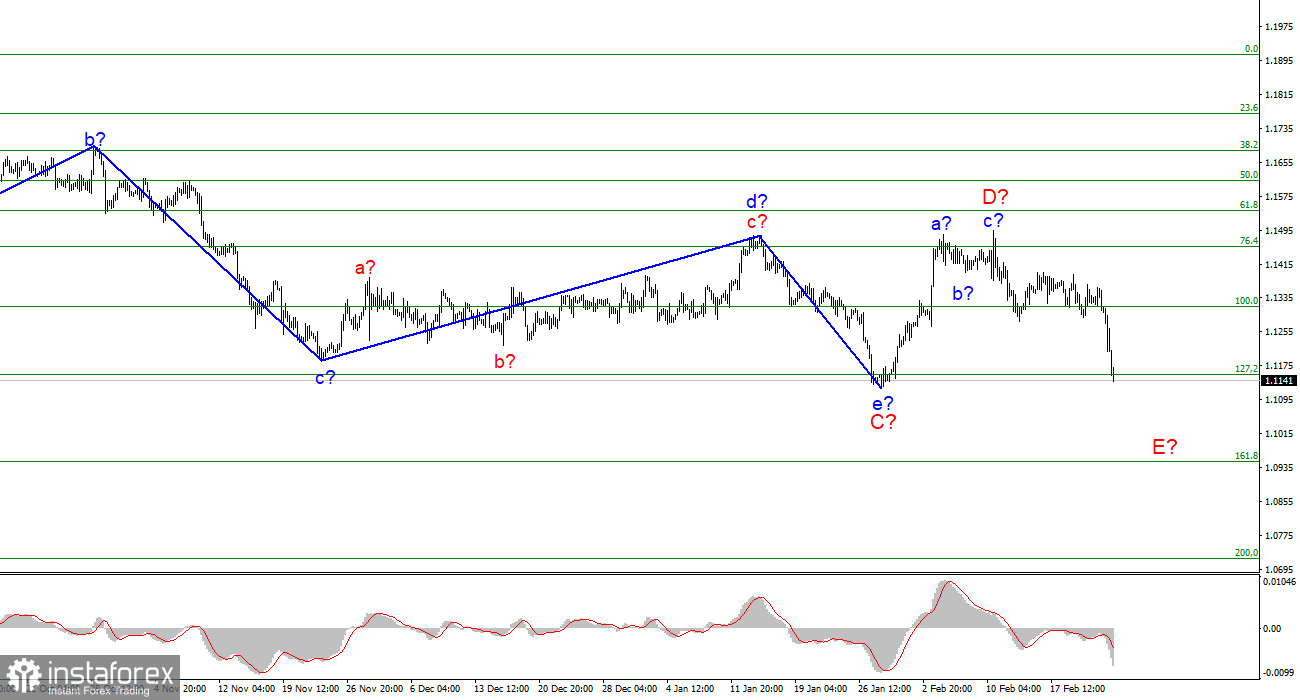

The wave marking of the 4-hour chart for the euro/dollar instrument has not changed recently. It has not changed today, as the European currency has collapsed, which fully corresponds to the current wave markup. Thus, the decline in quotes is interpreted as a wave E. At the moment, I believe that wave D is completed, since the news background openly supports the rise of the US currency, and the wave itself has taken a three-wave form. Based on this, I think that the probability that the instrument has moved to the construction of wave E is 80 percent. I give 20% of the probability that the entire wave markup will require additions and adjustments. However, now only the news background affects the market mood, and, unfortunately, it is very sad. Therefore, I believe that the decline will continue, and wave E may turn out to be very strong. Considering what is happening in Ukraine now, the whole wave marking can become very complicated.

There is no economic news, everything revolves around geopolitics.

The euro/dollar instrument fell by 180 basis points on Thursday and the demand for the euro currency continues to decline, while the dollar continues to grow. No one is interested in the economic news background right now, and there is practically none now. Today, the fourth-quarter GDP report was released in America, but tell me, who is interested in the American economy now? The US stock market is falling and would fall even if GDP grew by 20% in the fourth quarter. And the US dollar is rising because it is the world's reserve currency. This is all you need to know about the dynamics of the foreign exchange market right now.

I would not like to write now about the war or the military operation that began in Ukraine tonight. A lot has already been written about this by other analysts and news agencies. We are all adults, everything is clear to everyone. Now we need to think about what will happen to the markets in the near future. We are already talking not only about the euro/dollar instrument but about all markets. At the moment: gold and oil with gas show strong growth, the cryptocurrency market, stock, the Ukrainian hryvnia, and the euro with the pound are very much declining. From my point of view, this trend will continue at least in the next few days. It is unlikely that the military operation, as it is called in the Kremlin, will last only one day. Already tonight, the United States may impose serious sanctions against the Russian Federation. The UK and EU countries can follow this example. Then Moscow will respond to these sanctions because in the modern world this is how everything works: if sanctions are imposed against you, then you need to respond. Meanwhile, martial law and, it seems, war will remain in Ukraine. This will put serious pressure on all risky markets and currencies.

General conclusions.

Based on the analysis, I conclude that the construction of wave D is completed. If so, now is a good time to sell the European currency with targets located around the 1.0949 mark, which corresponds to 161.8% Fibonacci. A successful breakout attempt of 1.1154 will indicate that the market is ready for new sales of the instrument.

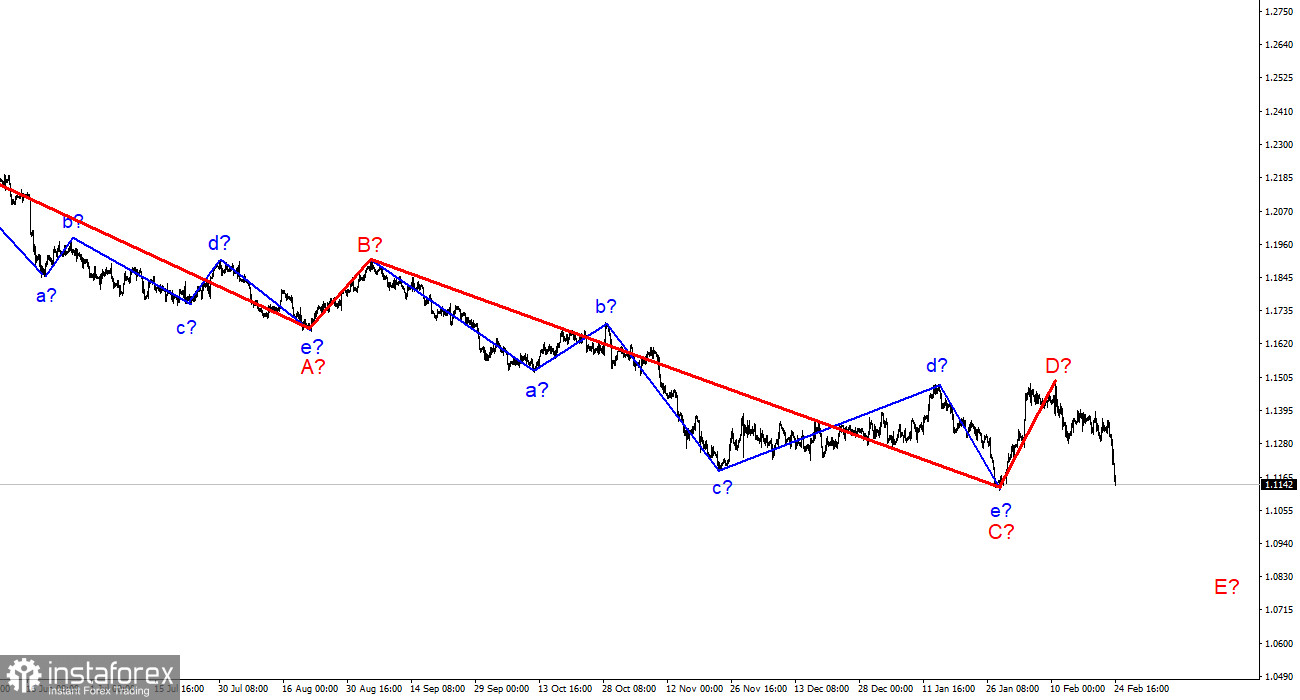

On a larger scale, it can be seen that the construction of the proposed wave D has now begun. This wave can be shortened or three-wave. Considering that all the previous waves were not too large and approximately the same in size, the same can be expected from the current wave. There is every reason to assume that wave D has already been completed. Then the construction of wave E began.