Yesterday, the pound was losing its positions for almost the entire day. And this process was accompanied by incessant reports of fighting in Ukraine. Investors were panicking and running away from risk. After all, the war is going on in Europe. This means that the risks extend to the entire continent. After the fighting began to gradually subside and acquire a largely fragmentary character, a banal technical correction began on the market. Which, in general, is not surprising, given the scale of the previous decline. But we are talking about a temporary stop. After the start of the corrective movement, Western countries gradually began to voice the imposed sanctions, which in fact turned out to be not as terrifying as promised. However, Western countries immediately declared that this is only the first block of sanctions, and if military actions do not stop, additional ones will be introduced. So the sanctions themselves have not affected the market in any way so far. They will begin to affect us in the near future. And only in a negative way. The fact is that Russia can fend off most of them with retaliatory sanctions that will cause comparable damage to the economies of Western countries. So now the market is waiting for retaliatory actions from Moscow, which the Kremlin clearly hinted at last night. In other words, yesterday evening's growth of the pound is only temporary and is rather a respite before a new wave of decline.

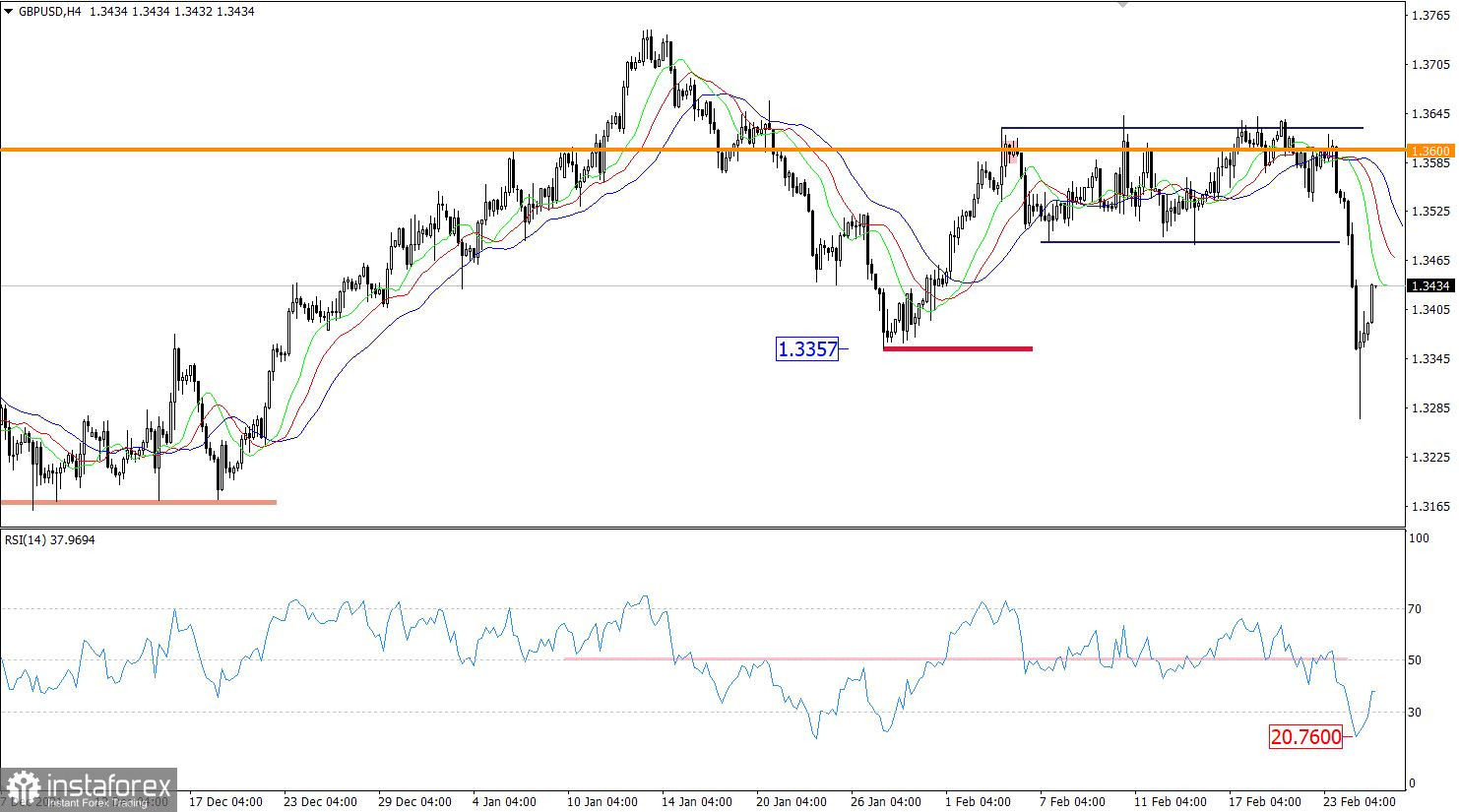

The British currency against the US dollar in the wake of strong speculation locally lost more than 300 points in value over two trading days. This led to the renewal of the 2022 low and a strong overheating of short positions. As a result, there was a technical correction in the market.

The RSI technical instrument fell to 20.76 in a four-hour period, which signaled a high level of oversold pound.

Moving MA lines on the Alligator H4 indicator indicate a downward trend. There is no intersection between MA lines.

Expectations and prospects:

In this situation, the correction is still taking place in the market, which led to a partial recovery of the British currency. The values of 1.3450 and 1.3480 can play as a possible resistance on the bulls' way. Thus, the downward move may eventually resume, supporting the general strengthening of dollar positions in the market. The largest increase in the volume of short positions is expected after keeping the price below 1.3350 in the daily period.

A complex indicator analysis gives a signal to buy in the short-term and intraday periods due to the corrective move. Technical instruments in the medium term indicate a downward move, signaling a sell.