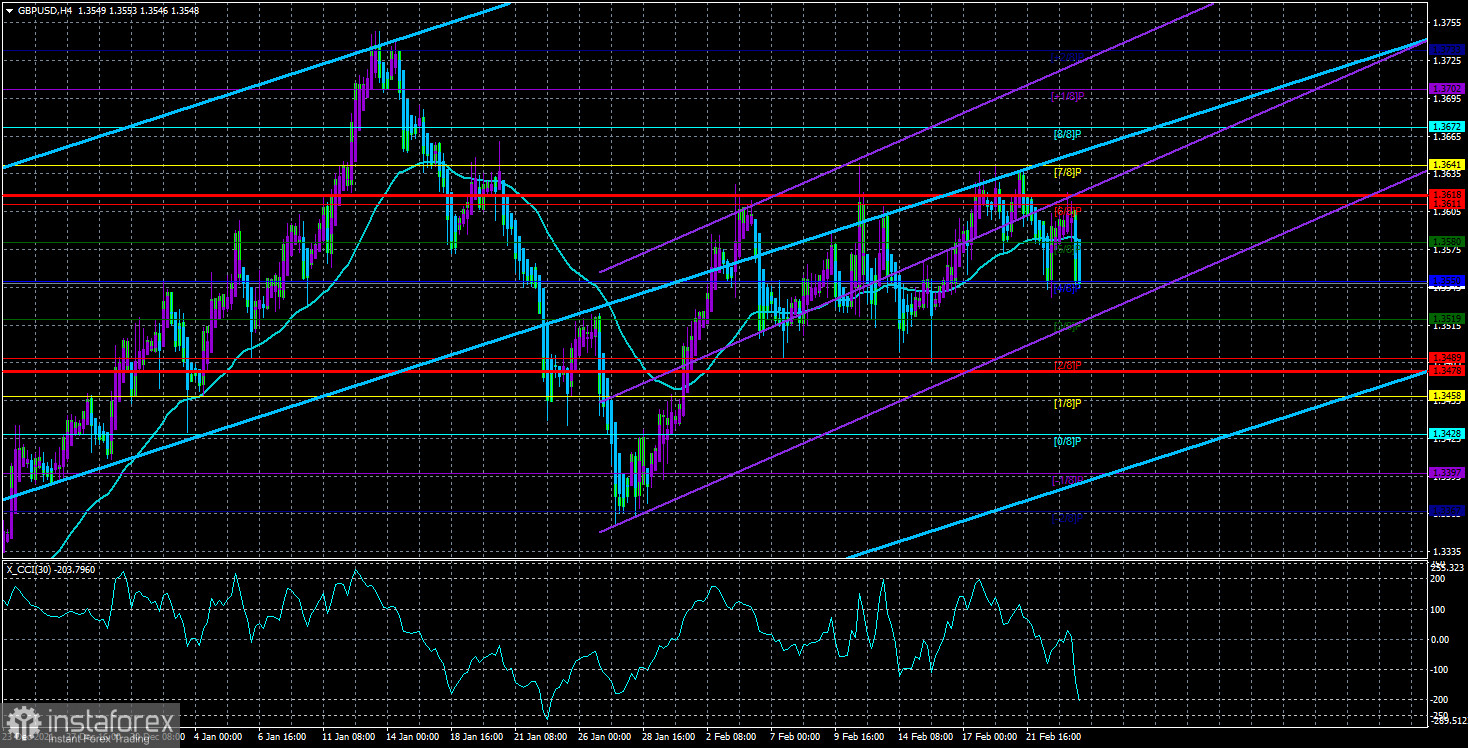

The GBP/USD currency pair on Wednesday continued to trade in the same mode as in the last few weeks. In a 4-hour timeframe, what is happening now does not look too much like a flat, but it also does not look like a trend. The technical picture is as confusing as possible, and this confusion is visible on all timeframes, even on the most senior ones. As a result, the pair continues to trade between the levels of 1.3489 and 1.3641. It turns out that the side channel has a width of at least 150 points. If so, then it is not narrow, and the movement is not pure flat. However, there is no trend now, if you look at everything in the context of one or two weeks. If you look at a more global timeframe, the bulls are now trying to form a new upward trend, but all their attempts are broken on the approach to the level of 1.3641, from which three bounces have already been made. Moreover, the nature of the pair's movement is very similar to a "swing", which is again noticeable on different timeframes. From all this, we conclude that the market is in an absolutely unstable state and, in principle, it can either collapse or jump up any day. We believe that although at the moment currency traders do not show a special reaction to geopolitical events, they are still in a restless state. If a full-scale war breaks out in Ukraine, it could hit all world markets very hard. Including currency. If we abstract from geopolitics, which we try to do every day, but it turns out badly, then there is practically no macroeconomic data now. That is, traders have nothing to react to.

Parliamentary hearings on the Bank of England report did not affect the market.

In principle, there was even one event yesterday that could theoretically affect the movement of the pound/dollar pair. The hearings in the UK Parliament on the report from the Bank of England - sounds quite formidable and important. However, nothing was said that the markets did not already know. Chairman Andrew Bailey and his colleagues talked about inflation, that for too long they refused to admit that it was not temporary, and about the risks that inflation creates. More eloquent was not even Andrew Bailey, but Jonathan Haskel, who noted that the risks for inflation may worsen due to the geopolitical situation. He also noted that a further increase in energy prices, which again may increase due to geopolitics, may lead to a further acceleration of the consumer price index. He also touched on the topic of the shortage of labor in the labor market. In general, in principle, nothing very important was said. And the pound sterling continued to "dance" in different directions during the day.

The news aura around Boris Johnson has also noticeably weakened in recent days. First, the market and the public have completely forgotten about the "coronavirus parties", and the UK Parliament is now discussing completely different problems and issues than the obscene behavior of Johnson and his colleagues. Second, Johnson has already said everything on the issue of Ukraine and Russia. Sanctions were imposed and the market assessed them as weak. It seems that Western countries have once again decided to scare Moscow with sanctions, but once again did not dare to introduce anything serious. Restrictions for the CSKA football club, several oligarchs, and several banks, of course, also hit the Russian economy, but hardly enough to abandon their plans and demands. Therefore, now it is safe to say that the sanctions caused only laughter in the Kremlin. At the same time, the threat of a full-scale war in Ukraine will exert psychological pressure on participants in all markets. We do not rule out that volatility will rise sharply in the near future, and movements will become even more unpredictable.

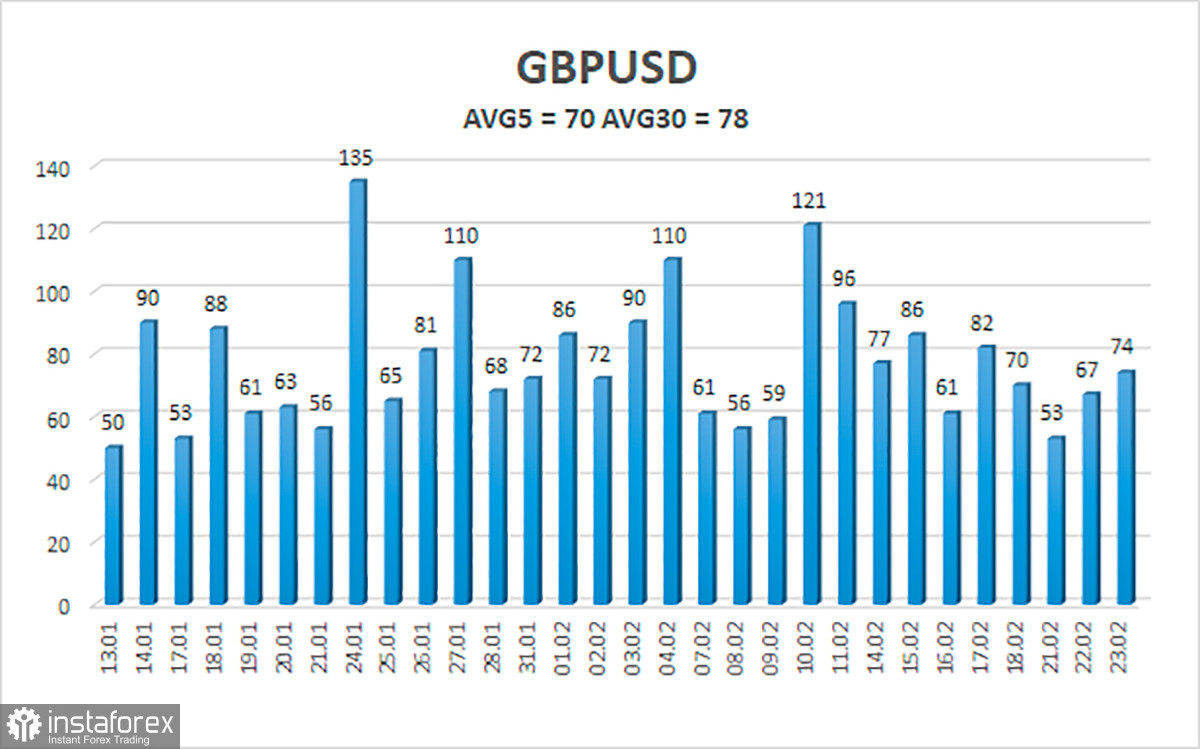

The average volatility of the GBP/USD pair is currently 70 points per day. For the pound/dollar pair, this value is "average". On Wednesday, February 24, thus, we expect movement inside the channel, limited by the levels of 1.3478 and 1.3618. The upward reversal of the Heiken Ashi indicator will signal a new round of upward movement within the framework of the "swing".

Nearest support levels:

S1 – 1.3550

S2 – 1.3519

S3 – 1.3489

Nearest resistance levels:

R1 – 1.3580

R2 – 1.3611

R3 – 1.3641

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe continues to trade near the moving in the "swing" mode. Thus, at this time, long positions with targets of 1.3611 and 1.3641 can be considered in case of consolidation above the moving average, but the high probability of a flat should be taken into account. It is possible to consider short positions before the Heiken Ashi indicator turns upwards with targets of 1.3519 and 1.3489, but again - there is a high probability of a flat.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.