To open long positions on GBP/USD, you need:

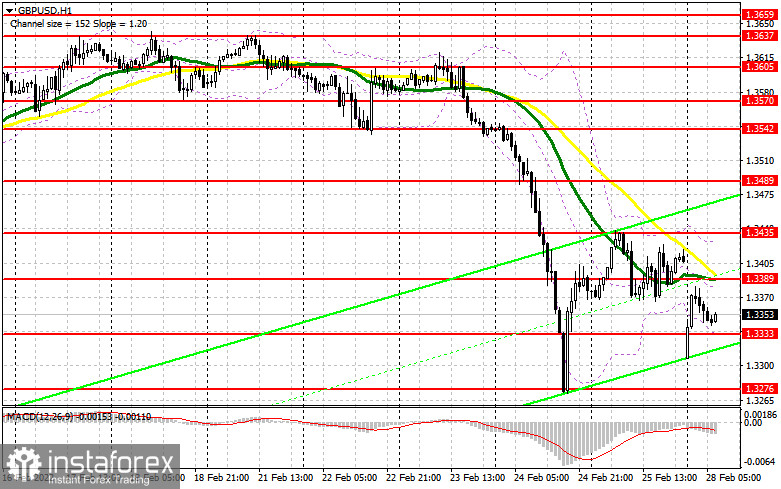

Last Friday, several signals were formed to enter the market. Let's take a look at the 5-minute schedule and figure out where it was possible and necessary to enter. In my morning forecast, I paid attention to the 1.3417 level and advised you to make decisions on entering the market. A sharp rise above this range even before the European session opened seemed to be able to continue the pair's upward potential, but as we can see, no one was willing to continue buying the pound. A false breakout and a return under 1.3417, followed by a test of this range from the bottom up, resulted in forming a sell signal for the pound, which resulted in a large sale and brought about 40 points of profit. In the afternoon, the bears continued to be more active, achieving a breakthrough and consolidation below 1.3389 - a signal to sell the pound. However, this did not lead to a major downward movement. The drop was about 20 points and then the pressure on the pair decreased.

Today started very sadly for pound bulls, as the market opened 100 points below Friday's close. The aggravation of global geopolitical tensions forces traders to buy the US dollar in order to somehow protect themselves in the event of a more serious armed conflict. Negotiations between representatives of Russia and Ukraine are due to take place today, so I recommend that you follow their results very closely. It is better not to rush when opening long positions. It is also not necessary to pay attention to various kinds of fundamental statistics today: there are no statistical reports for the UK, and data on the US, in the conditions of what is happening in the world now, are unlikely to have any significance for traders.

It is important to protect the support of 1.3333 during the European trading session, by which the pound will surely collapse with negative news and another Russian aggression against Ukraine. You can consider long positions from 1.3333 only after forming a false breakout there, since this entry will be made against the bear market. The pound's growth in this scenario will lead to a resistance of 1.3389, where the moving averages are playing on the bears' side. The bulls will pay attention to this level, as going beyond this range can strengthen the pair's upward correction. A breakthrough and a test of 1.3389 from top to bottom creates another buy signal with the pair recovering to 1.3435 – the upper limit of the upward correction channel observed by the pound at the end of last week after the largest sell-off since the news about the coronavirus. The 1.3489 area is a more distant target, where I recommend taking profits. In case GBP/USD falls during the European session and the bulls are not active at 1.3333, and most likely it will be - negotiations between Russia and Ukraine have failed, it is best not to rush with long positions. In this case, the nearest support will be the 1.3276 area. Forming a false breakout there will provide an entry point to long positions. You can buy GBP/USD immediately for a rebound from 1.3232, or even lower - from a low of 1.3200, counting on a correction of 20-25 points within the day.

To open short positions on GBP/USD, you need:

Bears are still in full control of the market. Although bulls take advantage of the moment and actively return when the pair moves downwards, further geopolitical uncertainty continues to put pressure on risky assets. For today, the nearest target will be the support of 1.3333, but it would also be nice to think about how to defend the resistance of 1.3389. A breakthrough and a reverse test of 1.3333 will increase pressure on the pair, which will provide the first entry point into short positions with the goal of another fall to the lows: 1.3276 and 1.3232. The 1.3200 area is a more distant target, where I recommend taking profits. This level of support will also be intermediate, since with such a large sale, it is unknown where the pound may collapse. In case GBP/USD grows during the European session, I advise you to take a closer look at short positions in the area of the intermediate resistance of 1.3389, where the moving averages are playing on the bears' side. Forming a false breakout at this level will provide a good entry point into short positions. In case the bears are not active at 1.3389, it is best to postpone short positions to a larger level of 1.3435, since it is not known how events around Ukraine will develop further. I also advise you to open short positions there in case of a false breakout. It is possible to sell GBP/USD immediately for a rebound from 1.3489, or even higher - from a high like 1.3542, counting on a correction of the pair down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) reports for February 15 showed that long positions sharply increased while short ones decreased. This led to the return of the delta of its positive value. Although the results of the Bank of England meeting did not come as a surprise, clear hints from the central bank on a more aggressive tightening of monetary policy clearly fuels the appetite for risks on the part of major players. If it were not for the ongoing conflict between Russia and Ukraine, which has reached a new level, one could count on a more active recovery of the pound. In the meantime, further demand for risky assets is questionable. Given that the British economy is currently going through not the best of times and at any moment the pace of economic growth may seriously slow down - an increase in rates may harm the pace of recovery in the near future. However, optimism is inspired by the recent good report on retail sales, which implies a strong growth in the indicator. The fact that inflation in January remained at the same levels and practically did not change year-on-year - all this may affect the BoE's plans, which will moderate the pace of policy tightening. Further geopolitical events around Russia and Ukraine, as well as the decisive actions of the Federal Reserve regarding future interest rates in March of this year – all this will continue to put pressure on pound bulls. Some traders expect that the US central bank may resort to more aggressive actions and raise rates by 0.5% at once, rather than by 0.25% — this will become a kind of bullish signal for the US dollar. The COT report for February 15 indicated that long non-commercial positions increased from 44,709 to 50,151, while short non-commercial positions decreased from 53,254 to 47,914. This led to an increase in the non-commercial net position from -8,545 to 2,247. The weekly closing price remained unchanged at 1.3532 versus 1.3537.

Indicator signals:

Trading is conducted below the 30 and 50 moving averages, which indicates a bear market.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the average border of the indicator around 1.3390 will act as resistance. In case the pair falls, the lower limit of the indicator in the area of 1.3333 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.