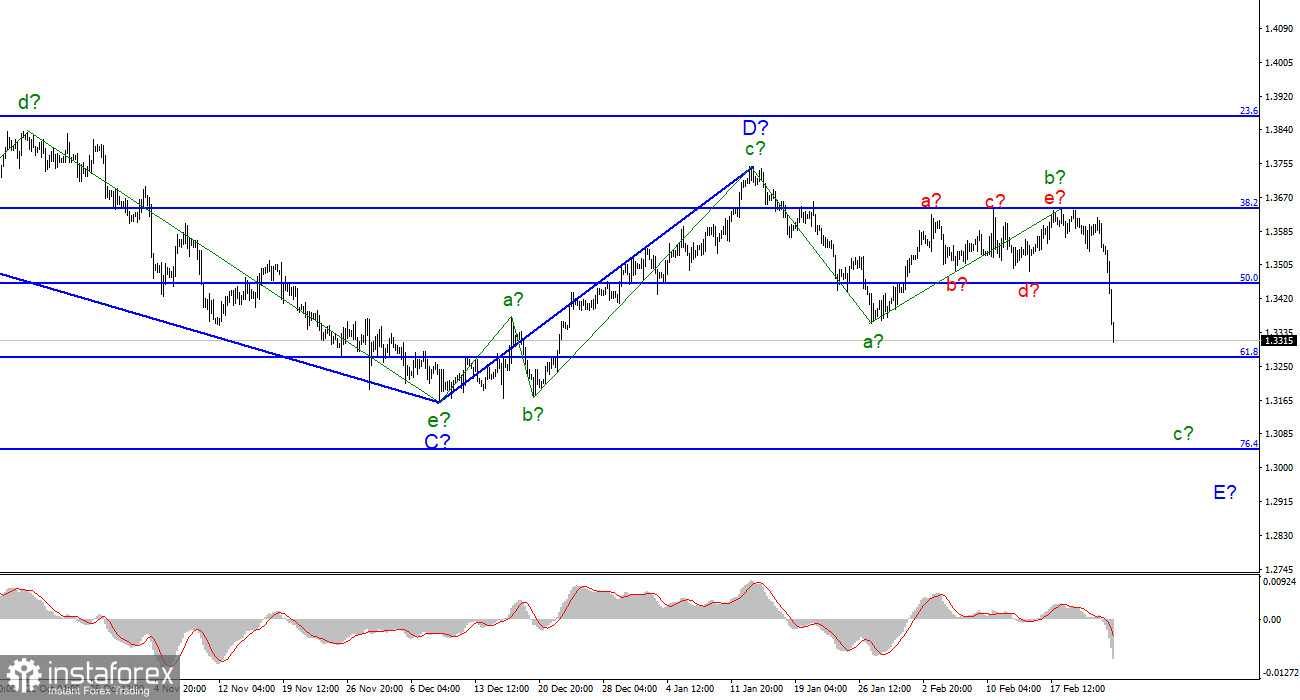

As for the GBP/USD pair, the wave pattern looks further convincing. The presumed wave b in the downtrend section E became very complicated. However, it ended after several failed attempts to break the 1.3642 mark. There are five internal waves within wave b, so this wave should have been completed. The fall in quotations during the last few days indicates the formation of wave c. Currently, the low of the anticipated wave a has been broken. Therefore, the construction of the downward section of the trend is definitely to resume within the framework of wave E. Consequently, the entire downward section of the trend has taken a five-wave structure. Moreover, its presumed wave E should also have a five-wave pattern, i.e. to take a very extended form. The quotations may slightly retreat from the reached lows due to a failed attempt to break the level of 1.3272. The wave c in E does not look complete yet. Moreover, the latest news may be the reason for increasing demand for the dollar for at least some days.

Bank of England Andrew Bailey does not make any explicit statements

The GBP/USD pair declined by 270 basis points on February 24. The markets dropped precipitously yesterday after the news broke that Russia had invaded Ukraine and major Ukrainian cities had been shelled by aircraft. Many military bases were destroyed. This event had a dramatic impact on market sentiment. The market started to sell off risky currencies en masse and invest in the US dollar. Notably, both Russian and global stock markets crashed yesterday.

At the same time, Bank of England Governor Andrew Bailey delivered a speech on Tuesday and Wednesday. His speech did not have any focus of attention due to the crucial significance of geopolitics at the moment. Even if Bailey had made significant statements, they would have produced no strong reaction. However, Bailey did not state any important facts. He only complained that the regulator's representatives very often named inflation temporary. This issue implies that it is not temporary. While the Bank of England refused to accept this fact, inflation continued to rise. The Bank of England has raised the interest rate by 40 basis points cumulatively at the last two meetings. Moreover, it may raise it by another 50 points at the next two meetings. However, currently, this news does not have any impact on the British pound. Both the pound and the euro may continue to decline for a few days. However, the market will reverse sooner or later as the British pound has no connection to war between Russia and Ukraine. Risky assets tend to fall. Moreover, they also can recover.

General conclusions

The wave picture of the GBP/USD instrument implies the formation of wave E. The construction of the presumed b wave has been completed. The instrument made two failed attempts to break the level of 1.3645, resulting in a new decline and later in the collapse. The quotes should continue to fall in the coming days. I believe that the construction of wave c in E has already started. Therefore, now I recommend selling with the targets located around 1.3046, corresponding to the 76.4% Fibonacci level. A failed attempt to break the level of 1.3274 might push the instrument slightly upward.

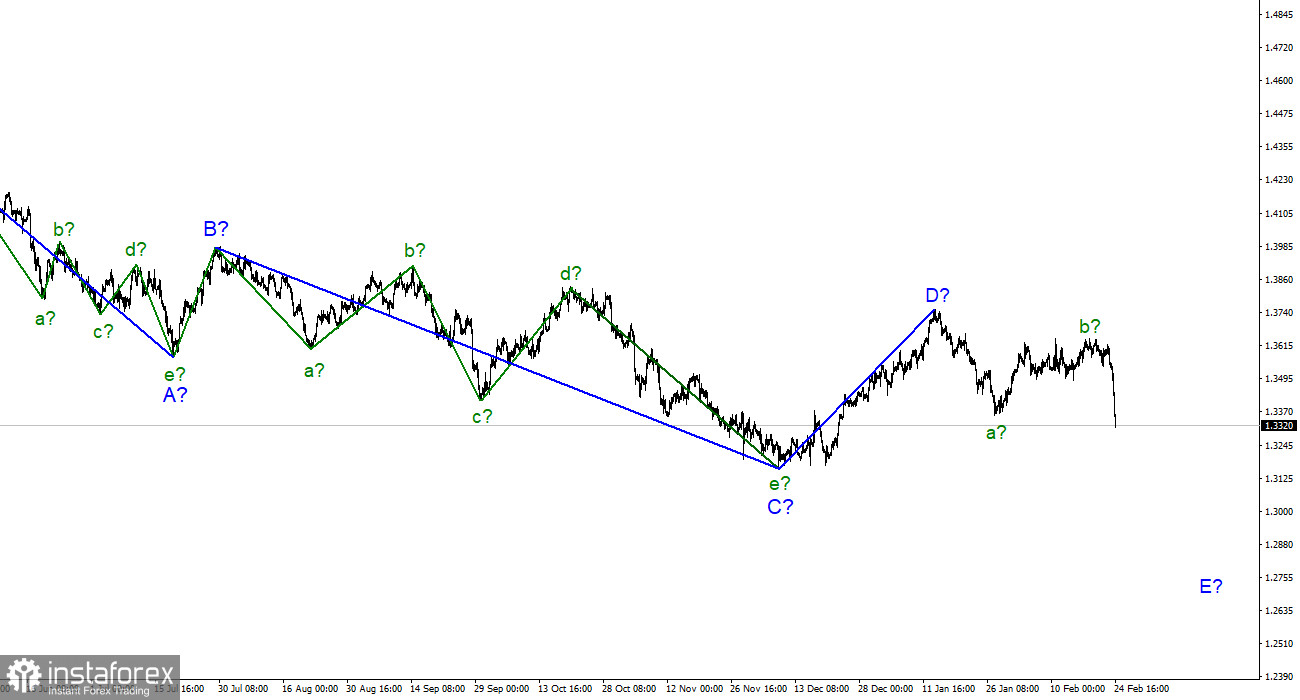

On a larger scale, wave D also looks complete. However, the whole downtrend section has not been completed. Therefore, I expect further decline of the instrument with the targets below the low of wave C in the coming weeks. Wave D turned out to have a three-wave structure. So, it can not be interpreted as wave 1 of the new uptrend section.