The GBP/USD currency pair fell down by more than 200 points on Thursday. As we said earlier, this was due to Russia's invasion of Ukraine. The Kremlin says that the Russian Federation is conducting a military operation to demilitarize and denazify Ukraine, without using the word "war". However, whatever you call the war, it will still remain a war. That is, the event when people die on both sides. The most terrible thing is that the forecasts of the West, which has repeatedly stated that an invasion of Ukraine could happen "just a few days ago," have come true. Moscow took a desperate step to prevent Ukraine from joining NATO, but now, there is no doubt it will receive sanctions from the United States and the European Union in response. We do not undertake to judge what these sanctions will be, but there is no doubt that Moscow will have something to respond to. This situation is not such when the whole world simply isolates Russia as an aggressor. The world depends on Russia. The same Europe is unlikely to be able to quickly and effectively replace Russian gas and oil with analogues.

Disconnecting Russia from SWIFT is also unclear what results it will bring. After all, SWIFT is not just a Western payment system that Russia is allowed to use. Russia is a full participant in this system, therefore, Russian partners overseas and in Europe will also suffer losses. In general, as we said earlier, when the war begins and sanctions begin to fall, no one wins. Moscow also understands this, but the Kremlin has more important geopolitical tasks. Therefore, I am ready to sacrifice the financial system and the economy. To what extent this step is justified, we will find out in the near future. Meanwhile, the pound/dollar pair, which had been in a movement very similar to a flat for several weeks before, is falling. This cannot be called a downward trend, because tomorrow or the day after tomorrow, a reverse movement may follow. If not tomorrow, then in a week. As it was in 2020, when the US dollar rose for a couple of weeks, but then a long period of its decline began.

Boris Johnson believes that Europe should abandon oil and gas from Russia

In principle, there is nothing surprising in the fact that one of the most prominent speakers of our time – British Prime Minister Boris Johnson - was one of the first to react to the outbreak of war between Ukraine and Russia. It should be recalled that in this conflict London supports Ukraine, supplies it with weapons and helps financially. Johnson was also among those who predicted the Russian invasion of Ukraine "from day to day." Unfortunately, he was right. However, now the "move" is for Europe and the West. However, this is far from the end, as sanctions have not yet been introduced. Of course, investors in the Russian market reacted in this way precisely because these sanctions may be imposed in the near future. Therefore, if this assumption is confirmed, then a new fall may not happen. But so far, it is sanctions that are being discussed in the UK.

Boris Johnson said that "the worst fears" were justified, and "Russian President Vladimir Putin unleashed a war in Europe." He expressed words of support to the Ukrainian people, noting that this is not about "some country", but about the second largest country in Europe, "which has enjoyed freedom and democracy for decades." "At the moment," Johnson said, "we, together with our allies, are working on a package of large-scale sanctions that will be designed to stop the Russian economy. According to the British prime minister, Europe should abandon Russian gas and oil, which gave Vladimir Putin control over Europe. In general, now we should expect sanctions from the EU and the United States, which could further collapse the Russian markets, and with them the pound and the euro. The more the geopolitical situation heats up, the stronger the dollar grows, which the US absolutely does not need, with their huge public debt...

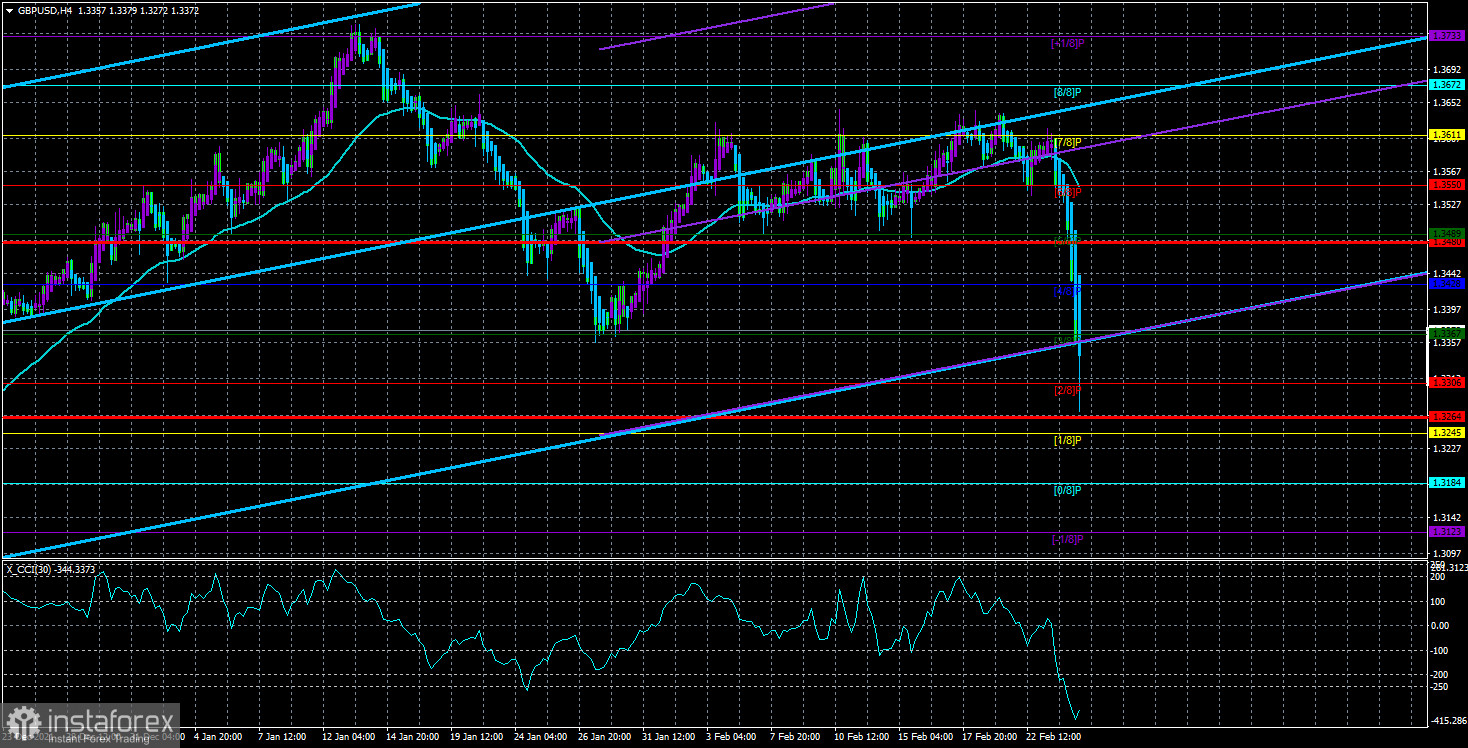

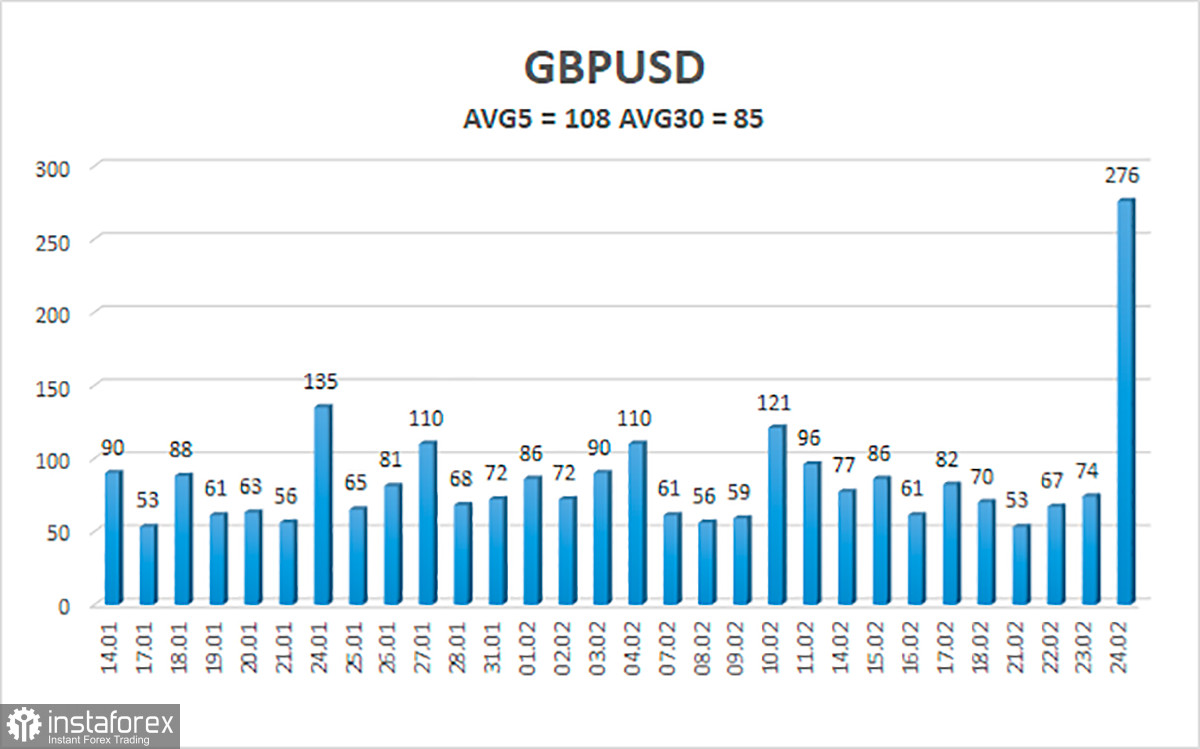

The average volatility of the GBP/USD pair is currently 108 pips per day. For the pound/dollar pair, this value is "high". On Thursday, February 25, therefore, we expect movement inside the channel, limited by the levels of 1.3264 and 1.3480. The upward reversal of the Heiken Ashi indicator will signal a round of corrective movement.

Upcoming support levels:

S1 - 1.3306

S2 - 1.3245

S3 - 1.3184

Nearest resistance levels:

R1 - 1.3367

R2 - 1.3428

R3 - 1.3489

Trading recommendations:

The GBP/USD pair fell on the 4-hour timeframe and the bearish mood persists. Thus, at this time, you can stay in short positions with the targets of 1.3306 and 1.3264 until the Heiken Ashi indicator turns up. It will be possible to consider long positions not earlier than the price taking above the MA with the targets of 1.3611 and 1.3672, which is not expected in the near future.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. 25 February. The foreign exchange market crashed. And not only him. A war broke out between Ukraine and Russia.

Forecast and trading signals for EUR/USD on February 25. Detailed analysis of the movement of the pair and trading transactions.

Forecast and trading signals for GBP/USD on February 25. Detailed analysis of the movement of the pair and trading transactions.

Explanations for illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which you should now trade.

Murrey levels are target levels for movements and corrections.

Volatility levels (red lines) - a likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means that a trend reversal is approaching in the opposite direction.