Gold prices stayed above $1,900 an ounce yesterday and barely reacted to U.S. economic data. But by the end of the American session, there was a complete collapse in gold prices.

On Thursday, Russia launched a full-scale invasion of Ukraine. Russian President Putin said the attack was an attempt to demilitarize Ukraine.

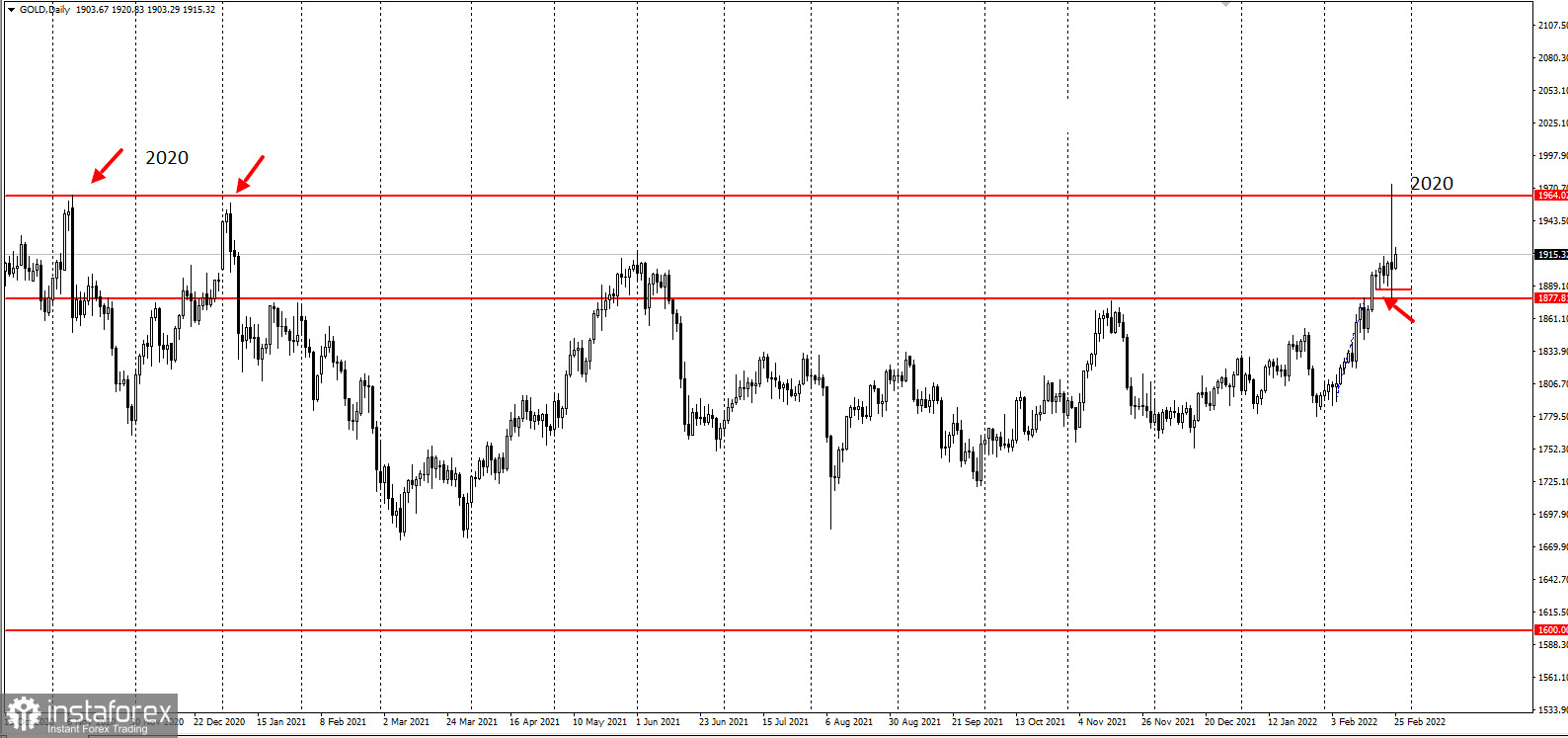

Against the backdrop of these events, gold soared "into the sky" and temporarily updated the peak of the crisis year of 2020, but by the end of the American session, it completely returned all the reached 7000p. The U.S. reacted weakly to the release of economic data.

On Thursday, seasonally adjusted sales of new houses in January were down 801,000, down 4.5% from December's revised sales level of 839,000, the Commerce Department said.

The drop in new home sales was relatively in line with consensus forecasts. Economists were looking for a sales level of around 811,000.

The report says new home sales are down more than 19% for the year.

Economists predict that the U.S. housing market, an important pillar of the U.S. economy, could struggle this year as the Federal Reserve looks to raise interest rates by raising mortgage rates.

Rising home prices and shrinking inventories are causing many potential homeowners to leave the market.

The report states that the median selling price of new homes sold in January 2022 was $423,300.

According to Ole Hansen, head of commodity strategy at Saxo Bank, gold was in the overbought zone amid geopolitics, and a price collapse was inevitable.